Coming into year end, the equity markets are at all-time highs, the crypto markets are acting like super heroes and oil is holding up at 52 week highs. Everything is great. Except for the chip stocks.

Don’t get me wrong, the Semiconductor Index (SOX) has had a great 2017. But the last three weeks the SOX has looked like it blew a hole out when they were putting on their socks on a snowy morning.

The SOX has pulled back over 15% in that time. Is it temporary?

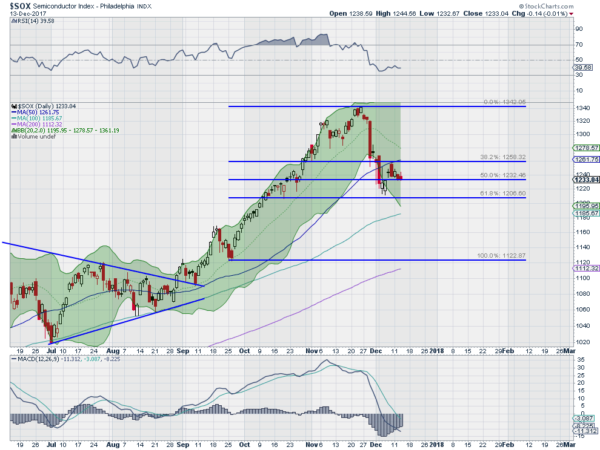

The chart below gives some place and price levels to watch to help figure this out. Measuring the move from the September pullback to the peak in November sets the range. Since then it has retraced 61.8% of the move higher and crossed down below the 50 day SMA. A bounce last week brought it back to the 50 day SMA and the 38.2% retracement level where it stalled and reversed. Now it is back lower at a 50% retracement of the move up.

This creates a lower high if it does not reverse. A sign that the downturn is not over. A move below the 61.8% retracement at 1206 would confirm that with a lower low and look for continuation to 1122.

Notice that momentum turned bearish but never went extreme. That also bodes for more downside. The RSI has leveled in bearish territory while the MACD is slowing its descent as it moves negative. The Bollinger Bands® are also open to the downside. Keep an eye on this range, 1206 to 1258. Above it all may be well. Below it downside continues.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.