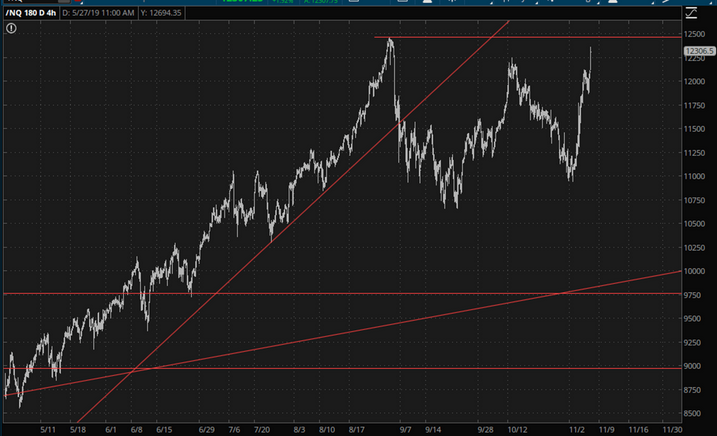

It seems that the lifting of election uncertainty was just the tonic that the market needed. As of this post (written on Sunday evening), equities are exploding higher and getting close to lifetime highs. The Nasdaq 100 is up the strongest, well more than 2% and approaching its peak from early September (see horizontal line):

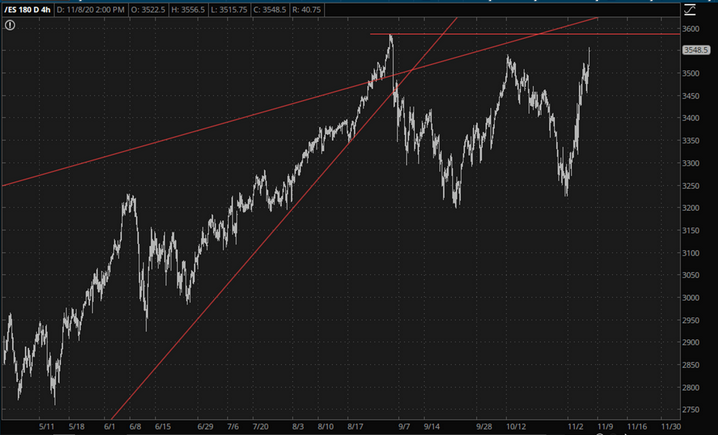

The S&P 500 Futures pattern is virtually identical, although the percentage change is a little more subdued at about 1.5%.

The small caps are up about half as much as the NQ, but they, too, are very close to lifetime highs (the chart below is a daily, as opposed to hourly, since the lifetime high was much earlier on the /Small Cap 2000 Futures):

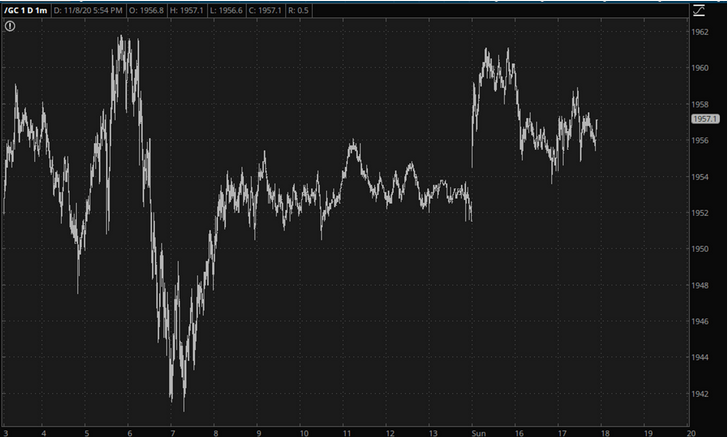

I must confess, I’m frustrated with gold, which is limply up only about a quarter of a percentage point. Gold seems to be correlated with stocks these days, but in a very watered-down fashion. Here is a minute bar chart of /GC with a nice rise early on, but unlike equities, it’s just flopping around like a goldfish.

I must say, it’s somewhat surprising that the likely prospect of higher taxes would egg people on into equities, but you can’t argue with the price action.