- Activision Blizzard (ATVI) shares have slumped in the past year

- The company recently announced delays in two major game releases

- The Wall Street consensus outlook is bullish, with a 12-month price target that is 40% above the current share price

- The market-implied outlook (derived from options prices) continues to be bearish

Activision Blizzard (NASDAQ:ATVI) reported Q3 earnings on Nov. 2 and beat expectations. The California-based electronic gaming and multimedia company also announced that the releases of the newest iterations of two of its most popular games, Overwatch 2 and Diablo IV, will be delayed until 2023, sending the share price 14% lower on Nov. 3.

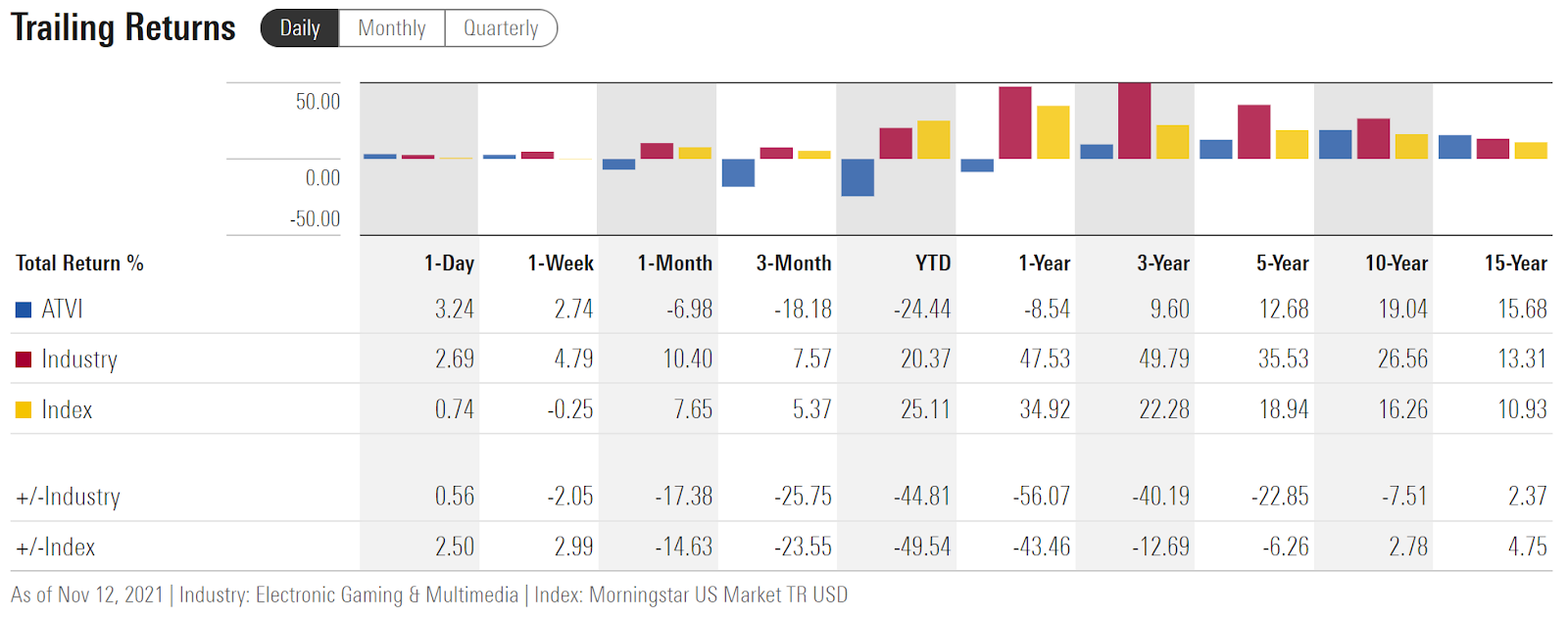

ATVI has a total return of -24.4% for the YTD, and the shares are 33.3% below the 12-month high.

Source: Investing.com

With the substantial declines this year, ATVI looks quite cheap, with a forward P/E of 17.9. For comparison, Take Two Interactive (NASDAQ:TTWO) and Electronic Arts (NASDAQ:EA) have forward P/E’s of 39.8 and 22.8, respectively.

Activision's earnings growth has been unimpressive in recent years. Q4 tends to be the company’s strongest quarter of the year, but Q4 2020 EPS (reported on Feb. 4 2021) was lower than Q4 2019 and Q4 2018.

Source: E-Trade. Green values represent amount by which EPS exceeded the consensus expected value.

The recent results aside, investors have been underwhelmed with ATVI’s growth for years. The 3-year annualized total return for ATVI is less than ⅕ that of the Electronic Gaming and the Multimedia industry (as defined by Morningstar). The 5-year annualized returns are slightly better, but are still only barely higher than ⅓ of the industry level.

Source: Morningstar

I last analyzed ATVI on Mar. 6, when the shares were trading at $91.75. At that time, the consensus outlook from Wall Street was bullish, with a 12-month price target that was almost 25% above the share price. Even the lowest of the price targets from the 22 ranked analysts tracked by E-Trade was 9.96% above the share price on Mar. 6.

Even with this bullish view and the reasonable valuation, I gave ATVI a neutral rating. My primary concern was that the market-implied outlook for ATVI, derived from options prices, was sending a bearish signal. Over the roughly 8 months since that post, ATVI returned -23.68%, as compared to 23.1% for the S&P 500.

The market-implied outlook represents the consensus view of buyers and sellers of options on a stock. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the strike price) between now and when the option expires.

By analysing the prices of call and put options at a range of strike prices, it is possible to calculate a probabilistic price return forecast that reconciles the options prices. This is the market-implied outlook. For more information, including links to the relevant finance research, see my overview post.

The Wall Street analyst consensus and the market-implied outlook provide perspectives from different market constituencies. Whether these two forms of outlooks agree or disagree, the comparison is useful.

With more than 8 months since my last analysis, I am revisiting my opinion on ATVI. The shares have declined substantially, making them look fairly cheap, but the recent announcement of significant product delays is a concern. I have updated the market-implied outlook for ATVI, and compared this view with the current Wall Street consensus outlook.

Wall Street Consensus Outlook for ATVI

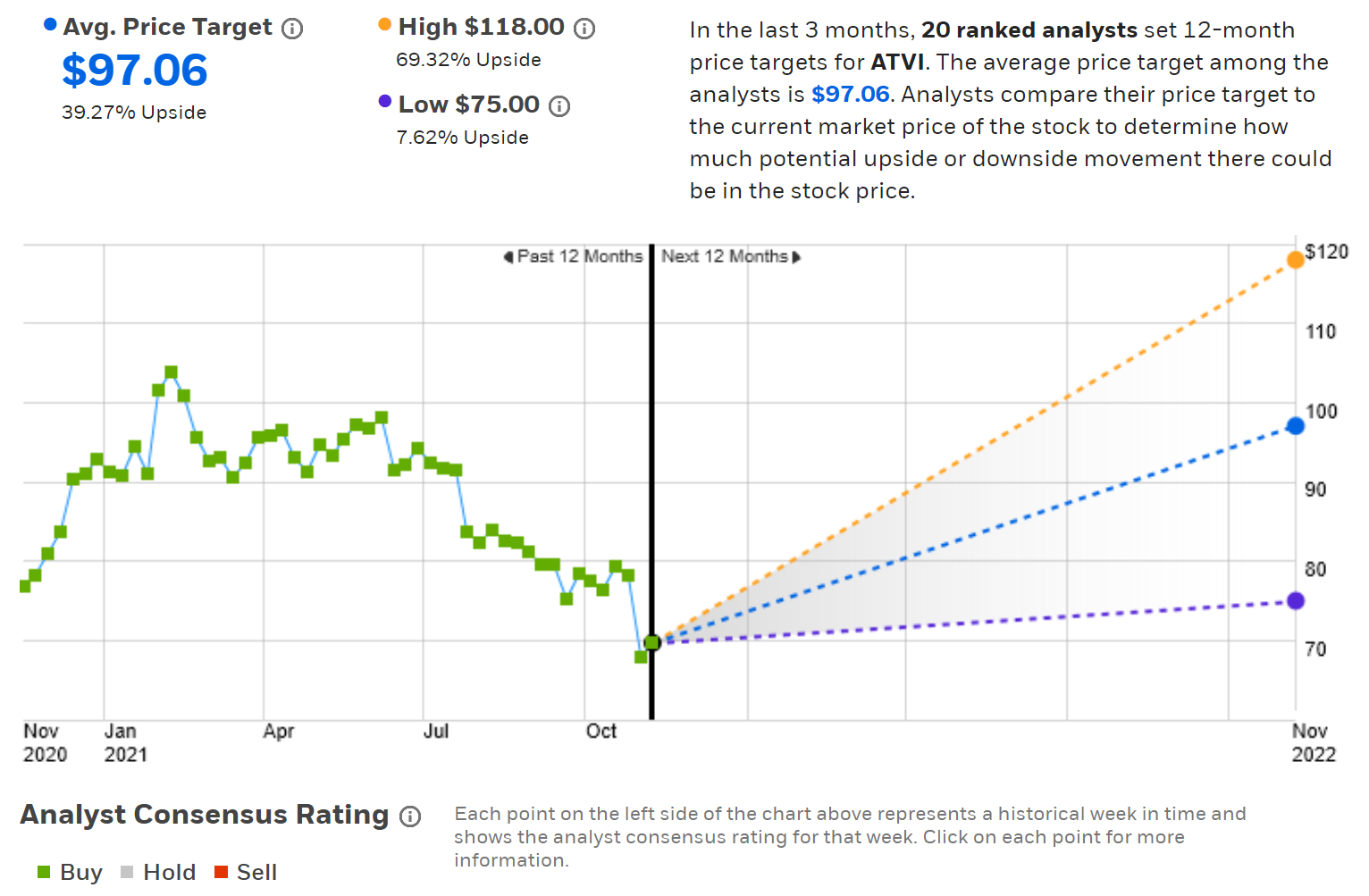

E-Trade calculates the Wall Street consensus using ratings and 12-month price targets from 20 ranked analysts who have published their views over the past 90 days. The consensus rating for ATVI is bullish, as it has been over the past 12 months. The 12-month price target is $97.06, well below the 12-month consensus price target back in March ($114), but the expected 12-month price return, 39.3%, is considerably higher than it was in March because of the decline in share price in the intervening months.

Source: E-Trade

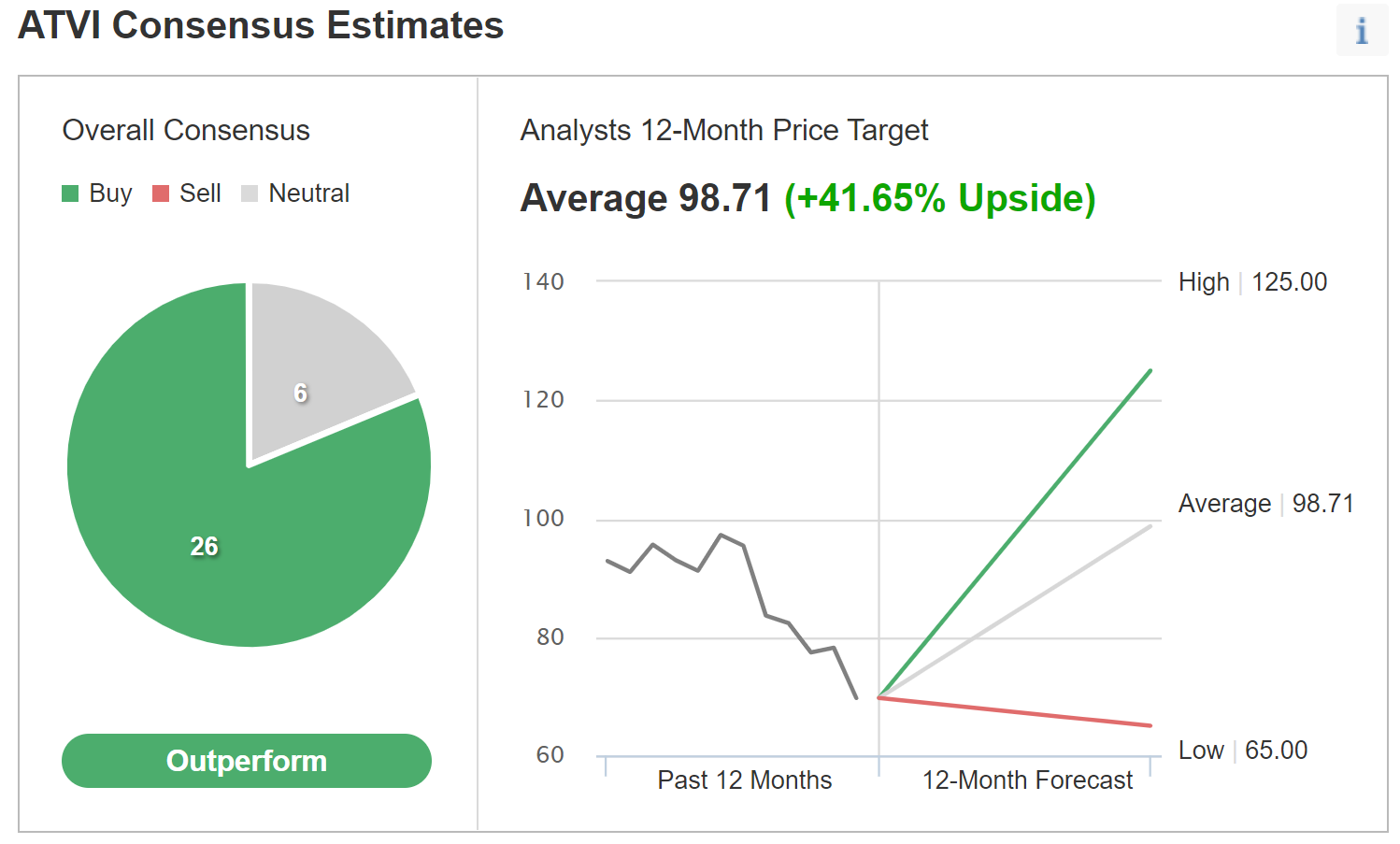

Investing.com’s version of the Wall Street consensus is calculated using ratings and price targets from 32 analysts. The consensus rating is a buy and the consensus 12-month price target is 41.65% above ATVI’s current share price. Of the 32 analysts, 26 are bullish and 6 are neutral.

Source: Investing.com

The Wall Street consensus outlooks calculated by E-Trade and Investing.com, are both bullish and have 12-month price targets that are about 40% above the current share price. The very high expected price appreciation is largely attributable to the substantial decline in the share price in recent months.

The consensus 12-month price target has fallen, but the share price has gone down even more. The analysts are generally sticking to their positive outlooks, even as the market has sold off.

Market-Implied Outlook for ATVI

In March, I calculated the market-implied outlook to Jan. 21, 2022 (using options that expired on this date). For this article, I have calculated the market-implied outlook for ATVI to Jan. 21, 2022, as well as to June 17, 2022, using the prices of options that expire on each of these dates.

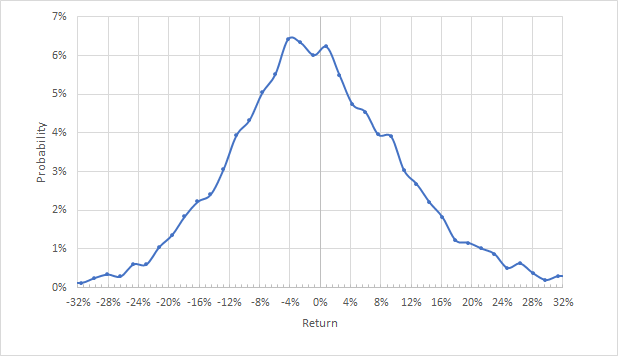

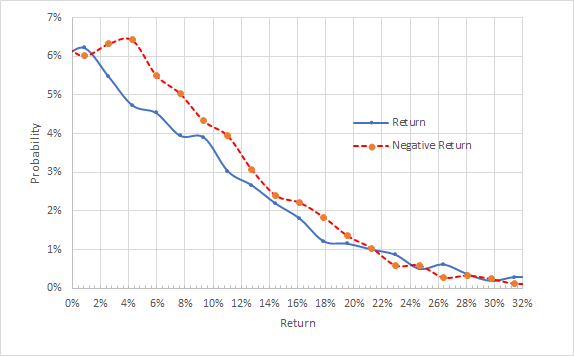

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to Jan. 21, 2022 is generally symmetric, although the peak probabilities are tilted towards negative returns. The maximum probability corresponds to a price return of -4% over the next 2.25 months. The annualized volatility derived from this distribution is 34.8%.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

Viewed with this representation, it is clear that the probabilities of negative returns are consistently higher than for positive returns of the same magnitude for a wide range of the most-probable outcomes (the red dashed line is above the solid blue line for almost every return in the left ⅔ of the chart). This is a moderately bearish outlook, consistent with peak probability at a negative price return.

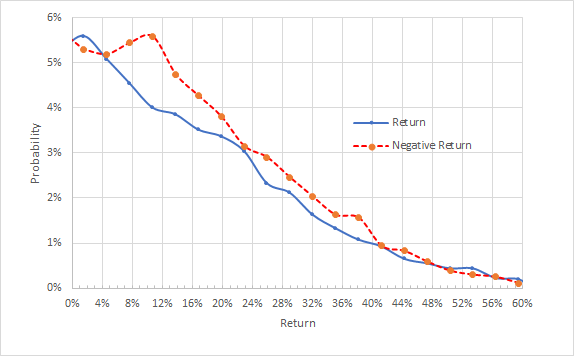

The market-implied outlook for the 7-month period from now until June 17, 2022 is consistent with the shorter-term outlook. The probabilities of negative returns are consistently higher than for positive returns of the same magnitude. There are two small peaks in probability, one corresponding to a price return of +1.5% and one corresponding to a price return of -10.5%. This is a moderately bearish market-implied outlook for the next 7 months. The annualized volatility calculated from this distribution is 37.2%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

Summary

ATVI is 33% below the 12-month high and the shares look cheap on the basis of estimated forward earnings. The Wall Street consensus price target has declined in recent months, but the share price has fallen more. The result is that the current 12-month price target implies a higher expected return than back in March (40% today vs. 24% in March).

The Wall Street consensus rating continues to be bullish. Back in March, the market-implied outlook to January 2022 was bearish and continues to be bearish. The market-implied outlook to June 2022 is also bearish. In considering the recent management commentary on release delays, the bullish Wall Street consensus outlook, and the bearish market-implied outlook, I am maintaining my neutral rating for ATVI.