- Growth stocks feel the heat of yields resurgence, plunging Tesla (NASDAQ:TSLA) sends Nasdaq diving

- BoJ knocks down yen again, but other major FX pairs stuck in narrow ranges

- Gold and oil pare back gains as dollar regains some footing

Bond yields stage surprise year-end rally, stocks don’t like it

Markets have turned choppy as trading winds down for the year. With just three trading days remaining and very few significant developments for investors to sift through, the bond market is taking centre stage amid the lack of direction in equity and FX markets.

After a hawkish 2022 wrap up of central bank meetings in December, it seems that investors are no longer betting on an imminent dovish pivot by the Fed & Co. Instead, there is growing uncertainty about what the interest rate outlook holds for the coming year, even as inflationary pressures appear to be subsiding and the major economies are slowing.

Investors had been hoping that there would have been clearer signals by now from policymakers that their tightening campaign is coming to an end. But with the Fed flagging a terminal rate above 5% and the ECB hinting that it’s only halfway through its tightening cycle, the mood has soured towards the year end.

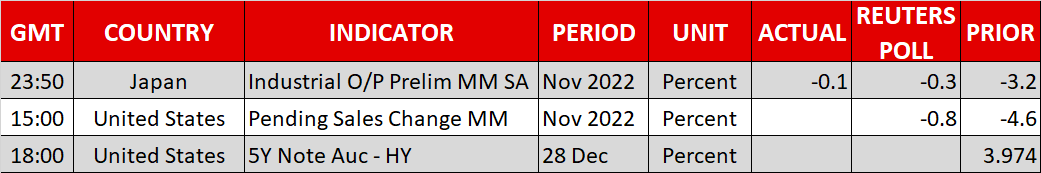

Most notably, sovereign bond yields have been on the up since the conclusion of the December policy meetings, ending a near two-month-old slide. The US 10-year Treasury yield is back above 3.80% at six-week highs, Australia’s and New Zealand’s equivalent yields shot up more than 10 basis points in Asian trading today, while the two-year yield on German bunds is at its highest since 2008.

Nasdaq hit by higher yields and Tesla slump

Unsurprisingly, stocks and specifically, rate-sensitive tech stocks are feeling the pressure of this latest uptick in longer-term borrowing costs. Growth and tech stocks are seeing their valuations getting compressed again as their expected future cash flows are discounted at higher interest rates when yields surge.

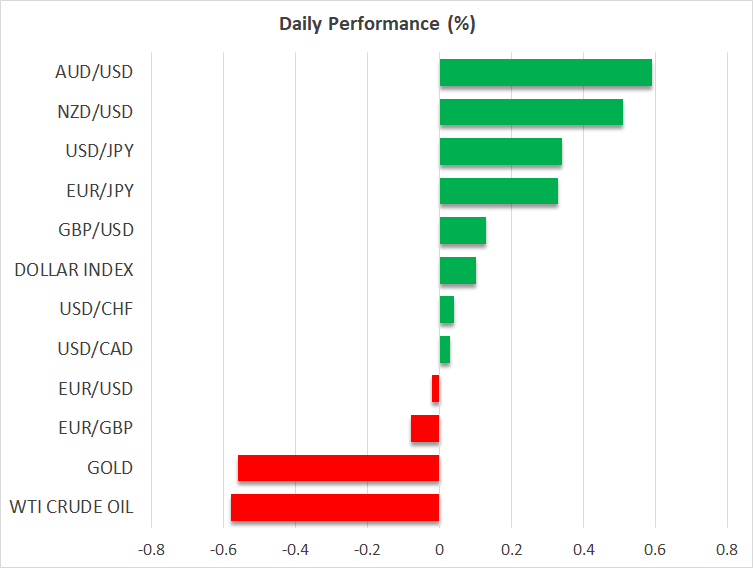

The Nasdaq Composite fell the most on Tuesday (-1.40%), followed by the S&P 500 (-0.40%), but the Dow Jones outperformed again, edging up slightly (+0.11%). Although the moves are not too dramatic and even modest when considering that tech behemoth Tesla plummeted by more than 11%, the Nasdaq is down almost 10% since the beginning of the month and on track to close the year with losses of 33%.

Tesla’s plunge reflects some of the challenges facing tech stocks heading into 2023, amid concerns about weakening demand and ongoing supply disruptions. These were highlighted by a Reuters report yesterday that said Tesla is planning to reduce vehicle production at its Chinese plant in January, as well as an earlier report that the company is offering discounts on two of its models in the United States.

However, the broader market selloff appears to be easing on Wednesday. US futures were more or less flat in European trading where shares were mixed on the continent but up sharply in London.

Yen extends losses, bucks the trend in sideways FX market

In the currency markets, it was a much more muted affair. The US dollar is inching higher but is lacking any real momentum, with most major pairs trading sideways.

The euro is steady but has been unable to make much headway on ECB policymaker Klaas Knot’s comment this week that the central bank will likely continue to hike rates by half-percentage point increments until the summer of 2023.

The yen, however, remained on the backfoot, breaching the 134 level to the dollar, as the Bank of Japan kept downplaying the significance of the widening of its yield band at its December gathering. In the summary of that meeting, board members pointed to the dysfunction in the Japanese government bond market as the reason for tweaking their yield curve control policy rather than for starting the process of exiting stimulus. However, there was also an acknowledgement that price increases are both broadening and accelerating in Japan, citing “progress” in achieving their 2% inflation goal.

This likely leaves the door open to further surprises at future meetings in 2023, but for now, there is disappointment that the hawkish noises aren’t louder and the yen looks set to continue to struggle during the holiday trading period.

Oil rebound might be faltering

The somewhat firmer dollar and doubts about how quickly Chinese demand would bounce back following the country’s scrapping of its quarantine rules weighed on oil and other commodities such as copper on Wednesday.

With Covid infections still very high, it could be several weeks if not months before demand fully recovers in China and oil prices are slipping today as investors reassess the outlook.

There was also some expectation that Russia might have announced much tougher restrictions on its exports of crude oil and oil products than the ones it did on Tuesday. Moscow’s counter measures to the West’s price cap only went as far as refusing to sell to buyers who are complying with the cap, either directly or indirectly, while the fact that Russian oil is already being sold at less than $60 a barrel means that there will be a limited impact on supply.

Looking ahead, it will be tougher for oil futures to extend their latest rally and gold’s upswing also seems to be losing steam. The precious metal is battling to hold onto the $1,800/oz level amid the steadier greenback and the rally in bond yields.