Fridays bond sell-off sends commodities and precious metals lower in Asia. Watch global bond yields ahead of Jackson Hole.

Monday mornings at 6 am Singapore can be an emotional time for traders. The fact that many of us are at work then aside! Monday 6 am is a magical witching hour when electronic trading starts the week on products such as the S&P 500, oil, US Bonds and Precious Metals. Significantly it is also the time that Tokyo (7 am Tokyo) Brokers switch on their margin servers. As a result price action can be “robust” to say the least as the market reacts to weekend news or to price movements in FX from late New York or early Asia. (2 AM Singapore for those poor FX dealers)

If the market gaps or prices move significantly this can trigger a sudden rush of margin stop outs by either the US Futures Exchanges or Japanese Margin Brokers in a particularly illiquid time of the week. The resulting price action can create a perfect storm type atmosphere where illiquidity, large moves combine to exacerbate even more moves and more stops etc in a very unvirtuous perfect circle.A prime example being the 20% USD/ZAR move in 30 minutes in January.

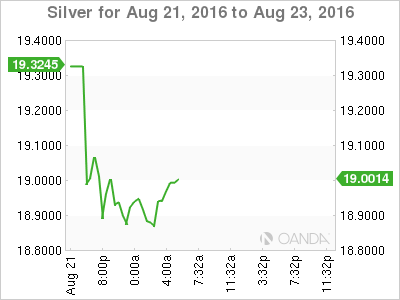

This appears to be what has happened in a few markets this morning. Most notably silver where the semi-precious metal opened and immediately sold off nearly 3% in as long as it took me to type this sentence.

A picture tells a 1000 words….

We have since made a small recovery.

News wise we didn’t have a lot out over the weekend apart from some Kuroda comments.

Kuroda Says ‘Sufficient Chance’ for More Easing in Sept.: Sankei

This was certainly enough to see USD/JPY gap higher on the Spot FX open to 100.90. Yellen’s Jackson Hole speech will be written about ad nauseam this week but for me the most significant driver were,

- Very extended and stale XAG positioning.

- The global bond sell-off (higher yields) we saw to finish the week.

XAG/USD longs have consistently been our most extended long positions amongst any of the precious metals and FX crosses for the last few months. Indeed after this mornings washout, it remains the most popular long amongst our clients’ percentage wise.

This isn’t actually a huge change from Friday much to my surprise and tells me that we still have a lot of long positioning out there. The daily chart makes for gruesome viewing as well with a sea of red on the candles for the last two trading sessions. Bond markets need to be closely watched today for signs of a continuing sell-off. Combined with the factors above this could see more downside pressure on Silver.

Support comes in at 18.8000 the 100-day moving average, then 18.7150 days low and then 18.5000 the bottom of the Ichi moko cloud.

Resistance is at 19.30 days open and the New York low.

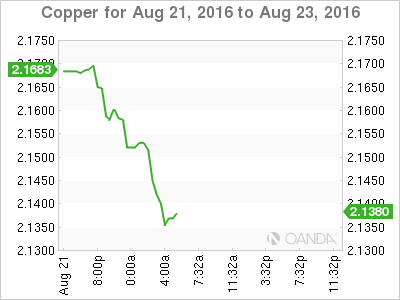

Commodities

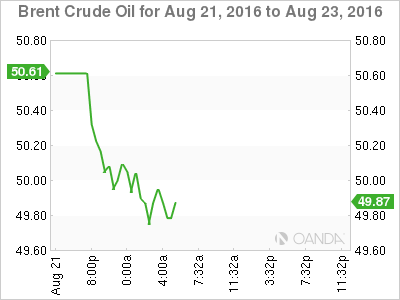

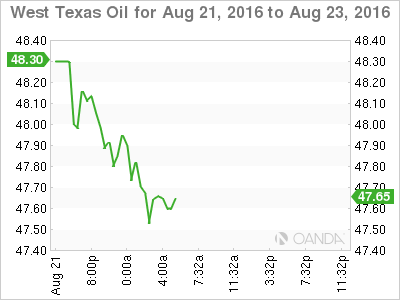

Similar set ups in Silver seem to be at play in commodities today. ie extended positioning and higher rates. Certainly, oil didn’t enjoy the 6 am open either.

and WTI….

Interestingly both “oils” bounced from their lows suggesting the OPEC nirvana of productions cuts they’ll actually stick to contains the downside for now.

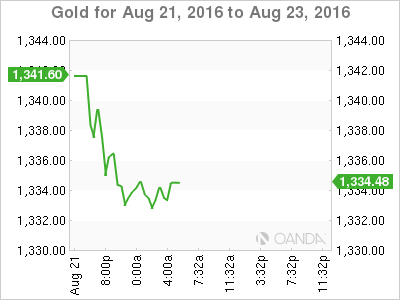

and Gold

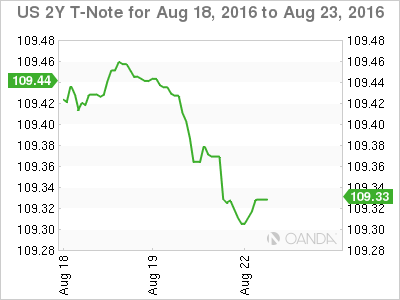

U.S. 2-Year T-Notes are back to pre Brexit levels

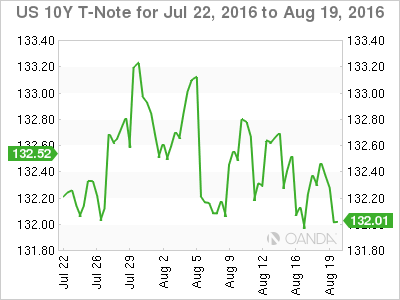

As are U.S. 10-Year Bonds

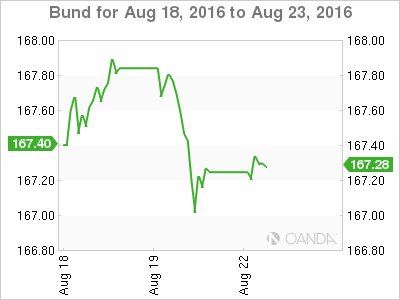

Even Bunds were sold!

Conclusion

Part of the bond sell-off story is definitely attributable to the street looking for some Fed Funds fire and brimstone from Ms Yellen this Friday in Jackson Hole. Another part may be the increasing perception that Central Bank monetary policy globally may be reaching its final stages of marginal utility as I have touched on before. But perhaps the lesson to be learned here is that nothing goes up forever and how acutely sensitive commodities, stocks and precious metals are to any sign of rising yields globally.

As I have said above watch global bonds this week. I am in no way calling the top of the global bond market but they are most certainly setting the short term agenda for everything else it seems ahead of Friday.