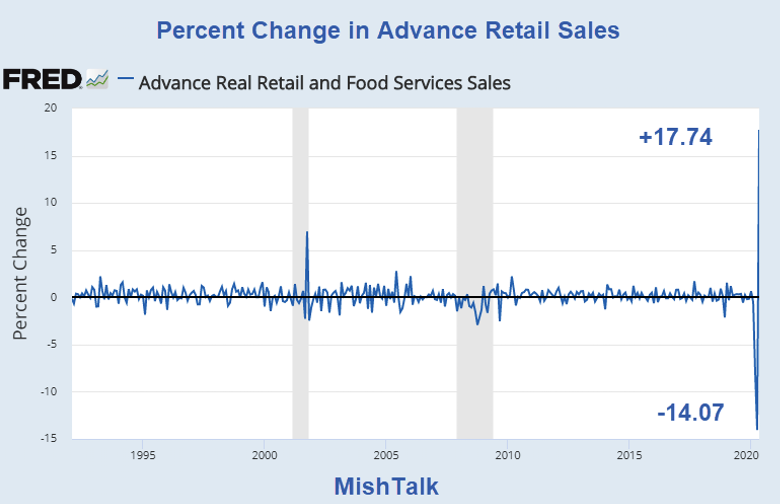

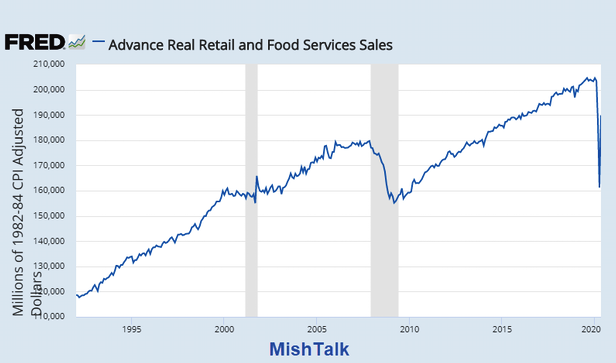

Retail sales surged a greater than expected 17.7% in May but the numbers are well below the pre-pandemic levels.

Those touting a V-Shaped recovery will point to today's Advance Retail Sales Numbers

Advance Retail Sales

Despite the surge, sales numbers are back to levels seen in late 2015 and early 2016.

On a year-over-year basis, sales are 6.1% below May 2019.

Total sales for the March 2020 through May 2020 period are down 10.5% from the same period a year ago.

Far Better Than Expected

Still, the sales numbers are far better than expected.

The Econoday consensus was +7.5% in a range of +2.3% to +12.3%.

5-Month Totals

- Total: -4.7%

- Motor Vehicles and Parts: -10.5%

- Furniture: -18.1%

- Electronics and Appliances: -19.3%

- Building Materials: +6.7%

- Food and Beverage Stores: +13.1%

- Health & Personal Care: -2.4%

- Gasoline: -16.7%

- Clothing: -42.9%

- Sporting Goods: -9.9%

- Department Stores: -21.0%

- Nonstore Retailers: +16.6

- Food and Drinking Places: -22.3%

The big winners were online shopping (Amazon (NASDAQ:AMZN)) +16.6%, and food stores up 13.1%.

What's Coming?

We had a big surge, but many people are still fearful of crowds.

It will take a long time for restaurants, gasoline, and other items like hotel, airline traffic that are not in retail sales to recover.

Stimulus Checks

People got money and spent it, but they also skipped mortgage payments and credit card payments.

Those Out of a Job

There are still 20 million people out of work.

It is foolish to believe they will all be back working the same number of hours at the end of June.

Fed vs Kudlow

- The Fed Warns of High Downside Risk

- Larry Kudlow says "The Economy is Off to the Races."

Expect a Relapse

There are too many things that can go wrong and many of them will.

The Fed does not expect a V-shaped recovery and neither do I.

Fade Kudlow. These numbers look far better than they are.