It’s been an interesting morning in the restaurant space as several of the industry’s major players, including McDonald’s (NYSE:MCD) and Domino’s (NYSE:DPZ) , reported their latest earnings results. Despite solid beats by both of the aforementioned companies, the market’s reaction has been entirely different.

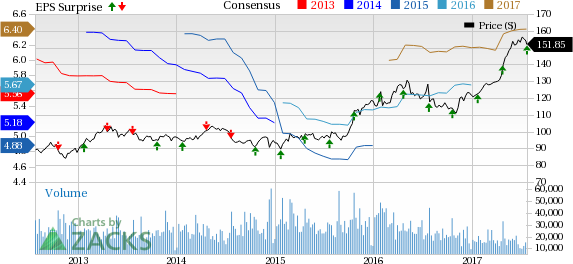

McDonald’s topped expectations on the top and bottom line, posting adjusted earnings of $1.73 per share and revenues of $6.05 billion. These results surpassed our Zacks Consensus Estimates of $1.62 and $5.99 billion, respectively. Profits improved 19% year-over-year, while revenues were down about 2% on a constant-currency basis.

The real story for McDonald’s was its impressive comparable-store sales growth in key markets. Comps in the U.S. gained a respectable 3.9%, but comps in the company’s International Lead Markets—which includes mature markets like Australia, Canada, France, Germany and the U.K.—soared 6.3%.

Elsewhere, McDonald’s saw 7% comps growth in its High-Growth Markets, a segment that includes countries with high restaurant expansion and franchising potential—such as China, Italy, Poland, Russia, and South Korea (read more: McDonald's Tops Q2 Earnings on Solid Comps Growth).

Shares of MCD opened at $157.75, nearly 4% higher than Monday’s close, following the release of the report.

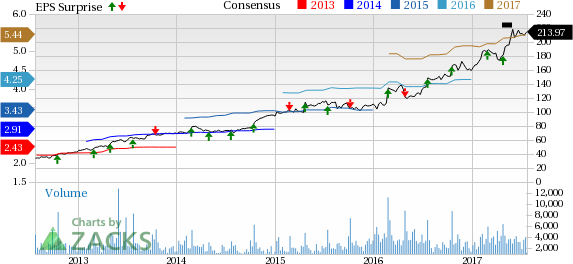

This price action was not matched by Domino’s, despite the pizza chain reporting similarly impressive numbers. Domino’s posted earnings of $1.32 per share on revenues of $629 million, surpassing our Zacks Consensus Estimates of $1.22 and $613 million, respectively.

Revenues in the company’s supply chain unit, which includes ingredients and equipment sold to franchisees, climbed 15% year-over-year. Same-store sales at company-owned restaurants soared 11.2%, while international comps rose a modest 2.6%.

DPZ shares opened lower on Tuesday, eventually sliding more than 10% to an intraday low of $192.57 in morning trading.

Weakness in the Domino’s international business is likely to blame for the market’s harsh reaction to the report. For instance, the company’s Domino’s Pizza Group Plc franchise is the largest pizza delivery chain in the U.K., and with like-for-like sales growth coming in much lower than last year, investors might be worried about the company’s strength in key markets.

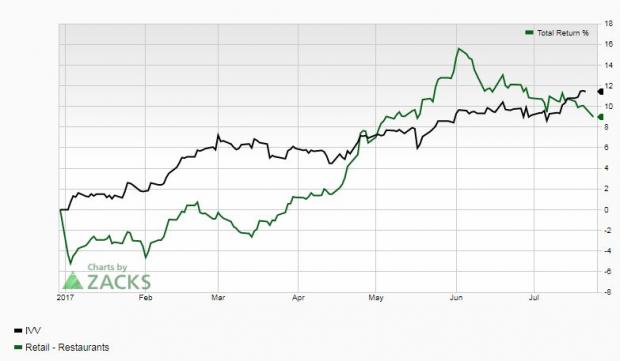

Overall, the retail restaurant business has been more familiar with challenges this year. The industry is sitting in the bottom 19% of the Zacks Industry Rank, and its modest growth has been outpaced by the S&P 500 so far.

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Original post

Zacks Investment Research