Reliance Steel & Aluminum Co. (NYSE:RS) provided an update on its operations located in close proximity to the regions affected by the Hurricane Harvey. Currently, the company operates in 13 locations, with total sales representing around 4% of its consolidated net sales in the first half of fiscal 2017.

Over the last week, owing to severe weather conditions, many facilities remained closed and were unable to ship products. However, there was no material damage to the facilities, equipment or inventories. Some of these facilities have resumed operations as of Sep 5.

Per management, the areas impacted by the storm will take time to return to its normal shipping levels. The company was however, unable to quantify any impact on its third-quarter 2017 results.

Reliance Steel has underperformed the industry over the last three months. The company's shares have lost 3.4% over this period against the industry’s 15.5% gain.

Reliance Steel posted a profit of $103 million or $1.40 per share in second-quarter 2017, up around 2.1% from $100.9 million or $1.38 a year ago. Earnings per share topped the Zacks Consensus Estimate of $1.38.

Reliance Steel recorded net sales of $2,475.2 million, up around 12.3% year over year, coming ahead of the Zacks Consensus Estimate of $2,416.1 million.

The company, in its second-quarter call, noted that it expects earnings for the third quarter to be in the band of $1.15-$1.25 per share.

Reliance Steel is likely to gain from the strong momentum across aerospace and automotive markets. It is also expected to benefit from aggressive acquisition strategy, broad and diversified product base and wide geographic footprint. Reliance Steel remains committed to offer incremental returns to shareholders.

However, the company’s business in the energy markets is expected to remain under pressure due to low oil pricing. The non-residential construction market also remains on a slow road to recovery. The steel industry also suffers from fundamental issues including low capacity utilization, cheaper imports, excess supply and inventory glut.

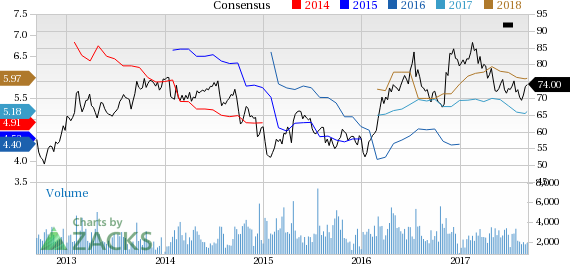

Reliance Steel & Aluminum Co. Price and Consensus

Zacks Rank & Stocks to Consider

Reliance Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industrial space are Agco Corporation (NYSE:AGCO) , Caterpillar Inc. (NYSE:CAT) and Cintas Corporation (NASDAQ:CTAS) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Agco has an expected long-term earnings growth of 13.5%.

Caterpillar has an expected long-term earnings growth of 9.5%.

Cintas has an expected long-term earnings growth of 12%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cintas Corporation (CTAS): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS): Free Stock Analysis Report

Original post

Zacks Investment Research