Open source software giant Red Hat Inc (NYSE:RHT) late Wednesday posted mixed Q3 earnings, offered a tepid outlook, and noted its CFO was resigning to work for another company.

The Raleigh, NC-based company reported Q3 EPS of $0.61, which was $0.03 better than the $0.58 that analysts expected. Revenues jumped 17.5% from last year to $615.3 million, but missed Wall Street’s $618.46 million estimate.

Subscription revenue, which represents 88% RHT’s total sales, in the quarter grew 19% to $543 million. Meanwhile, billings in the latest period of $679 million badly missed estimates of $700 million.

Looking ahead, Red Hat Co forecast Q4 EPS of $0.61, which is in-line with Wall Street estimates. Q4 revenues are seen ranging from $614 to $622 million, coming in well short of analysts’ $638.17 million view.

Perhaps the biggest news news stemming from the report was that RHT’s CFO would be resigning to take a CEO position at another company. Red Hat commented via statement:

Frank Calderoni notified Red Hat of his decision to step down as Executive Vice President, Operations and Chief Financial Officer of Red Hat, effective in late January 2017, to enable him to accept a chief executive officer position at another company. Mr. Calderoni has indicated that he would make himself available to Red Hat after the effective date of the resignation for transitional support, as needed.

Jim Whitehurst, President and CEO, after consulting with the Board of Directors of Red Hat, announced that upon Mr. Calderoni’s resignation in January, Red Hat intends to appoint Eric Shander, Vice President, Finance and Accounting and our principal accounting officer, to act as the CFO of Red Hat, pending a decision on a permanent replacement.

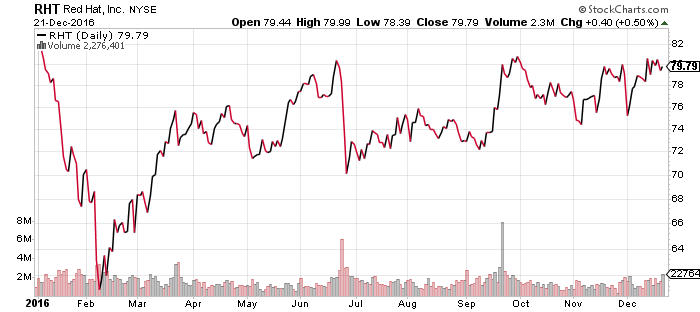

Red Hat shares plunged $10.82 (-13.56%) to $68.97 in after-hours trading Wednesday. Prior to today’s report, RHT had fallen -3.65% year-to-date, versus a +10.74% gain in the benchmark S&P 500 index during the same period.