In its semiannual monetary report to the Senate Finance Committee the Fed warns of six downside risks.

The risks are not spread evenly. Low wage earners and small businesses are particularly vulnerable.

Please consider the Fed's Monetary Policy Report to the Senate Committee on Banking, Housing, and Urban Affairs and to the House Committee on Financial Services.

The report is 66 pages long and is full of interesting charts and comments.

Let's start with Powell's statement on risk:

"Despite aggressive fiscal and monetary policy actions, risks abroad are skewed to the downside."

Six Downside Risks

- The future progression of the pandemic remains highly uncertain.

- The collapse in demand may ultimately bankrupt many businesses.

- Unlike past recessions, services activity has dropped more sharply than manufacturing—with restrictions on movement severely curtailing expenditures on travel, tourism, restaurants, and recreation and social-distancing requirements and attitudes may further weigh on the recovery in these sectors.

- Disruptions to global trade may result in a costly reconfiguration of global supply chains.

- Persistently weak consumer and firm demand may push medium- and longer-term inflation expectations well below central bank targets.

- Additional expansionary fiscal policies— possibly in response to future large-scale outbreaks of COVID-19—could significantly increase government debt and add to sovereign risk.

Labor Market

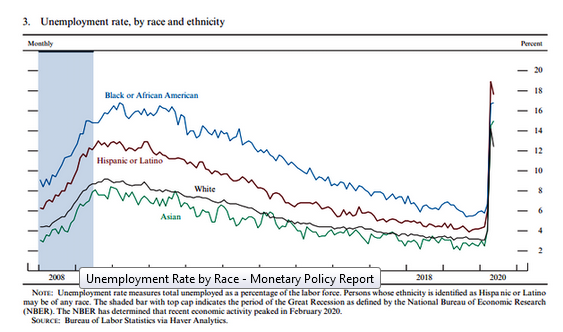

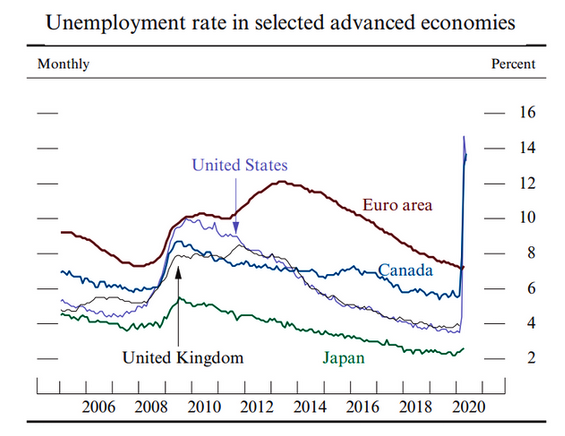

The severe economic repercussions of the pandemic have been especially visible in the labor market. Since February, employers have shed nearly 20 million jobs from payrolls, reversing almost 10 years of job gains. The unemployment rate jumped from a 50-year low of 3.5 percent in February to a post–World War II high of 14.7 percent in April .

Unemployment Rate by Race

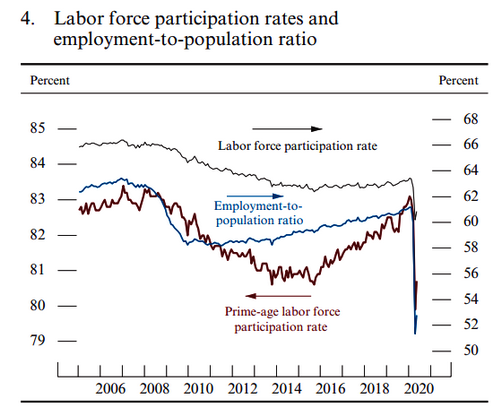

Labor Force Participation Rate

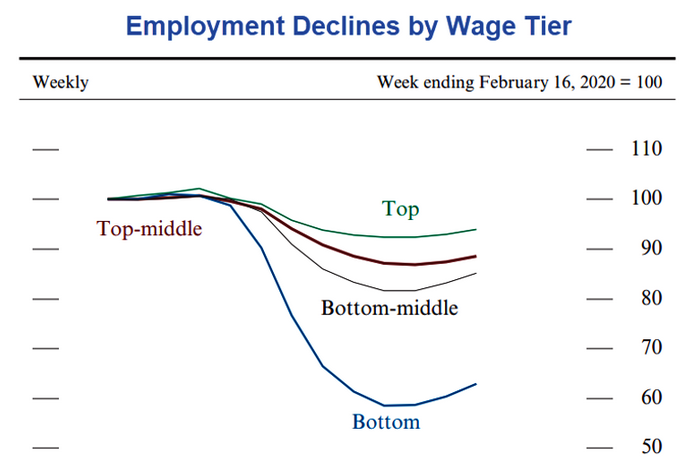

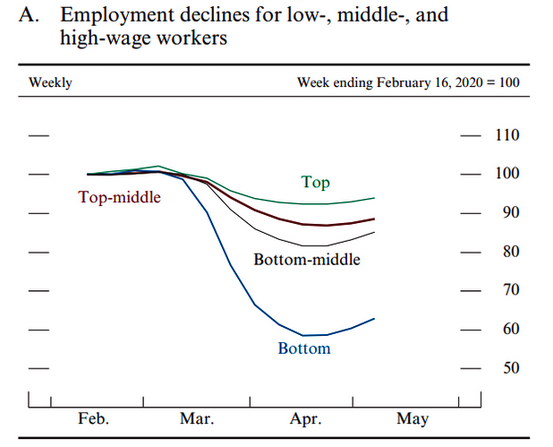

Employment Declines by Wage Group

Low Wage Earner Employment

Employment for lower-wage earners remains roughly 35 percent lower than in February, compared with 5 to 15 percent lower employment for higher-wage earners. These differences are also consistent with results from a recent survey conducted by the Federal Reserve Board that indicated that among households with an annual income of $40,000 or less, nearly 40 percent of individuals who were employed in February experienced job loss in March or early April, compared with 20 percent of the population overall.

Small Businesses

More than 99 percent of U.S. firms have fewer than 500 employees, and almost 90 percent have fewer than 20 employees. Altogether, businesses with fewer than 500 employees account for almost half of private sector jobs.

A wide variety of data reveal an alarming picture of small business health during the COVID-19 crisis. Surveys of small businesses suggest that pessimism about business viability is prevalent.6 The majority of small businesses have seen revenue losses, and half of small businesses do not expect to return to their usual level of operations within the next six months.

Data from Homebase, a provider of scheduling and time sheet services for small local businesses, show that between 30 and 40 percent of establishments in sectors deeply affected by social distancing have gone inactive since February 15.

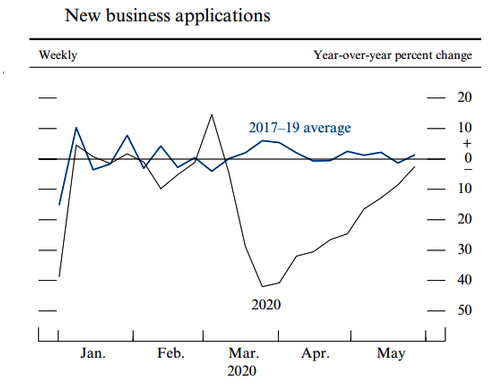

New Business Applications

Direct Subsidies Skew Unemployment Rates Globally

Several European and Asian countries have thus far experienced sizable declines in hours worked but relatively small increases in unemployment given the size of the drop in economic activity, partly reflecting direct wage subsidies provided by the governments to keep workers on firms’ payrolls.

I put a spotlight on employment but there are many other charts in the report on inflation, treasury rates, inflation expectations, and other topics that you might be interested in.

Fed Projects 2020 Growth at -6.5%, Unemployment 9.3%

Fed's New Tool

The Fed does not expect a V-shaped recovery and neither do I.