Investing.com’s stocks of the week

By now, most retailers have cleared their Halloween gear off the shelves and decked their halls with Christmas merchandise.

The holiday shopping season is nearly upon us. And even though brick-and-mortar shopping is far from dead (as I showed last week), we can’t ignore the e-commerce explosion, either.

Now, the world’s most popular online retailer, Amazon.com Inc (O:AMZN), is wildly overvalued and out of reach for many investors.

However, it’s possible to put in a cheap short-term trade on the retail giant without buying a single share of Amazon stock.

What Can Brown Do for You?

United Parcel Service Inc (N:UPS) is one of the oldest and largest package delivery companies in America.

It delivers packages in over 220 countries and serves nearly 10 billion customers. Importantly, UPS is also one of Amazon’s chief U.S. package delivery providers.

This year, both UPS and FedEx Corp (N:FDX) are projecting a large increase in volume thanks to Amazon’s surging Prime membership.

But, as you know, Amazon currently trades at about 900 times its trailing earnings, an absurd multiple.

On the other hand, UPS trades at 24 times earnings, a significant discount to both Amazon and FedEx, which sports a price-to-earnings multiple of 33.

And while it’s not a pure-play on Amazon’s shipping business, UPS does present an attractive alternative to owning Amazon shares.

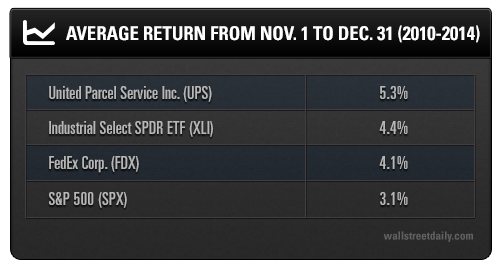

To be fair, UPS trades at a premium to the S&P 500 (18 times earnings), but the stock outperforms the market by a nice margin during the holiday season.

So, how do we profit from UPS on a compressed timeline?

Use the Option, Luke

The easiest way to execute this strategy would be to buy UPS shares today and then sell them sometime around first-quarter earnings. And there’s nothing wrong with that approach.

But how about a low-risk trade that can save you at least 60% in upfront capital?

Because volatility has dropped to pre-flash crash levels, options are once again cheap. A short-dated, slightly out-of-the-money (OTM) option like the April 2016 $105 calls trades for around $3.90 right now.

100 shares of UPS at current levels would cost you $10,400. A 10-contract purchase of the $105 calls costs just $3,900. That’s a 63% discount to owning shares!

Ultra-aggressive investors might consider an in-the-money option like the April 2016 $95 calls.

These are a bit more expensive, at $9.80, but they’re still much cheaper than owning shares. And they’ll move faster than the OTM options because they have a tighter price correlation to the underlying shares.

With either option, you only need a slight move in the underlying stock to make a huge profit. And your total exposure is limited to your net debit, or the amount of money you spent to enter the trade.

Another huge bonus to this trade: You’re not only capturing Amazon’s shipping business but also much of Amazon’s online retail competition, as well.

As you can see, this low-risk trade offers big-time upside.

Bottom line: Don’t overpay for Amazon shares. Take advantage of cheap UPS options to cash in on this year’s e-commerce holiday surge.

On the hunt,