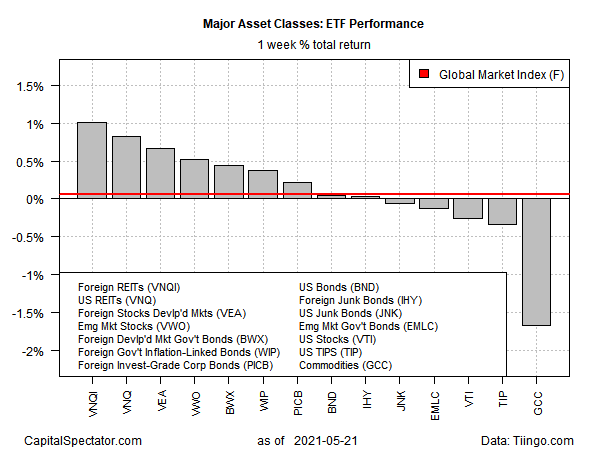

Foreign and US property shares rallied last week, posting the strongest gains for the major asset classes, based on a set of exchange traded funds through Friday, May 21.

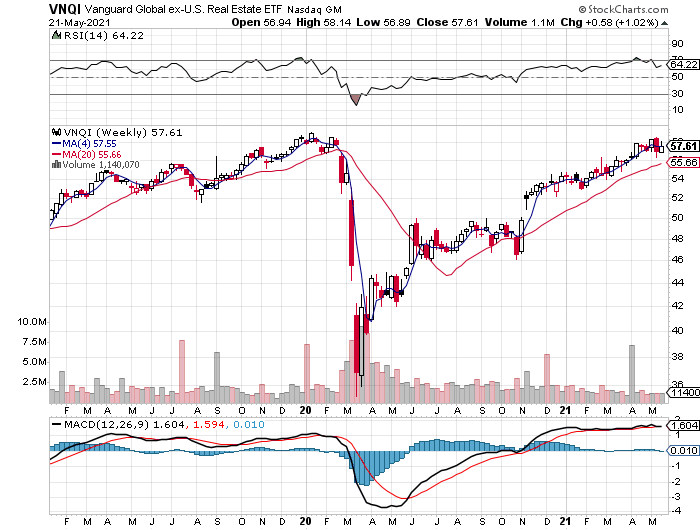

The top performer: Vanguard Global ex-U.S. Real Estate ETF Shares (NASDAQ:VNQI), which rose 1.0%. The fund is near its pandemic high but has yet to fully recover from the coronavirus crash in March 2020, as shown in the weekly chart below.

A close second-place gainer last week: US real estate investment trusts (REITs). Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) rallied 0.8%. The fund has traded at or near record highs in recent weeks.

US stocks lost ground for a second straight week via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), which slipped 0.3%. Meanwhile, US bonds ticked up 0.1%, although Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) continues to trade in a tight range after suffering a persistent correction in the first quarter.

The Global Markets Index (GMI.F) posted a slight gain, rising 0.1% last week. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETF proxies.

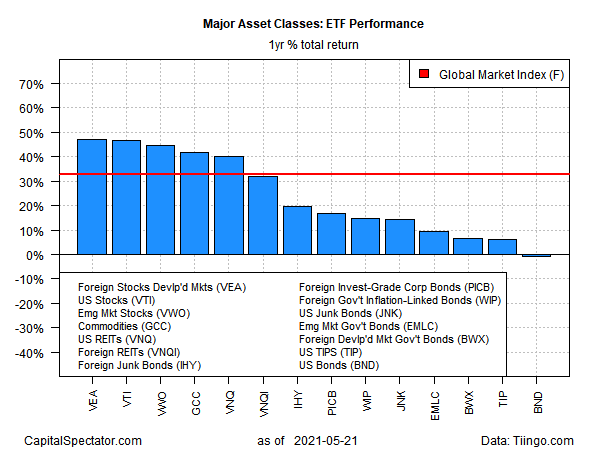

For the one-year trend, foreign stocks in developed markets ex-US are the top performer by a hair. Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA) is up 47.1% on a total-return basis over the past 12 months, slightly ahead of the second-best one-year performer: US stocks (VTI), which is ahead by 46.7%.

The weakest one-year performer for the major asset classes: US bonds via BND, which has shed 0.7%.

GMI.F is up 32.8% over the past year.

Note that one-year returns for some corners of the global markets are unusually high at the moment because year-ago prices were dramatically depressed due to the coronavirus crash.

Accordingly, trailing one-year results will remain temporarily elevated due to extreme year-over-year comparisons until last year’s markets collapse washes out of the annual results.

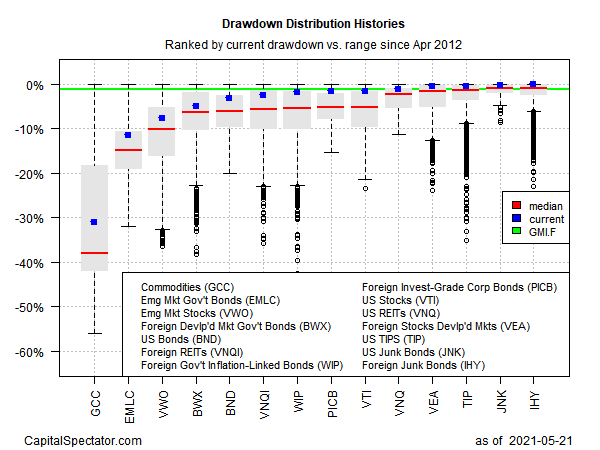

Monitoring funds through a drawdown lens shows that foreign high-yield bonds are the leaders with the smallest peak-to-trough decline for the major asset classes. At last week’s close, VanEck Vectors International High Yield Bond ETF (NYSE:IHY) ticked up to a record high.

The deepest drawdown is still found in broadly defined commodities via WisdomTree Continuous Commodity Index Fund (NYSE:GCC). The ETF, which equally weights a broad basket of commodities, is down 31.0% from its previous high.

GMI.F’s current drawdown is currently -1.2%.