Repligen Corporation (NASDAQ:RGEN) reported fourth-quarter 2019 earnings per share of 20 cents, beating the Zacks Consensus Estimate of 18 cents. The figure also surpassed the year-ago earnings of 19 cents.

Moreover, total revenues of $69.5 million exceeded the Zacks Consensus Estimate of $68 million. Additionally, the top line surged 34% year over year (35% at constant currency) on strong performances by the filtration and chromatography product franchises.

We remind investors that last May, Repligen acquired the privately held bioprocess analytics company C Technologies for a $240-million cash-and-stock deal. Excluding the impact of currency and acquisitions/divestures, Repligen’s revenues grew 21% organically year over year in the fourth quarter.

On the fourth-quarter conference call, management stated that within the seven months of its ownership, revenues from C Technologies products totaled $16.4 million, in line with the company’s expectation.

Despite earnings and sales topping expectations, shares of Repligen were down 7.4% on Thursday. However, the stock has soared 71.8% in the past year against the industry’s decline of 1.8%.

Quarter in Detail

In the reported quarter, adjusted research and development expenses were $4.9 million, up 63.3% from the year-ago figure.

Adjusted selling, general and administrative expenses were $22.2 million, surging 54.2% year over year.

Adjusted gross margin was 57.2%, reflecting a 240-bps improvement compared from the 2018-level. Adjusted operating income was $12.7 million, reflecting an increase of 15% year over year.

As of Dec 31, 2019, Repligen had cash and cash equivalents worth $528.4 million compared with $513.5 million on Sep 30, 2019.

Full-Year Results

For 2019, Repligen generated revenues of $ 270.2 million, up 39% year over year (41% at constant currency) with organic growth of 33%.

Adjusted earnings per share of $1.07 were higher than the year-ago earnings of $0.66.

2020 Guidance

Repligen expects total revenues in the range of $309-$319 million, implying an organic growth of 10-14%.

Adjusted net income is projected in the range of $57-$60 million while adjusted operating income is anticipated in the band of $70-$74 million.

Adjusted EPS is anticipated within $1.07-$1.12 for 2020.

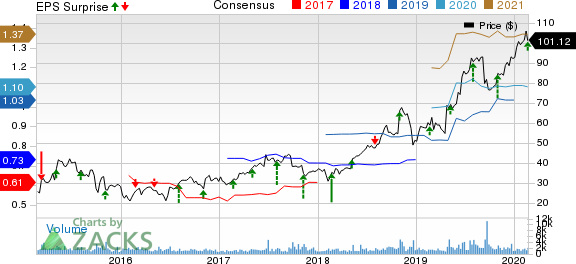

Repligen Corporation Price, Consensus and EPS Surprise

Zacks Rank & Other Stocks to Consider

Repligen currently sports a Zacks Rank #1 (Strong Buy). Other top-ranked stocks from the healthcare sector include Aduro Biotech, Inc. (NASDAQ:ADRO) , Vericel Corporation (NASDAQ:VCEL) and Oncolytics Biotech Inc. (NASDAQ:ONCY) , all sporting the same top Zacks Rank as Repligen. You can see the complete list of today’s Zacks #1 Rank stocks here.

Aduro’s loss per share estimates have been narrowed 10.5% for 2020 over the past 60 days.

Vericel’s earnings estimates have been revised 112.5% upward for 2020 over the past 60 days.

Oncolytics’ loss per share estimates have been narrowed 11.9% for 2020 over the past 60 days. The stock has gained 7.8% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Repligen Corporation (RGEN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Oncolytics Biotech Inc. (ONCY): Free Stock Analysis Report

Vericel Corporation (VCEL): Free Stock Analysis Report

Original post

Zacks Investment Research