The analyst community is now scrambling to re-adjust, re-calibrate, or reinterpret their narrative for the remainder of 2017. As we wrote in our previous edition: “Financial articles have lately battened down the hatches, as if a storm is brewing. Better to be prepared for an ill wind than be caught flat footed in a raging gale.” As a new narrative evolves, several game prognosticators are looking beyond the near term and expressing negative diatribes about what may come in 2018. Their forecast, not new news by any means, is that a recession is highly probable, almost a lead pipe cinch, if you will.

Why the dour thoughts? If you really think about it, there will always be a recession in our future. The trick has always been to predict its occurrence well ahead of time in order to reposition your investment portfolio. In other words, “batten down the hatches, as if a storm is brewing.” The other open question is how bad will the recession be? The last one, the “Great Recession”, was extremely deep, primarily because the banking industry was in the forefront of it all. A slowdown in the business cycle can happen, independent of banks, but if banks are entwined in the mess, then recovery times will be extended. Average recovery times have been 18 months. The last recovery took more than four years.

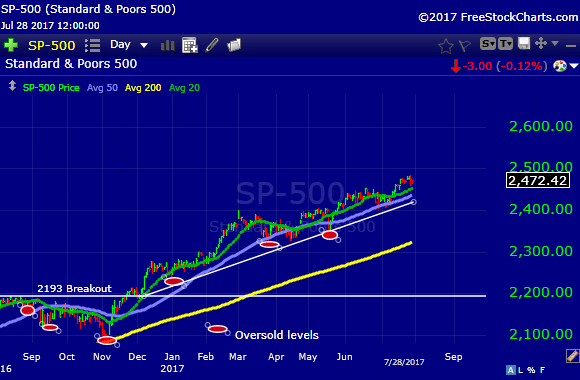

The current Bull market, with respect to the S&P 500, is into its eight year, second only to the one following the Dot.com crash, which lasted nine years. All indicators are still pointing north to everyone’s consternation. When will the market top out, and why is this peak moment so important? Market valuations are definitely on the high side. The famous Shiller CAPE Index keeps warning that a top is near, but buyers keep appearing with cash to invest. Oversold levels appear, profits are taken, and new buyers join in.

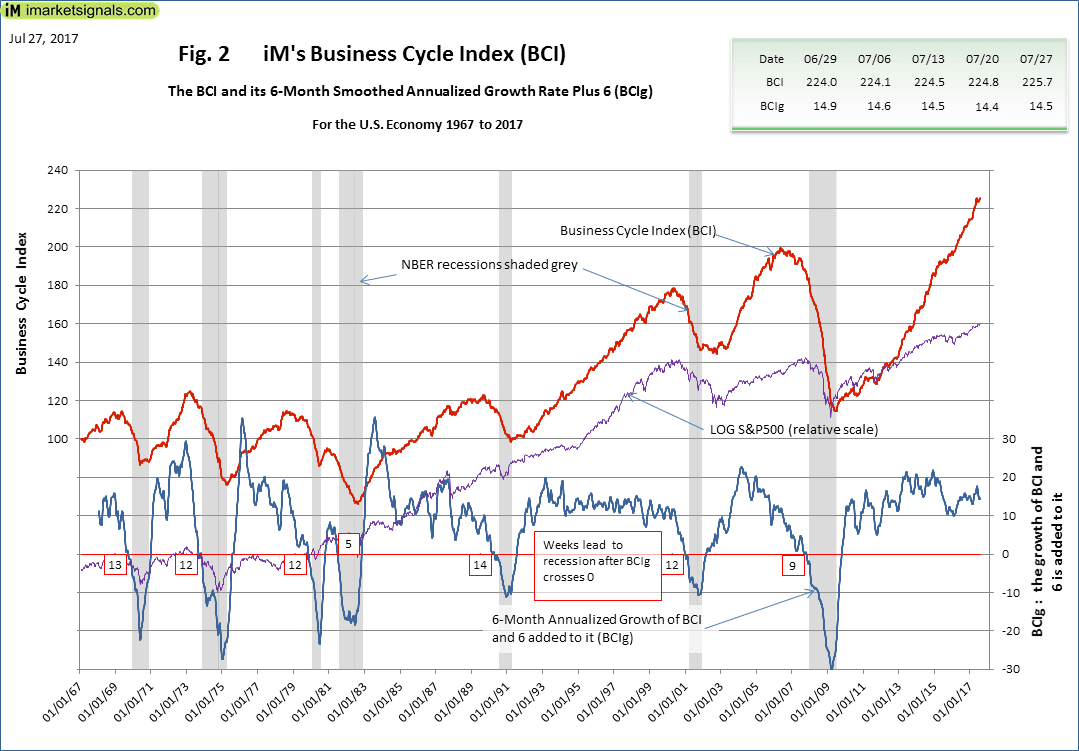

The issue, however, from a recession standpoint, is that once the market has peaked and turned downward for more than a brief correction, business leaders begin to circle the wagons, banks restrict credit, and consumers stop spending. This vicious cycle produces the dreaded recession. The Business Cycle Index (BCI) presented below actually reflects these various ebbs and flows:

There are several “recession” prediction models out there, but this particular one has the best track record from our perspective. According to the company that prepares this index: “There is no bell ringing when the market peaks before recessions, but indicators such as iMarketSignals’ Business Cycle Index (BCI) are useful in identifying recession starts well in advance. By exiting the stock market at the time of BCI’s recession signals, investors would still have avoided about 60% of the market declines from pre-recession peaks to inter-recession troughs on average. The BCI uses the below listed economic data, which are incorporated into the index at their publication date:

- 10-year treasury yield (daily)

- 3-month treasury bill yield (daily)

- S&P500 (daily)

- Continues Claims Seasonally Adjusted (weekly)

- All Employees: Total Private Industries (monthly)

- New houses for sale (monthly)

- New houses sold (monthly)”

For the seven recessions depicted, the BCI accurately indicated its arrival on average eleven weeks beforehand (note the figures in the small red outlined boxes that accompany the Blue line in the bottom portion of the diagram). If the past signals are to be construed as a valid harbinger for 2017, then it appears that we may be in safe waters for a bit. None of the three lines are headed south, but these conditions could change swiftly. The Red BCI line is accelerating at a sharper angle than ever before, which is disconcerting from any perspective. Could 2018 be a nightmare to come?

One analyst cites three “Black Swans” that could trigger a global recession.

John Mauldin is one of the few analysts that accurately predicted the Great Recession, although he admits that his estimate of stock market losses fell well short at $400 billion. The actual figure was well over $2 trillion. He sadly recalls what transpired a decade ago: “Conditions in the financial markets needed only a spark from the sub-prime crisis to start a firestorm all over the world. Plenty of things were waiting to go wrong, and it seemed like they all did at the same time.”

The liquidity crunch that occurred when everyone tried to sell mortgage-back securities at the same moment has been referred to as a “Black Swan”, a term that encompasses “an unpredictable or unforeseen event, typically one with extreme consequences.” Mr. Maudlin believes there are three such events today that could cause a massive global recession, deeper than the last one, by the end of 2018. Here is a brief summarization of his findings:

- Yellen and the Fed miss the mark: Quantitative tightening or interest rate normalization, whichever term you prefer, is a tightrope that our Fed has chosen to traverse in order to unwind the chains that have bound global market forces for years. According to the judgment of the FOMC, too quickly or too slowly are not acceptable options. Trump’s proposed stimulus program, which has never reached first base, only threw a monkey wrench into their carefully orchestrated plan. In the coming year, Trump can appoint six new members to the FOMC. Where might this new group take us all? More QE and more debt? Deflation? Something could surely give.

- Draghi and the ECB run out of options to save Europe: QE and bond purchases in the EU have outstripped their counterpart in the United States. Regardless of what Draghi and his ECB brethren say publicly, bond buying and negative interest rates may persist for some time to come. On a very thin surface, the European economy seems to be improving, but every step forward is often followed by another step back. The ECB and the BoJ, for that matter, are roughly three years behind the Fed when it comes to tapering their excesses. Global liquidity did not contract when the Fed commenced its normalization process. What will happen when the ECB and the BoJ start their respective tightening exercises? Things may not turn out so well.

- Chinese officials cannot thwart a massive debt meltdown: Is the world about to experience a real “China Syndrome”, the term made famous in a movie regarding the possibility of a nuclear meltdown? In a report from the People’s Bank of China, officials made note of what has been called off-balance-sheet lending for both state-controlled and independent “shadow” banks. The story is alarming. In an effort to achieve a soft landing and bolster an enormous sluggish economy, if 6.9% in growth can be described as such, credit has been allowed to grow at astronomical rates. In China, too big to fail is not the thought process. The belief there is that the government will save everything, not exactly a state of mind that will ensure some semblance of fiscal discipline. China has proven to be an exception on most all fronts and has always been accused of inflating or misrepresenting economic realities, but, when it comes to the prevailing debt bubble that is growing further still, this author proclaims, “The collapse, when it comes, could be earthshaking.”

What are the counter arguments to this “Three Black Swan Theory”?

Global and domestic economic data are neither too weak, nor too strong. It is also not a “Goldilocks” scenario either – it is not “just right”. In the U.S., business orders and consumer spending are flat. New housing starts are below expectations. GDP growth may come in around 2.5%, but without the gigantic boost that was promised by the Trump administration. Fed minutes have sworn that, “The actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.” The market has digested these morsels and determined that there will not be any more rate hikes in 2017.

As for Europe, the same old story seems to keep repeating itself. Economic data is improving, but inflation refuses to budge. The euro has strengthened from 1.05 to 1.17 over the past four months, a fact that could actually dampen any possibility of an upward inflationary trend, but Draghi is not concerned. Without inflation, however, there will be no thoughts of tapering current stimulus programs. On a positive note, political tensions seem to have eased related to exiting propositions, but Brexit negotiations could still mess with the present calm.

As for China, we have seriously underestimated the ability of Chinese officials to adjust and rescue the failing elements of their economy. Will this trend continue? Time will tell, as the world holds its breath.

A growing body of the analyst community, however, is imploring everyone to look at more long-term issues. From their perspective, these are the real “Black Swans” that could eventually bring everything down with a crash. From their point of view, politicians are only focused on issues that could impact the next election. Solving longer term problems just does not fit into their list of priorities.

One somber insight is as follows: “The economy is subject to some longer-term issues that are not going to be resolved by “Green Shoots” popping up here or there. For the time being, it looks like the growth rate of the US economy is going to stay in the lower 2.0s, and no politician or no budget or no monetary policy is going to alter the rate to any degree in the near term.” So much for Trump and his wizards from Wall Street.

What about the Almighty Dollar?

The USD is set to end July lower against all other major currencies, except for the Swiss Franc. Technical indicators are not signaling a bottom to the continuing decline that the greenback has sustained for the previous seven months, but it is fast approaching a major support line in the 92-area of the index, as depicted below:

Bank forex departments are presently forecasting a bounce off this threshold and a return to the 97 region by year end. Is it time to short the major pairings in favor of the USD? At some point, that strategy may be rewarded, but patience will be the key.

Concluding Remarks

Economies expand and contract over time, just like an accordion. If you are familiar with this tune, then you know that another recession is inevitable. The current eight-year Bull market must eventually call it a day, but when? Stocks typically tank well before recessionary currents take over, but will the Fed, the ECB, or China cause this prematurely? 2018 is looking gloomier by the day.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

by Tom Cleveland