Regency Centers Corporation (NYSE:REG) recently enhanced its financial flexibility by amending its unsecured term loan facility. The move helped the company pay down its line of credit that was used for financing its previously announced acquisition of Market Common Clarendon.

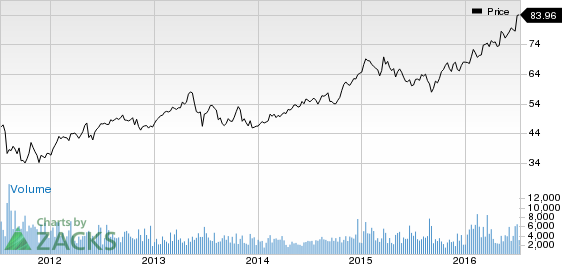

Shares of Regency were up 0.49% to $83.96 in Friday’s session.

This move seemed a strategic fit because the amendment increased the facility size by $100 million to $265 million as well as extended the maturity date to Jan 5, 2022. Further, it lowered the applicable interest rate to LIBOR plus 0.95% per annum (based on the company’s credit rating).

Regency also executed interest rate swaps, concurrent with the closure, for the full notional amount of the facility. This helped fix the interest rate at 2.00% through maturity. The company used the additional $100 million to pay down its line of credit, which has a balance of zero now. Notably, the amendment reflects lenders’ confidence in the company’s strength.

In May 2016, Regency, in association with AvalonBay Communities Inc. (NYSE:AVB) , acquired Market Common Clarendon from TIAA Global Asset Management for $406.0 million. Regency paid $285.7 million while AvalonBay contributed $120.3 million to the purchase price. This mixed-use development in Arlington, VA includes retail, restaurants, and residential buildings and is positioned next to Clarendon Boulevard in the Clarendon neighborhood.

Situated amid a dense, prosperous and highly educated customer base, with the retail and all residual components under Regency’s ownership (residential components under AvalonBay’s possession), the buyout seems a strategic fit for the company. In fact, the retail space is anchored by reputed companies like Whole Foods Market, Inc. (NASDAQ:WFM) and Apple Inc. (NASDAQ:AAPL) among others and there are various stores for fashion, electronics, groceries, and dining, offering Regency ample scope to leverage on the favorable market fundamentals. (Read: AvalonBay, Regency Centers Buy Market Common Clarendon)

Currently, Regency has a Zacks Rank #2 (Buy).

APPLE INC (AAPL): Free Stock Analysis Report

REGENCY CTRS CP (REG): Free Stock Analysis Report

AVALONBAY CMMTY (AVB): Free Stock Analysis Report

WHOLE FOODS MKT (WFM): Free Stock Analysis Report

Original post