Global markets for higher risk asset classes, such as equities, corporate bonds and emerging market government bonds, have sold off sharply in recent days in the face of rising developed market sovereign bond yields, in particular US treasury bond yields. Rising US government bond yields have been driven by recent US economic data that has been interpreted by the market as increasing the risk that US inflation may rise more rapidly than expected thus pushing the US Federal Reserve to hike its policy rate by more than the three hikes that are currently expected by the consensus among economists.

Higher bond yields have led to lower market valuations of riskier assets for three main reasons. First, higher interest rates result in higher borrowing costs, dampening investment and consumption in the economy leading to lower revenue and profit expectations. Second, higher interest rates reduce the net present value of future revenue streams. Third, as yields on risk-free assets such as US treasuries rise, investors are likely to demand a higher risk premium for holding riskier assets such as equities and emerging market bonds, thus causing the value of these assets to decline.

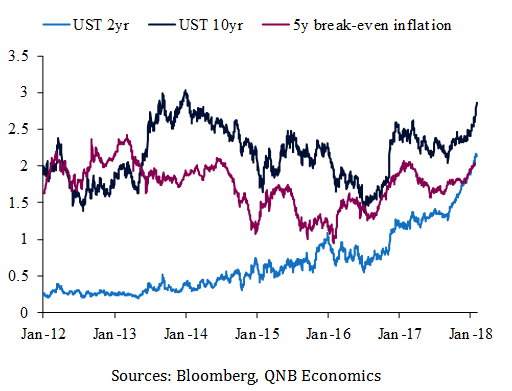

After reaching multi-decade lows in July 2016, global bond yields began to climb higher, pausing for breath during the first eight months of 2017, but then resuming their climb in response to upward momentum in global growth and rising inflation expectations.

Until recently, riskier assets had taken the rise in US treasury yields in their stride reflecting a number of factors. Incoming US wage growth and inflation data during this period remained benign, prompting markets to doubt that the US Federal Reserve would increase its short-term policy interest rates as fast as was projected.

Rising bond yields and inflation expectations

Sources: Bloomberg, QNB Economics

That environment has recently changed and bond yields have been driven up for three main reasons. First, higher growth and inflation expectations have driven up yields. Consensus growth forecasts have been systematically revised higher for global and US growth in the face of incoming macro data, as well as the passage of the US tax reform package that is expected to boost growth for, at least, the next two years. With unemployment in the US at multi-decade lows, and growth expectations solid, the market’s inflation expectations have continued to rise, pushing long-term bond yields up further. These stresses were exacerbated by the US employment data published last week. The monthly increase in non-farm payrolls of 200,000 jobs in January was significantly higher than expected by the market consensus at a time when unemployment is already low thus increasing the probability that wage growth may accelerate soon and push up inflationary pressures in the coming months. In the same data release, average hourly earnings accelerated to 2.9% y/y, the highest level since 2009. Therefore,the bond market now appears to be more concerned about upside inflationary risks and the potential that the Fed may have to raise interest rates more aggressively over the remainder of 2018 than the consensus of three hikes viewed by market economists.

Second, policy drivers are shifting in the direction of higher bond yields. On the one hand, US fiscal deficits have been revised higher with the passage of the US tax reform package thus increasing the supply of US government bonds in the market, pushing down bond prices and raising yields. On the other hand, the demand for US government bonds has softened, other things equal, because the US Fed is no longer a buyer of long-term US government bonds as it continues to unwind its balance sheet following its multi-year Quantitative Easing program. The reduced demand for US bonds also leads to lower bond prices and higher yields.

Third, investors appear to be demanding a higher term premium in the face of rising inflation expectations – the term premium is the additional compensation demanded by investors for holding a long term bond over a short term bond.

Whether the market price for equities and other risk assets continues to decline will in large part depend on whether the Fed becomes more hawkish going forward. This in turn will depend on the incoming inflation data that so far has remained tepid. If indeed inflation does surprise to the high side, investors are not only likely to bid up short-term bond yields but also demand a higher inflation risk premium for the additional risk of holding a long-term bond. Both those developments would be negative for risk appetite and global risk assets in general. The result is that markets are likely to remain volatile over the coming period in the face of uncertainty over the outlook for US inflation and US treasury bond yields.