From Contrarian Outlook: Don’t take dividends for granted. Business disruption is accelerating as entire industries are being eaten alive.

Uber and Lyft? Killed cabs.

Amazon (NASDAQ:AMZN)? It’s crushing retail and starving their REIT landlords right before our very eyes.

And soon, these disruptors might team up to offer more same day deliveries – and make more rivals obsolete!

These types of disturbances have added a new layer to contrarian investing. In years past, it was as simple as buying stocks when they were out-of-favor and holding them until they became back in vogue. The “Dogs of the Dow” strategy, for example, usually beat the market by banking the highest blue chip dividend yields – a sign that the tide was ready to turn back in the dogs favor.

But in 2017, it’s not good enough to buy what’s hated. In fact, it’s often dangerous. We income investors must decide whether the light at the end of the tunnel is real hope, or the lights of an oncoming train filled with Amazon boxes!

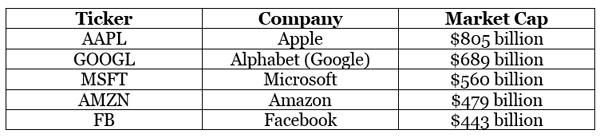

Here are the five locomotives steamrolling business models across the country (and globe). They are currently the five largest firms by market cap:

2017’s Five Business Bullies

Notice a pattern? All five are tech titans. More specifically, they are the five best companies at writing software, which they use to scale their own businesses, at the expense of countless others.

In recent years, they’ve routed the broader market. And their advantage has actually accelerated of late:

Tech Turns Up The Volume

Bubble? Probably not. While the stock market at large may be a bit richly priced right now, these five firms are legitimately beating up brick-and-mortar competitors in real life.

Of course these five stocks aren’t usually our beat. Only two (Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT)) pay any dividend. Even then, their yields are modest (1.5% and 2.1% respectively), though cases can be made for them as dividend growth plays.

But we’re not going “off script” to pick up one of these names. Instead we’re going to quickly review the dividend landscape at-large to separate the values from the value traps. There are safe and more compelling dividend growth plays today, and I’ll share my favorite in a moment. First, let’s stay away from payout trouble.

Stay Away: Retailer And Retail REIT Dividends

With delivery services just beginning to take off, I’m not even “safe” spots like supermarkets are safe. As I mentioned earlier there are countless Uber and Lyft drivers cruising this country looking for someone, or something, to drive from here to there.

Pharmacies were thought to be Amazon-proof, but CVS Health (NYSE:CVS) and Walgreens Boots Alliance (NASDAQ:WBA) investors are scrambling after reports that Amazon is looking into the pharmacy business. That’s a potential problem – maybe not for today, but perhaps in the years ahead. With CVS’s payout ratio already climbing, Amazon’s entrance could easily compromise future dividend growth:

Payout Growth, No Problem – For Now

Foot Locker (NYSE:FL) provides a cautionary tale. It’s the type of shareholder friendly company we typically wax poetically about, with 72% dividend growth and a 13% reduction in shares outstanding over the last five years. And the firm fought gamely for longer than I would have anticipated versus shoe delivery extraordinaire Zappos (now owned by Amazon).

But shares have dropped 30% in the last month after the dreaded “earnings and revenue miss” that the Internet eventually extracted. With a 2.3% yield, a decade worth of dividends was shaved off shares in a month.

The value guys are circling around this “cheap” stock, but unless the Foot Locker has a definitive online and mobile shopping answer to Amazon and Zappos (and even Nike (NYSE:NKE)), it’s going to be an uphill battle.

Stay Away: Consumer Staple Dividends

Consumer staples aren’t the “sure thing” they traditionally have been. The Internet has squashed these barriers to entry. Prime retail shelf space becomes less and less important as consumers move their shopping online – where they can buy any brand they’d like.

Plus, there is instant “brand recognition” with online reviews, where each review is brand agnostic. Five stars is five stars, after all.

For example, Kimberly Clark’s (NYSE:KMB) Huggies brand used to be a no brainer buy for moms. But my daughter is now two-and-a-half and she’s never seen a Huggies.

Instead she sports “premium nontoxic” baby-products from Honest Co. No brand name, no problem – Honest got one overnight when Jessica Alba took over as boss.

Conscientious “mom-sumers” have powered big sales growth for Alba. Her startup’s sales jumped from $60 million in 2013 to $170 million in 2014 (and gave the company a $1.7 billion valuation).

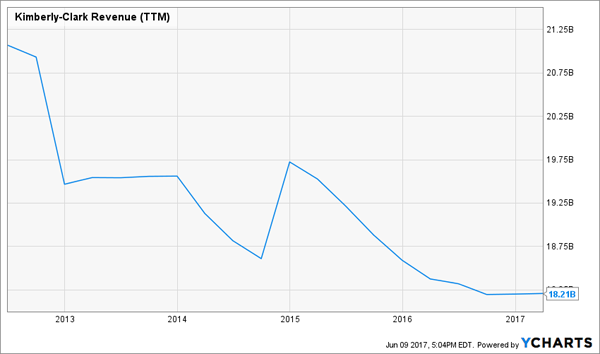

And KMB? It’s sales are slumping like a loaded diaper:

A Loaded Diaper

Stay Away: Restaurant Dividends

The restaurant business today is, more or less, a zero-sum game. But many of the recent winners don’t have tickers that you and I can easily invest in. Food delivery company Blue Apron – the most well known name in an increasingly crowded field – has raised $200 million from venture capitalists to advertise and scale its business.

I’m guessing you don’t have a stake in Blue Apron either. But you might be tempted by DineEquity (NYSE:DIN), which operates Applebee’s and IHOP. It is publicly traded, and is a generous dividend payer and grower to boot. Its yield looks increasingly attractive to income hounds:

At First Glance, A Good Looking Yield

Unfortunately the yield is soaring because the firm’s stock price is tanking!

Too Bad It’s A Mirage

My advice? Let the Silicon Valley VCs keep pouring money into Blue Apron and its countless knockoff competitors. If you want to spend money here, instead consider one of their food boxes – which are being heavily subsidized by gobs of capital!

Buy Now: A 5% Yield With 586% Upside

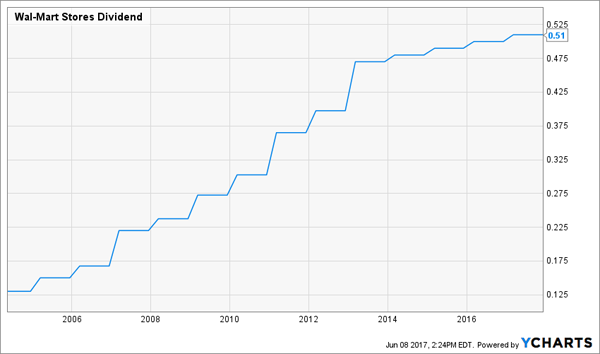

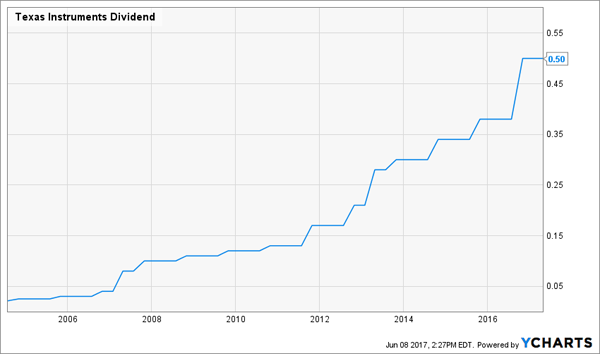

Check out these two dividends. Which would you rather buy today?

Dividend A: Plateauing

Dividend B: Accelerating

Of course you’re better off owning the second one. An accelerating dividend is a sign of business strength, while a slowing payout is a sign of trouble. And since stock prices follow their dividends over the long term, I’d much rather own the one that’s “hockey sticking” versus plateauing.

WalMart’s (NYSE:WMT) business and dividend – the first example – are both plateauing. Amazon is consuming its brick-and-mortar business, and the retail giant has no clue how to actually compete in online e-commerce.

It violated our key rule for business survival in 2017: Avoid being run over by the tech trains!

My favorite tech company to buy today isn’t one of the Big 5. Nor does it play on their train tracks. In fact, this company makes a critical component that is included in every single electronic device on the planet today!

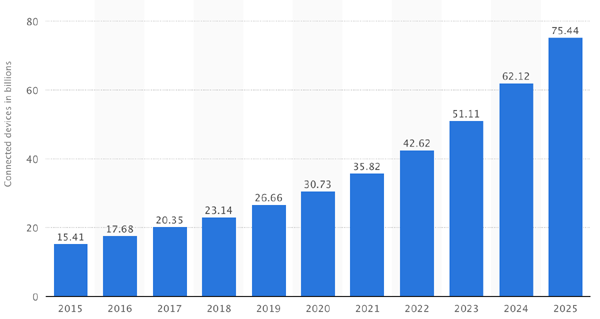

Since there are now more gadgets than humans on Planet Earth, we’re talking about a big market. We’re also talking about a booming one. The number of Internet connected devices alone is expected to top 75 billion in just eight years!

Connected Electronic Devices (In Billions)

Source: Statista

Anyone who buys this stock today is banking a 5% cash yield plus significant price upside in the years ahead – perhaps 586% or more, if history is any indication.

The SPDR S&P Retail (MX:XRT) ETF (NYSE:XRT) was unchanged in premarket trading Wednesday. Year-to-date, XRT has declined -6.38%, versus a 9.53% rise in the benchmark S&P 500 index during the same period.

XRT currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #34 of 45 ETFs in the Consumer-Focused ETFs category.