Industrial goods manufacturer Regal Beloit Corporation (NYSE:RBC) reported decent fourth-quarter 2017 results, on the back of modest organic growth and positive order trends. On a GAAP basis, the company reported a net income of $51.5 million or $1.15 per share compared with $45.6 million or $1.01 per share in the year-earlier quarter. The significant year-over-year improvement was backed by higher revenues.

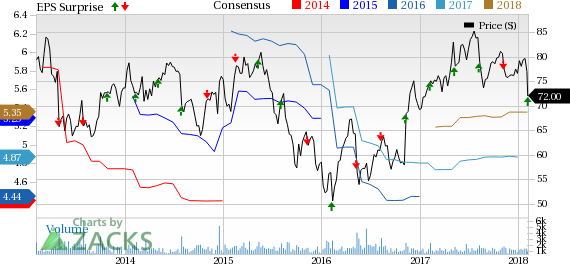

In the reported quarter, adjusted earnings were $1.14 per share compared with $1.04 in the year-ago quarter. The figure improved considerably year over year and came in line with the Zacks Consensus Estimate.

For 2017, Regal Beloit recorded GAAP earnings of $213 million or $4.74 per share compared with $203.4 million or $4.52 per share in 2016. Adjusted earnings for 2017 were $4.87 per share compared with $4.44 in the previous year.

Net sales increased to $820.7 million from $758.1 million in the year-earlier quarter, largely driven by organic growth across all segments. Moreover, quarterly revenues beat the Zacks Consensus Estimate of $790 million. For 2017, the company recorded net sales of $3,360.3 million compared with $3,224.5 million in 2016.

GAAP operating income improved to $78.3 million from $70.1 million in the prior-year quarter. Adjusted operating income was $79.5 million compared with $72.2 million in the year-ago quarter. Adjusted operating margin came in at 9.7%, up 20 basis points compared with the prior-year quarter.

Segmental Analysis

Revenues from the Power Transmission Solutions segment increased 13.2% year over year to $196.6 million. Sales were driven by rise in demand in the oil & gas and renewable energy end markets and in the distribution channel.However, GAAP operating margin decreased to 12.2% from 13% in the prior-year quarter.

Net sales in the Commercial and Industrial System segment were $407.7 million, up 10.4% year over year owing to broad-based global end market strength in both OEM and distribution channels. Operating margin at the segment increased to 5.9% from 5.6% in the prior-year quarter.

Net sales from the Climate Solutions segment were $216.4 million, up 0.6% year over year. Operating margin of the segment also improved to 14% from 12.5% in the year-ago quarter.

Balance Sheet and Cash Flow

At year-end 2017, Regal Beloit’s cash and cash equivalents were $139.6 million while long-term debt was $1,039.9 million compared with the respective tallies of $284.5 million and $1,310.9 million in the year-ago period. The company paid down $74.3 million of debt in the quarter under review.

Net cash from operating activities for 2017 totaled $291.9 million, down from $442.3 million in the year-ago period. In 2017, free cash flow was 106.4% of net income or $226.7 million compared with the respective tallies of 185.4% and $377.1 million in 2016.

Guidance

For 2018, Regal Beloit anticipates organic growth in range of low to mid-single digit single digits and expects to improve its adjusted operating margin for the third consecutive year. Additionally, it projects adjusted earnings per share guidance in the range of $5.35-$5.75 while GAAP earnings are expected in the range of $5.19–$5.59.

Regal Beloit carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the same space include Applied Industrial Technologies, Inc. (NYSE:AIT) , Cintas Corporation (NASDAQ:CTAS) and Deere & Company (NYSE:DE) . While Applied Industrial Technologies sports a Zacks Rank #1 (Strong Buy), Cintas and Deere & Company carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has an excellent earnings surprise history, surpassing estimates in the trailing four quarters with an average beat of 11.0%.

Cintas has an excellent earnings surprise history, exceeding estimates in the trailing four quarters with an average beat of 8.2%.

Deere & Company has posted earning beat in the trailing four quarters. It boasts an average beat of 19.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cintas Corporation (CTAS): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Original post

Zacks Investment Research