The outlook is turning grim for the US economy, or so a range of soft data and forecasts advise. But while expectations are deteriorating at the moment, the hard data continues to reflect a growth bias. Short of an epic, sudden (and at this point unexpected) collapse in business activity and/or consumer spending, the US economy will continue to expand for the near term. What happens beyond the next several months is unclear, which is par for the course. The crowd, however, is becoming increasingly pessimistic.

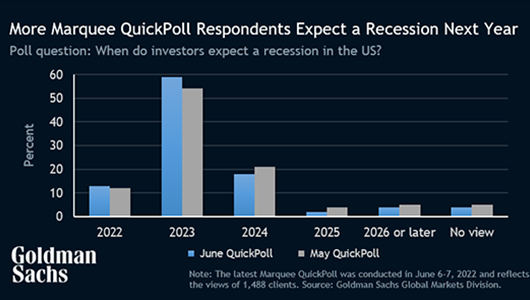

Sentiment is a factor in economics and on that front there are increasing signs of mood swing to the downside. A poll of investors from early June, for instance, finds strong expectations for a US recession at some point in 2023.

The Conference Board reports similar results. A new survey from the consultancy advises that more than 60% of business executives anticipate a recession over the next 12 to 18 months.

Even darker forecasts are circulating by various individual pundits. “The economy is going to collapse,” predicts Michael Novogratz, CEO of investment management firm Galaxy Digital.

“We are going to go into a really fast recession, and you can see that in lots of ways.”

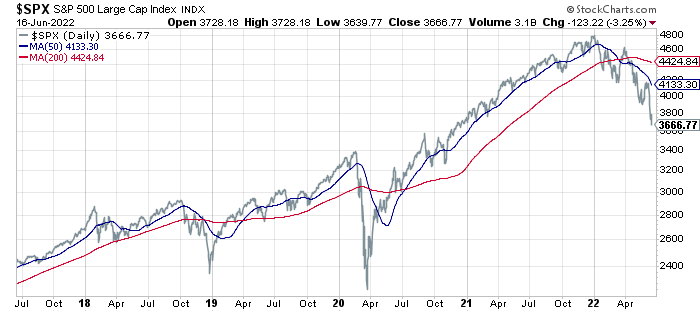

The stock market appears to be forecasting trouble ahead. The S&P 500 Index has fallen more than 20% from its peak, which is widely viewed as a bear market. Expectations for rising recession risk are thought to be the main driver.

The catalysts for the macro gloom include the usual suspects this year: surging inflation, rising interest rates and blowback on various fronts from the ongoing Ukraine war. Given the accumulating run of bad news, it’s easy to assume the worst and on some level it’s prudent to do so.

There’s also a case for a separate track of business-cycle analysis: estimating in real time, based on the data in hand, when the US slips over to the dark side, or doesn’t. On this front, it’s clear that the economy is still expanding and the odds remain low that an NBER-defined downturn is imminent. The details, based on analysis of several public and proprietary business-cycle indexes, are updated weekly in the US Business Cycle Risk Report. The newsletter’s main takeaway in the latest issue, echoing results in recent months: US economic activity is slowing, but gradually. Our current estimate for the earliest start date for contraction, assuming current conditions persist, is sometime in this year’s fourth quarter.

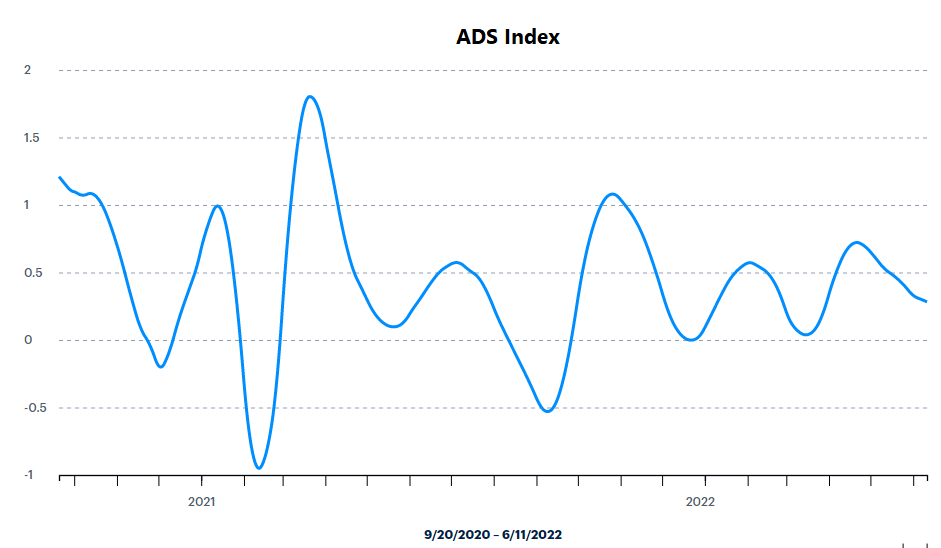

Meantime, a pair of business-cycle indexes published by two regional Federal Reserve banks show that the economy continues to grow at a moderate pace. The Philly Fed’s ADS Index, a multi-factor indicator, still reflects above-average business conditions through June 11.

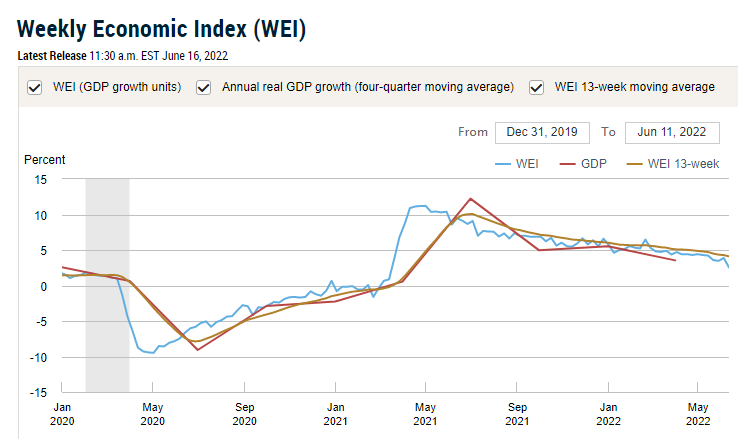

The New York Fed’s Weekly Economic Index (WEI) paints a similar macro profile through June 11. Note, however, that WEI highlights an ongoing slowdown in growth, although the odds remain low that a new recession is imminent.

A lot can go wrong for the economy in the months ahead, but it’s premature to rule out positive surprises. All the more so for trying to divine business conditions in the summer of 2023. For perspective, think back 12 months. What were you expecting in terms of major threats and/or conditions that would boost the economy? How have those expectations fared vs. current conditions today?

There’s a strong case for expecting that the current expansion will survive through the summer. Beyond that, the outlook becomes increasingly fuzzy, as it always does beyond a few months. That doesn’t mean you should ignore the business-cycle risks lurking, but just don’t confuse the dark forecasts for recession in late-2022 and beyond as high-confidence estimates. Indeed, the economy’s revised outlook still evolves one data release at a time.