An interesting email was circulated my way from a client over the weekend. The title of the post is “Why We’ll Never See “Normal” Interest Rates Again” and it is basically a synopsis on the long history of falling rates by the folks at Investment U.

While I don’t intend to dispute the author’s claims, I think that it perfectly encapsulates the sentiment and one-directional thinking about bonds at the moment. It also breaks a cardinal rule in the markets: never say never.

When you look at a long-term chart of U.S. Treasury bond yields, the trend pattern is readily accepted. The deeper you go back, the milder each correction becomes until they are like tiny blips on the screen.

That same phenomenon can be applied to the stock market as well. If you look at a 50-year chart of the Dow Jones Industrial Average (below), seemingly huge events like the 1987 crash, 2000 tech bubble, and 2008 financial crisis look like little speed bumps. We all know how devastating those events truly were and how investors reacted in the face of those moments.

*source: macrotrends.net

It’s funny because if someone wrote “Why Stocks Will Never Again Go Down”, it would be derided as a ridiculous fantasy. Yet if someone tells you that interest rates will never rise to a “normal” level again, it’s thought to be fairly rational.

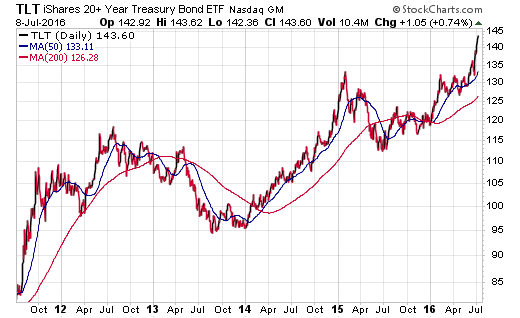

There seems to be a perception that bonds don’t lose money. That they can’t possibly go down given global headwinds, central bank intervention, and other exogenous factors. That’s a myth. If a vehicle like the iShares 20+ Year Treasury Bond ETF (NYSE:TLT) can rise 22% in the last year, it can just as easily fall 22%.

Remember the taper tantrum just a few years ago? TLT fell 20% from July 2012 through August 2013. Interest rates (and by extension bond prices) will see their prices ebb and flow just like any other asset class. There is no secret guiding principle that says interest rates will fall forever.

I’m not here to scare you into selling all your bonds or invest in rising rate funds. Those are extreme measures that are typically espoused by people seeking headlines or with very little skin in the game.

I own a ton of bond funds for myself and my clients. They have been very good to us both in their capital appreciation and the ability to help absorb volatility in other asset classes. In my opinion, most investors should have a core bond allocation as part of a diversified portfolio.

The lesson I would rather impart is to not assume an existing trend will extend indefinitely into the future. The moment you say “this stock will never fall” or “this correlation will never fail” or “I love this investment”, it will turn on you.

Disclosure: FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.