This week's "Things To Ponder" is a grab bag of things that got me to thinking about where we are today. While the markets have had a very strong rally in recent weeks it has been on the back of weak economic data. It is hoped, of course, that this will mean that the Fed will eventually rethink the speed at which they withdraw liquidity from the markets. However, there are also signs of very "exuberant" behavior at play as well from the leveraged loan markets to excessive valuations being paid for acquisitions based on the "number of users" which is all too reminiscent of the late 90's when it was about "clicks" and "eyeballs" per page. Of course, then again, it is different this time - right?

1) Everything Is Awesome? by Joshua Brown

There is an old saying that goes: "The more that things are different, the more they remain the same." From hemlines to hair-do's, skyscrapers to real estate, every bull market in history has been marked with signs of "irrational exuberance." Josh Brown did a great job this week pointing out some of the cultural issues that have arisen as of late that may once again be indicative "this time is different, and very much the same."

"Morgan Stanley’s analyst went full E-tard this week. He’s calling for a Utopian Society (his words, not mine) driven by, I kid you not, electric batteries. I think that’s a little far-fetched but just in case I’ve built a shrine to the Energizer Bunny in my garage.

In the meanwhile, to build this Robot Summer Camp, Tesla’s going to need more capital. So last night they dropped a $1.8 billion convertible note. Under normal circumstances, dilution might be a negative for a company’s share price. But not with Tesla. It’s a huge positive, apparently and the shares are surging – “It proves their ability to raise capital at will!” Oh my god. Maybe it is Utopia – Utopia for investment bankers – because when money has lost all meaning and becomes untethered to earth, you can really make a lot of it.

It’s not just Tesla. Ryan Detrick tells us that the current streak for small cap growth stocks is kind of special. They’re up 13 of the last 14 days. The last time that’s ever happened has been never. In, like, intergalactic history. First time for everything. May as well be now."

2) Valuations And Forward Returns by James Montier

Of course, while the "bulls play" it may not be a bad idea to take one step back and remember that what we "pay today" for an investment has everything to do with what it will return in the future. If you read nothing else this weekend - you should read the full piece below by James.

"Over the years I've witnessed many attempts by the practitioners of this most dark art to justify why tried and tested measures of valuation are no longer meaningful, or occasionally create new measures of valuation that purport to show the market to be cheap."

3) Has Housing Seen It's Peak by Zero Hedge

I discussed at length last week that the recent housing data was most likely NOT just a short term weather related issue. The rise in interest rates since June of last year is now working its way through the system as re-financing activity has been decimated (as witnessed by mass layoffs of mortgage bankers), rental profits are being crushed by rising prices and household formations continue to fall. Of course, as we have discussed many times in the past a large chunk of the reduction in housing inventory was driven by all-cash speculators buying houses and turning them into rentals.

The question has always been: "What happens when that speculation cycle eventually comes to an end?"

"Alas, just like the rental bubble whose bursting we chronicled here just last week, so the institutional bubble has just popped, which we know courtesy of RealtyTrac data reporting that institutional investors — defined as entities purchasing at least 10 properties in a calendar year — accounted for 5.2 percent of all U.S. residential property sales in January, down from 7.9 percent in December and down from 8.2 percent in January 2013. This was the biggest one month plunge in history. It gets worse: the January share of institutional investor purchases represented the lowest monthly level since March 2012 — a 22-month low."

From RealtyTrac:

“Many have anticipated that the large institutional investors backed by private equity would start winding down their purchases of homes to rent, and the January sales numbers provide early evidence this is happening,” said Daren Blomquist. “It’s unlikely that this pullback in purchasing is weather-related given that there were increases in the institutional investor share of purchases in colder-weather markets such as Denver and Cincinnati, even while many warmer-weather markets in Florida and Arizona saw substantial decreases in the share of institutional investors from a year ago.”

4) Lessons From The Bitcoin Fraud by Cullen Roche via Pragmatic Capitalist

I have maintained very serious doubts about the whole "Bitcoin Is the New World Order" mentality. While the idea of a virtual currency is very interesting in theory, there is a huge difference between theory and practice. In a world where every currency is based on "fiat," the real underlying value is simply "trust." While there have been many articles written about the U.S. losing its "reserve currency" status, the reality is that there are very few currencies in which transactions can be conducted with "trust." There are fewer currencies still that have both the "trust" and the "depth" within the currency markets to handle the volume of the global transactions that occur today. Cullen picks up on this point very well:

"The huge Bitcoin fraud at Mt. Gox has raised some serious questions about Bitcoin as a form of money. Almost a year ago I touched on some of the interesting elements of Bitcoin as a form of money. One of the crucial elements I discussed was the topic of trust. After all, modern money is mostly credit. And credit is based on a foundation of trust. If there is no trust then the money has no credibility. When I first talked about Bitcoin I said that this was a major problem for Bitcoin because it brought the element of fraud into the picture."

As a follow up to Cullen's point, Business Insider posted the following update as Mt. Gox today apologized for LOSING roughly $500,000,000 dollars worth of individuals bitcoins.

"The Asahi News Network has posted video of MtGox CEO Mark Karpeles' Tokyo press conference admitting 850,000 bitcoins — worth nearly half a billion dollars — held by the exchange are gone, and that the firm is filing for bankruptcy.

We have lost bitcoins due to weaknesses in the system," the France-born Karpeles said in Japanese according to the AFP. 'We are really sorry for causing trouble to all the people concerned,' he said, before bowing deeply."

5) Longest & Strongest Bull Markets by Bespoke Investment Group

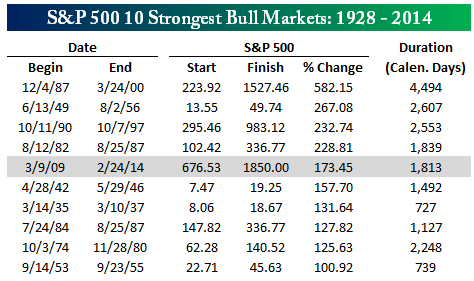

I recently wrote an article discussing historic bull market cycles. What I find interesting is that in the midst of a bull market cycle there are few that seem aware that they will eventually end. The end, of course, is that very nasty "mean reversion" thingy that I have often discussed. Recently, Bespoke addressed this point looking at previous bull market cycles as compared to the current cycle that began in March, 2009.

"The current bull market may only rank at seven in terms of duration, but it is already at number five on the list of ten strongest bull markets. Looking at the list, it could be some time before we crack the top four. In order to crack the 228.81% threshold to move into the top four, the S&P would have to rally another 20% to about 2,225. Finally, before setting your sights on the title of strongest bull market on record, keep in mind that in order to overtake the 1987-2000 bull market, the S&P 500 would need to rally an additional 150% to 4,620. Don't hold your breath."

With the bulls back in charge, I will upgrade our allocation model in this weekend's newsletter.

Have a great weekend.