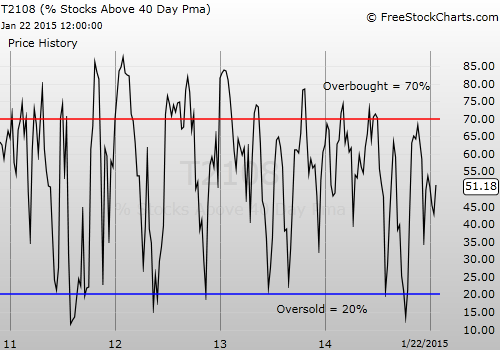

T2108 Status: 51.2%

T2107 Status: 47.1%

VIX Status: 16.4 (down 13%)

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #65 over 20%, Day #24 above 30%, Day #4 over 40%, day #1 over 50% (overperiod), Day #34 under 60% (underperiod), Day #135 under 70%

Commentary

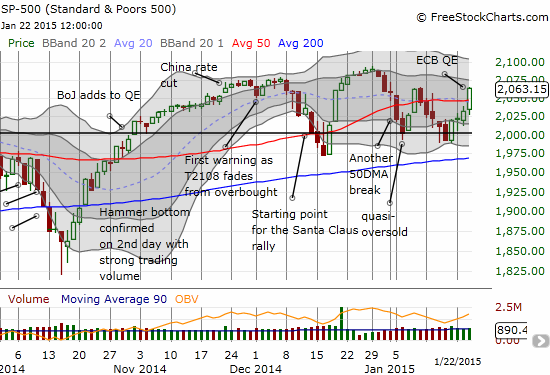

When I last wrote a T2108 Update a week ago, the market felt heavy enough to switch my trading bias to bearish. I stuck by the anti-volatility bets but was on the hunt for set-ups to go short on individual stocks. I chose not to chase the SPDR S&P 500 (ARCA:SPY) lower because I tend only to short the index when it is overbought or it experiences a major technical breakdown (well above oversold conditions). As it turned out, the S&P 500 never even retested 200DMA support as sellers completely lacked follow-through. It left me over the last week with very few bearish trades to even try.

The S&P 500 surges above its 50DMA….again

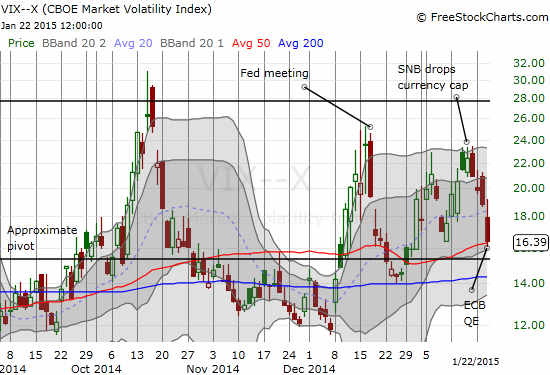

So, the market continued to chop with every move higher and then lower and higher again causing a whoosh of excitement. This time around the excitement came from the soothing salve of the European Central Bank (ECB). Its announcement of a quantitative easing (QE) program was apparently met with great market approval. The apparent impact on volatility was most dramatic and allowed me to close out all my anti-volatility positions with respectable gains: shares in ProShares Short VIX Short-Term Futures (ARCA:SVXY) and put options on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY).

The market’s salve comes in the form of a central bank just one week after a different central bank helped send volatility to its closing peak for the cycle.

The strong surge for ProShares Short VIX , and Short-Term Futures (SVXY) still left it stuck in a downtrend so far marked well by a declining 20DMA. Note how volatility reached a closing cyclical peak after the Swiss National Bank (SNB) threw markets for a loop by dropping its currency cap on the Swiss franc (NYSE:FXF)) against the euro (NYSE:FXE). A week later, the ECB helped plunge the VIX by 13% in a day, 27% off the last cyclical peak. This latest volatility cycle covered a nice range, but notice how SVXY still appears locked in a downtrend. I am a little more wary of the fade volatility trade and will look for a greater extreme next time I try it.

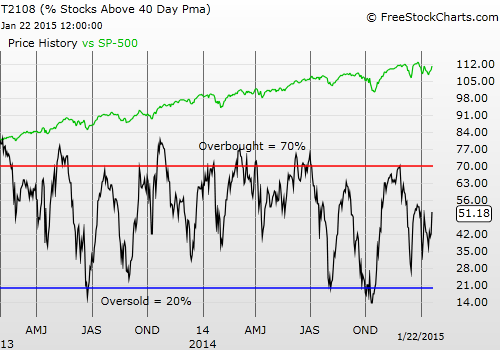

T2108 closed at 51.2% after an impressive surge of 9 percentage points. T2108 has not managed to move much higher than these levels since the bounce from the December lows. I have no reason to drop my long-standing assumption that the stock market is caught in a choppy range. I have changed the trading bias to bullish only because the S&P 500 broke above its 50DMA. I can only assume that all-time highs will represent a cap. A break to new all-time highs will be bullish with special caveats in place if T2108 tests overbought conditions around the same time.

Google (NASDAQ:GOOG) is one stock I thought I could fade when the trading bias was bearish. Yesterday, it blew right through 50DMA resistance and the high from the previous bounce. I set up a trade on put options to trigger only if the stock broke through its low of the day after today’s open; unfortunately the condition triggered and within minutes GOOG was off and running. The stock now looks quite manic. However, since the last low now looks like a hammer bottoming pattern, I must change my trading bias on GOOG to bullish. If I had been prepared to change bias earlier, yesterday's incredible surge would have made a very profitable trade on call options! Resistance looms overhead from the declining 200DMA.

Google turns manic and confirms a double bottom.

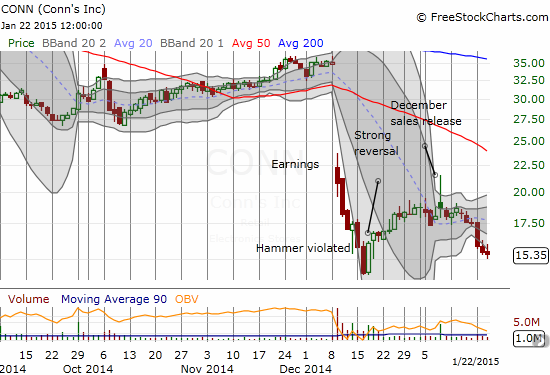

The trade on Conn’s (NASDAQ:CONN) came to an abrupt end as the stock declined 11% to start the week. I was hoping the stock would rebound after January options expiration. The stock position was even at that time and the call option I sold against the stock expired worthless (paying for half of the higher strike call options I purchased). So, I cut the stock loose and bought a few call options just in case the stock revives again.

With the supportive options action expired and behind it, Conn’s resumes its sickly ways.

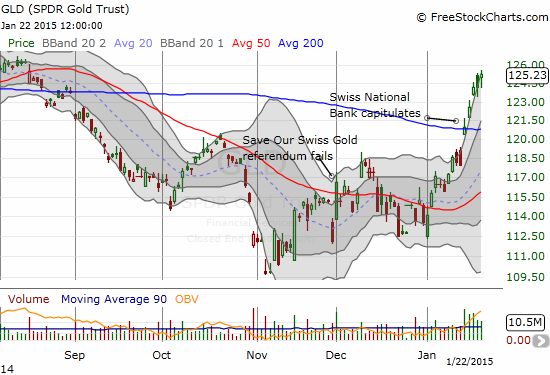

In some good news, I closed out all my gold-related short-term trades with nice profits yesterday. I sold a bit early as gold took a brief dip. I had a sensitive sell trigger in effect because SPDR Gold Shares (ARCA:GLD) has been ripping higher well above its upper-Bollinger Band® – such moves are rarely sustainable and usually lead to substantial pullbacks at some point. I am looking to buy aggressively into that next dip.

The ever stronger US dollar is not preventing gold from continuing to soar year-to-date.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Disclaimer: long GLD, long GOOG put options, long CONN call options, net LONG the euro (short term!), short the Swiss franc