Yesterday was a strange day. The S&P 500 went straight down to 4,115 well below support at 4,180 I mentioned on Wednesday, and then went straight back up 4,295. Days like Thursday are impossible to understand, and the only thing one can do is try and put the pieces together.

Here is my interpretation of what happened yesterday; you can choose to agree or disagree; that’s your call. But if I am right, yesterday’s rally isn’t going to last, just like the one on Jan. 24 didn’t last.

For whatever reason, TIP rates fell dramatically in what looked like a gigantic flight to safety. It must have kicked off an algo program or something that resulted in the buying of technology and growth stock. That then led to a big short-covering rally as investors scrambled to unwind their put positions adding fuel to the fire.

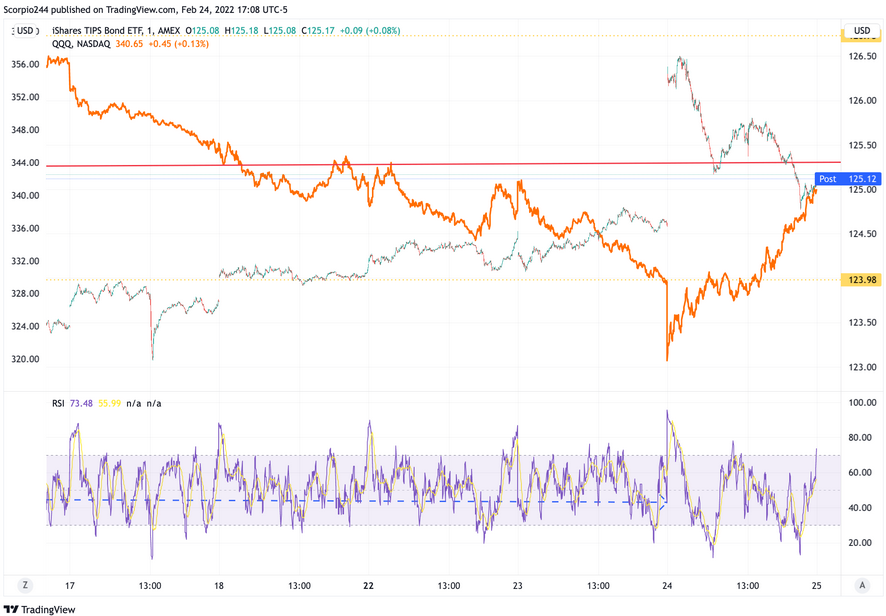

It seems fairly easy to see what happened with the TIP ETF and the QQQ from the chart below.

To give you a sense of how dramatic the decline in the TIP rate was, the 5-yr TIP dropped to -1.48% yesterday morning from -95 basis points on Wednesday afternoon.

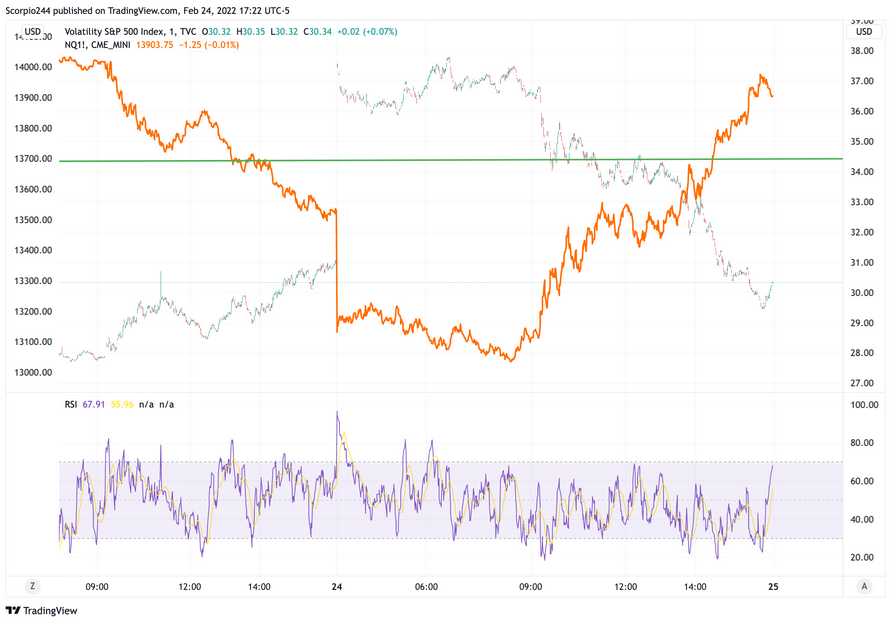

This led to a massive afternoon meltdown in the VIX as traders began to unwind their put positions. I did manage to dig through the options data, and most of the options there were trading for the SPY and Q were for today’s expiration date. That could mean that traders look to put hedges back on, heading into the weekend.

It was sort of surprising that the 10-year yield finished the day higher yesterday at 1.97%.

That’s really all, too much dislocation to get into anything else.