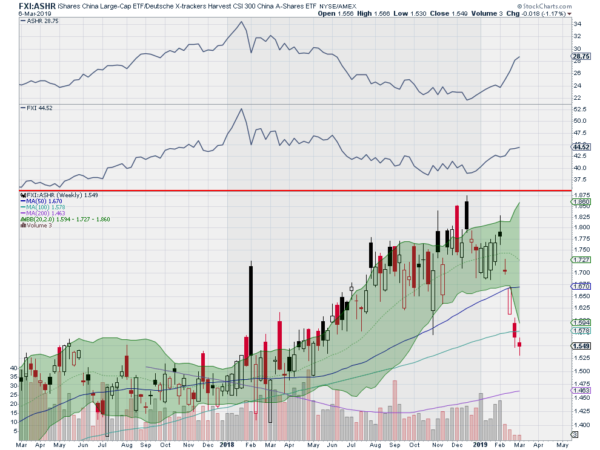

The Chinese stock market has been has been leading the way higher with explosive upside since the beginning of 2019. As the Shanghai Composite is driving higher a funny thing has happened underneath the surface. The chart below tells the tale.

The top of the chart shows the ETF’s based on the Shanghai Composite $ASHR and Chinese large caps $FXI. Large caps tend to have more Government involvement, funding and ownership than the average company. The bottom panel shows the ratio of the FXI/ASHR.

Both were falling throughout 2018, but on a relative basis the FXI was outperforming the entire year. This is what you would expect for a country where the Government was pumping the economy. Money flows to the entities they support over the general public company. This is not the revelation.

What is interesting is the radical shift of strength to the broad based Shanghai Composite at the start of February. Not only was this shift strong enough to stop and reverse the large cap outperformance, but it also created positive performance for the market. It is truly the broad base that is leading the Chinese Markets higher.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.