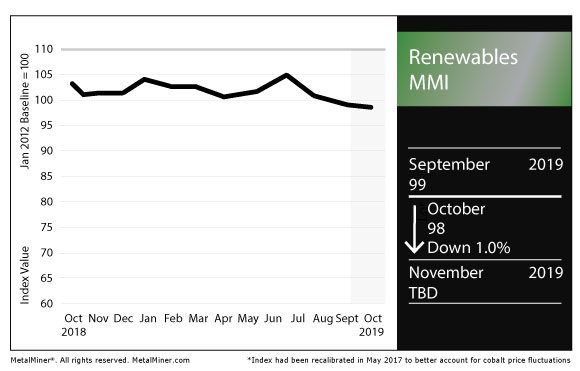

The Renewables Monthly Metals Index (MMI) slipped one point for an October MMI reading of 98.

Glencore (LON:GLEN) Signs Cobalt Supply Deal with China’s GEM

Mining giant Glencore (LON:GLEN) has entered into a cobalt supply agreement with China’s GEM Co. Ltd.

According to the miner, the five-year cobalt hydroxide deal calls for it to supply a minimum of 61,200 tons of cobalt between 2020 and 2024.

“GEM is very pleased to announce this long-term strategic co-operation with Glencore (LON:GLEN),” GEM Chairman Kaihua Xu said. “This agreement represents a major cornerstone in GEM’s cobalt sourcing strategy as it will support GEM’s continued contribution to the Chinese New Energy Market.

“In an ever-changing and fast evolving cobalt environment, GEM and Glencore (LON:GLEN) have managed to maintain a very strong working relationship.

“By securing a key battery raw material, GEM clearly demonstrates its ability to implement and deliver its vision for an electrified, carbon-free transportation system.”

Nico Paraskevas, Glencore’s head of marketing for copper and cobalt, touted the partnership with the Chinese firm.

“The extension of our long established partnership with GEM further endorses Glencore’s important role in supplying the materials that enable the energy and mobility transition,” Paraskevas said. “Furthermore, this long term partnership provides Glencore (LON:GLEN) with a stable outlet for a significant portion of its expected future Cobalt Hydroxide production.”

Earlier this year, Glencore (LON:GLEN) announced a long-term cobalt supply agreement with the Brussels-based Umicore.

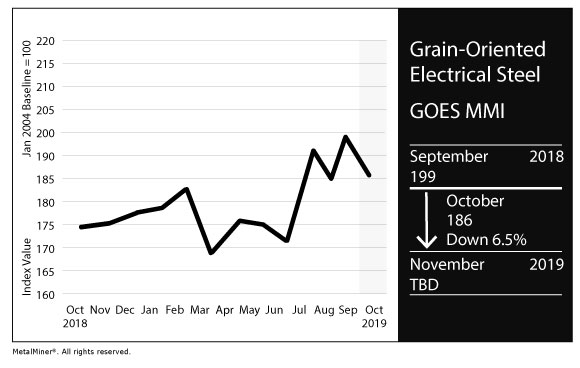

GOES

The GOES MMI, the index tracking grain-oriented electrical steel, fell 13 points for an October reading of 185.

The U.S. GOES price fell 6.6% month over month to $2,565/mt as of Oct. 1.

German steelmaker Thyssenkrupp (DE:TKAG), a producer of electrical steel, recently announced the mutual termination of the mandate of CEO Guido Kerkhoff, effective Oct. 1. Kerkhoff’s tenure ended after just over a year, having been appointed to the role in July 2018.

The news comes in what has been a challenging year for the German firm, which recently was relegated from the German blue-chip DAX index.

Actual Metal Prices and Trends

U.S. steel plate fell 7.7% month over month to $736/st as of Oct. 1. Chinese steel plate fell 0.6% to $573.56/mt.

Korean steel plate fell 3.5% to $548.78/mt. Japanese steel plate fell 1.4% to $798.23/mt.

Chinese silicon rose 0.3% to $1,440.89/mt.

by Fouad Egbaria