Street Calls of the Week

-

The pause in financial conditions tightening helped stocks rally.

-

Semiconductors’ market cap weighting reached an all-time high.

-

Mag7 corporate bond yields are almost on par with Treasuries.

-

Credit & Equity markets are extreme expensive, complacent.

-

Passive index investors are all-in on tech, light on defense.

Overall, in the short-term the pause in financial conditions tightening has helped stocks rally off oversold levels —perhaps along with some renewed optimism on what the year ahead might bring, and golden age, AI, etc. But I think we need to remain on guard and watch regarding financial conditions; a resumption in tightening will risk triggering some of the significant vulnerabilities building up in markets.

1. Financial Conditions

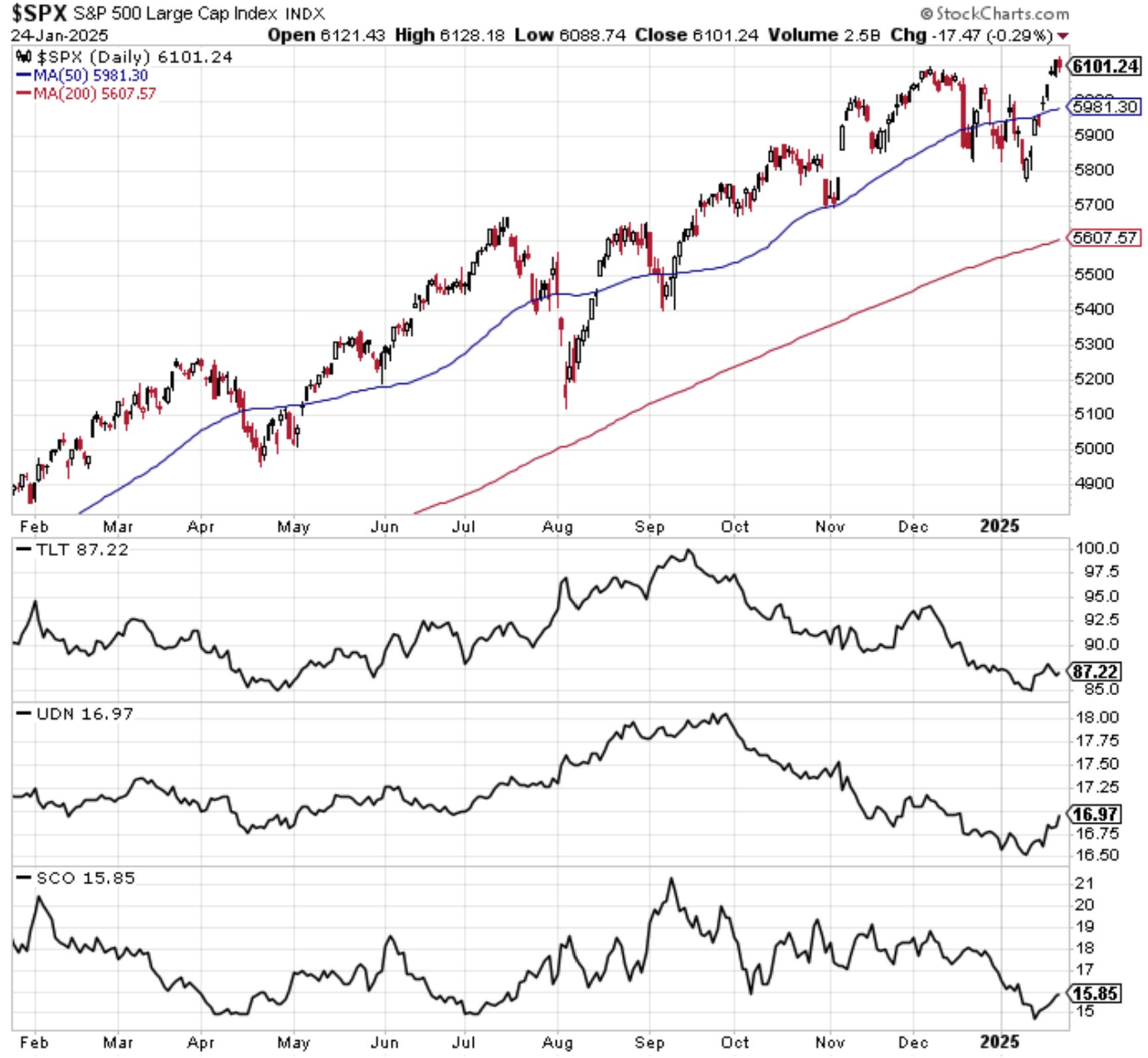

First up is a look at some Intermarket analysis; arguably what’s been behind some of the recent market weakness has been rising bond yields (TLT, bond prices, as a tracker for this in the chart below), strong dollar (UDN, inverse USD), and rising oil prices (SCO, inverse crude oil).

Basically, if you get a surge in US dollar, bond yields, and crude oil — that’s a tightening of financial conditions, a headwind for the economy and risk-taking, and at a certain point stocks come under pressure. So I think this S&P 500 chart will be key to keep watch on as they are all rebounding at the moment, and taking some pressure off stocks: question is for how long.

Source: Callum Thomas using StockCharts

2. Semiconductors

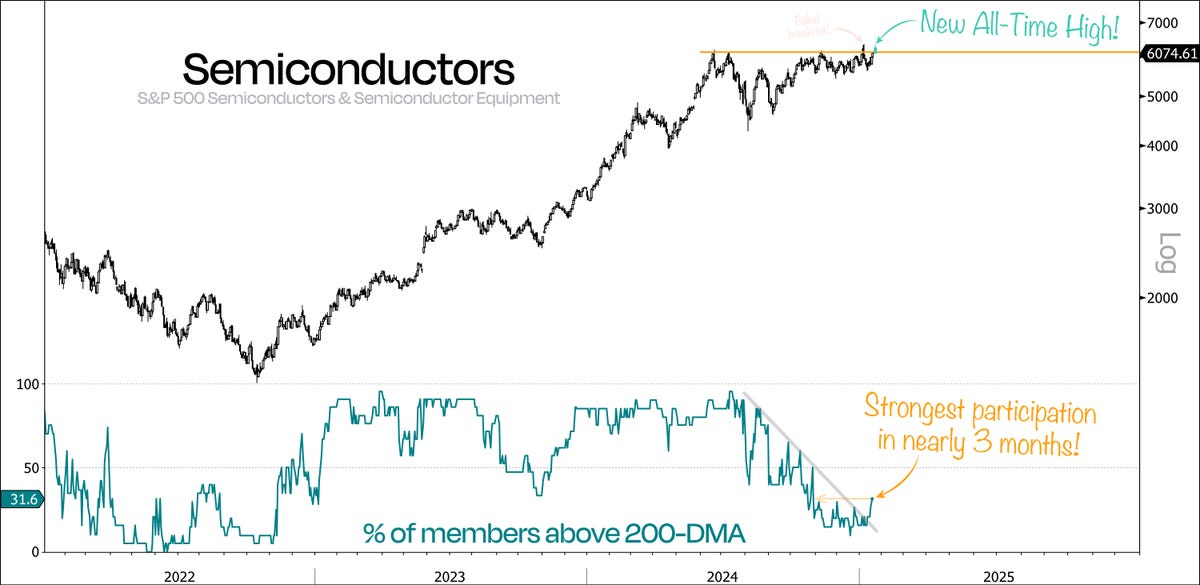

A big driver of the AI-hype bull market has been strength in semiconductors (at least up until they peaked as a sector about middle of last year). I think this year is going to be a potential moment of truth for this part of the market. On the one hand you have the “AI Manhattan project” where a consortium of AI players have pledged to invest some $500B, on the other hand there’s the just-released Chinese breakthrough model DeepSeek which has demonstrated the success of open-source models and greater efficiency (maybe you don’t need mega datacenters, or at least as many as we thought). Then there’s the remaining open question of how do you even commercialize AI, and competition will bring pressure down on any profit margins that can be generated — I think what this adds up to is perhaps a period of rethinking on capex, earnings prospects, and maybe a shakeout in some of the excesses here.

Source: @DualityResearch Duality Research via @TheChartReport

3. Semiconductors Market Cap Weight

And speaking of excesses. Maybe that is the new normal, maybe it’s an echo of 2000 (maybe a bit of both).

Source: Topdown Charts

4. Magnificent Corporate Bonds

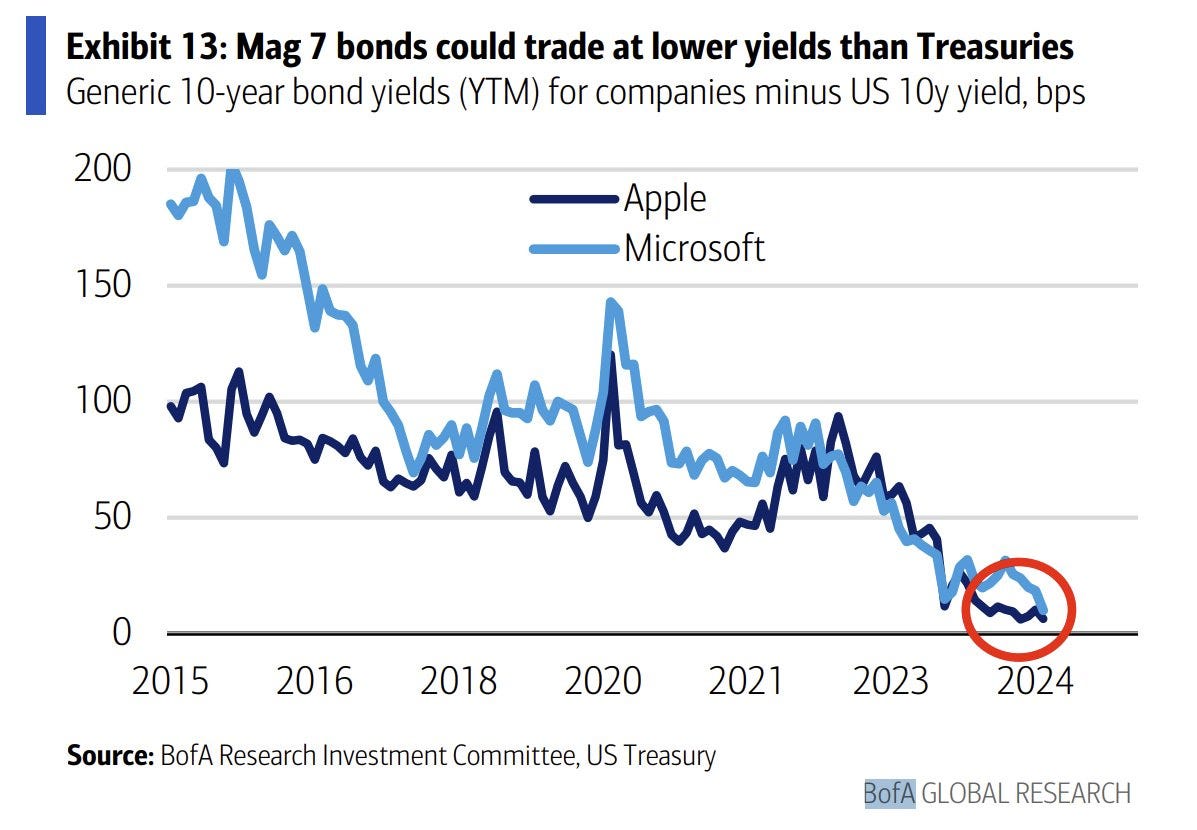

There is an apparent belief among bond market participants that Apple (NASDAQ:AAPL) / Microsoft (NASDAQ:MSFT) are as good as the US government in terms of willingness and ability to make good on debt payments. With the way the US fiscal situation has been going, maybe they have a point, but also it goes to show how complacent sentiment is on big tech and credit in general.

Source: Andrew Sarna

5. Credit Risk Premium

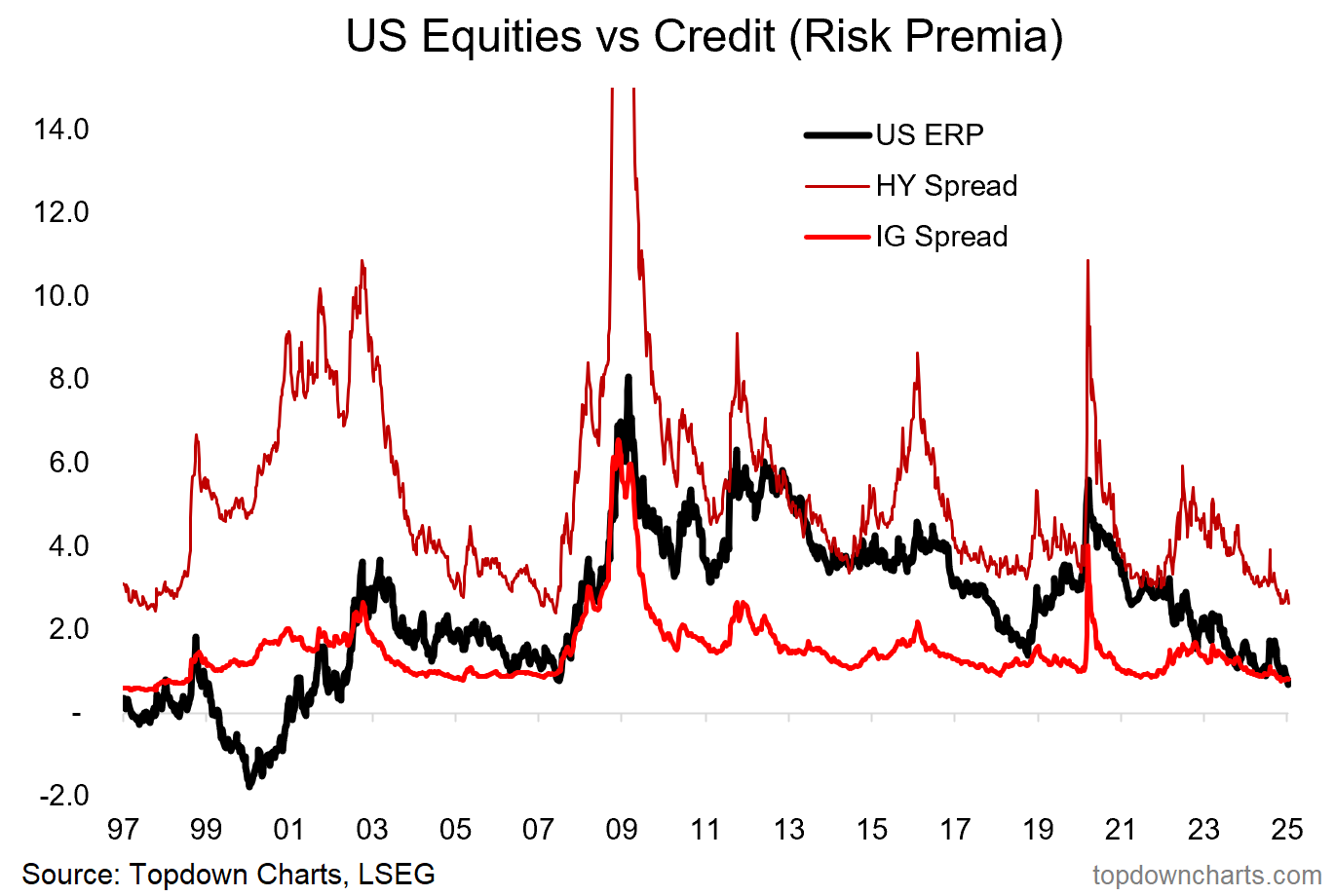

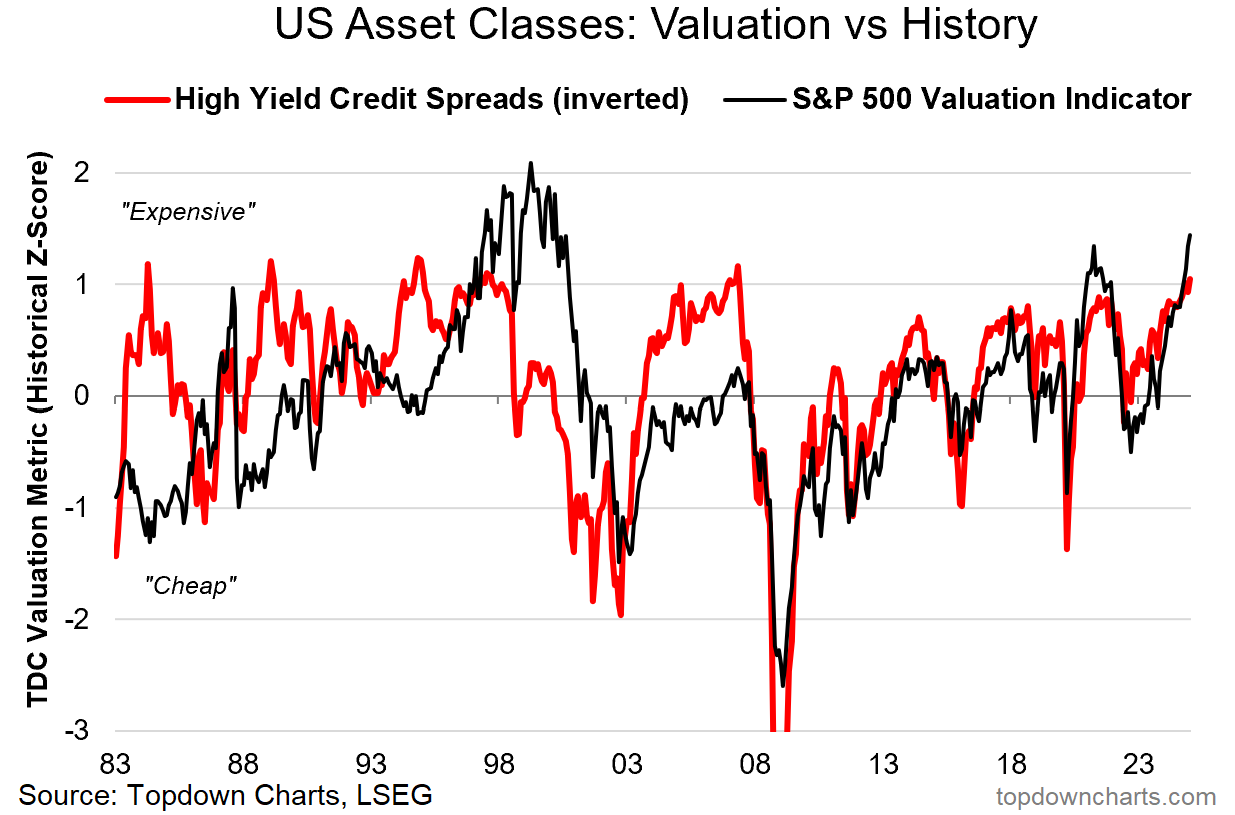

It’s not just big tech — complacency is *the* vibe of the market right now. High-yield corporate bond spreads are back to 2007 levels, and the equity risk premium is closing in on multi-decade lows.

No risk premium, no problem it seems.

Source: Topdown Charts Professional

6. Credit vs Equity Valuations

Flipping things on the credit side, the other way to look at it is both equity and credit markets are extreme expensive, overvalued, and at risk should we run into any macro turbulence.

Source: ChartStorm Perspectives Pack

7. Unanimously Expensive

And here’s another angle on it, this one shows what looks to be the average historical percentile ranking across 8 different valuation metrics, and the signal is unanimous: the US stock market has reached new heights of valuation extremes. You can kind of explain away some of this with data points of how valuations don’t matter in the short-run, or that it’s expensive for good reason, etc, but I think it’s quite dangerous to try and argue that valuations don’t matter when we’re at this stage of the cycle (and it might even be outright irresponsible).