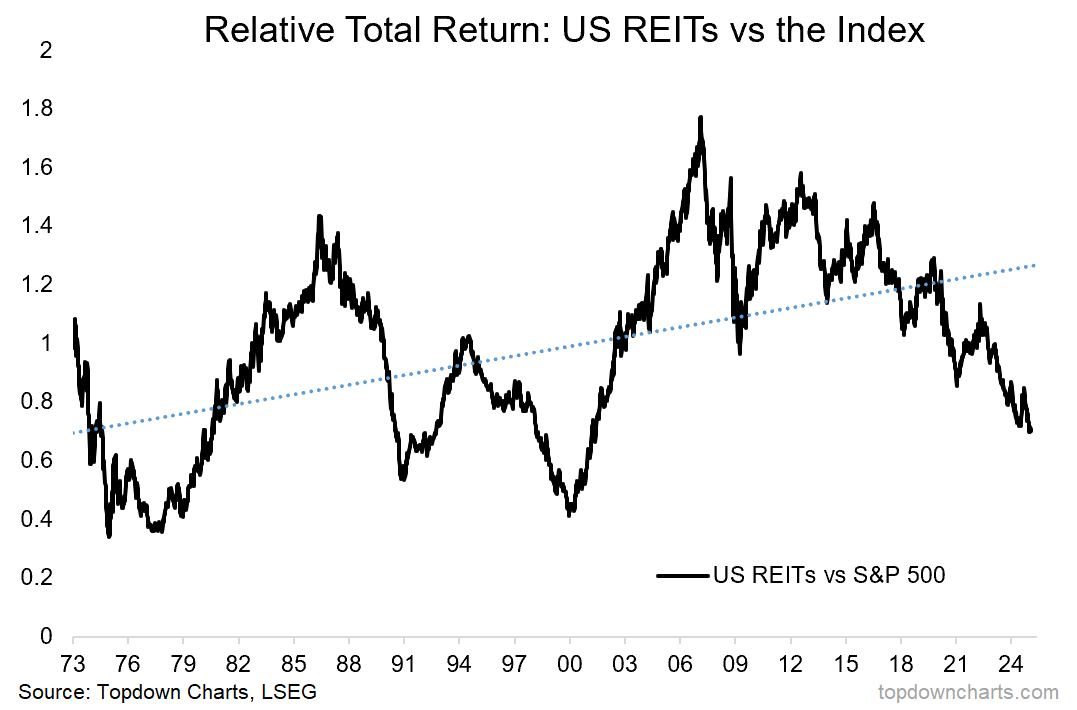

Despite boasting a dividend yield thrice that of the index, REIT total returns (i.e. including dividends reinvested) have lagged significantly behind stocks.

Since peaking in 2007, REITs have basically been in an 18-year relative bear market vs the S&P 500 — placing them at a 24-year low vs stocks, and marking a major deviation from the long-term up-trend.

REITs last suffered such underperformance in the late80s/early90s in the wake of the commercial real estate bust, and then again fell behind in the late-90’s as the dot com bubble frenzy saw this “old-economy” sector shunned.

But history rhymes, we just saw a 10-15% drawdown in commercial real estate following the 2022/23 rates and inflation shock (the drawdown is more than 20% in real CPI-adjusted terms). And we are in the middle of another tech stock boom (which again has seen old economy sectors like REITs being left behind).

Eventually, tech stocks will top (maybe already have?!), and commercial real estate prices have already stabilized and stopped falling. So things could soon be turning up for REIT relative performance. Probably the last ingredient would be lower interest rates.

Dwell on that for a second: REIT relative returns would benefit from a top in tech and lower yields (to trigger rotation) — that’s basically a defensive setup. So aside from offering a much better yield than stocks (you get paid to wait), it’s also effectively a defensive position at a time when risks are rising.

I will say though, they’re not without risks, the latest surge in bond yields saw REITs relinquish their rate-cut-rally gains from last year, so the sector remains at risk should interest rates surge out of control (and that is a tail risk).

But I would say the greater, more likely, and more damaging risk would be an unwind in tech stocks. Given that REITs still see the deeply negative surveyed sentiment, record low ETF asset allocations (contrarian signs), oversold technicals, cheap relative value, and may serve as a tech-top hedge; I would say they are worth another look.

Key point: REITs may be set for a relative return rebound.

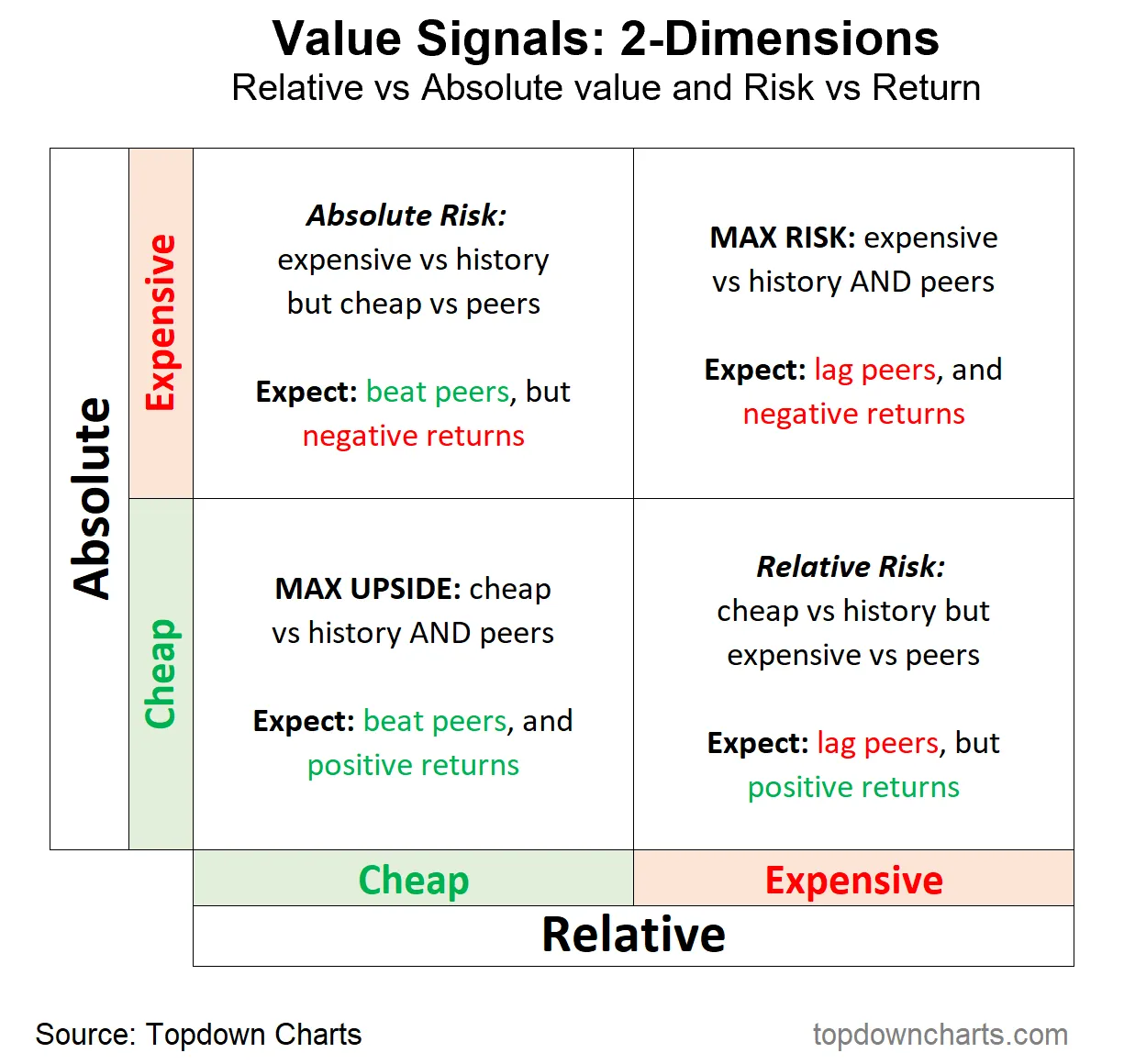

Concepts - Relative Risk in Equities

A quick highlight/refresher — the below table is from “How to Use Value Signals for Global Equities“. It highlights how to think in 2-dimensions when it comes to stock market returns and valuations.

Most commentators talk about the absolute return and risk situation (is the market overvalued vs history? Is the outlook for stocks to go up or down?) — but fewer speak about relative risk and return (how does this asset/sector/stock compare to that asset/market? will this one outperform vs that one? what other information can we decipher from this relative performance trend?).

When it comes to sector analysis like what we looked at today, relative valuations and relative returns can not only highlight interesting opportunities (e.g. REITs as an alternative hedge/defensive position), but also give clues to the stage of the market cycle (e.g. think about the chart above how extreme and divergent from trend it got at the peak of the dot com bubble).

REITs relative returns may be giving us important clues on the stage of the market cycle right now. So a highly relevant chart + concept for today’s market.