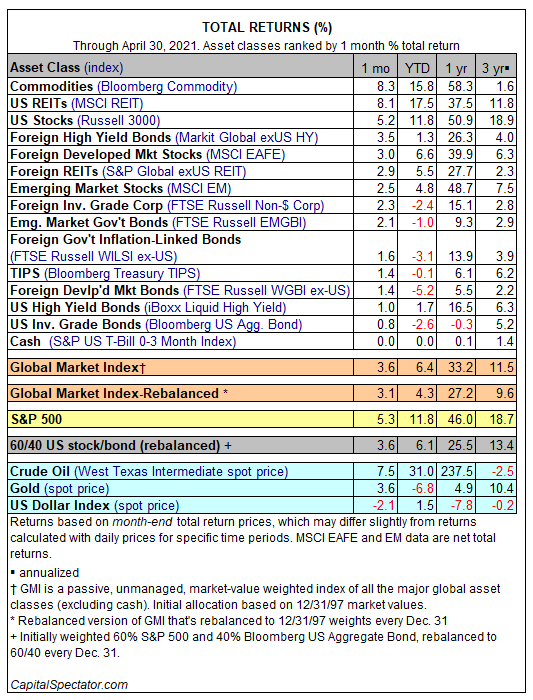

April delivered across-the-board gains in the major asset classes as risk-assets around the world rebounded from widespread losses in March. Thanks to a strong tailwind, you had to really work hard to lose money last month in conventionally managed multi-asset-class portfolios.

The lead performer in April: broadly defined commodities, which surged 8.3% via the Bloomberg Commodity Index. The increase marks the strongest monthly advance in nearly a year and catapults the asset class to the second-best return year-to-date, second only to US real estate investment trusts (REITs).

US stocks continued to rise at a strong pace in April. The Russell 3000 Index jumped for a third straight month with a sizzling 5.2% gain—the best monthly rally for the benchmark since last November.

Even the beleaguered US bond market managed to eke out a modest gain as the rise in interest rates took a breather last month. The Bloomberg US Aggregate Bond Index rose 0.8%—the first monthly profit so far this year.

The worst performer last month: cash via S&P US T-Bill 0-3 Month Index, which was unchanged in April.

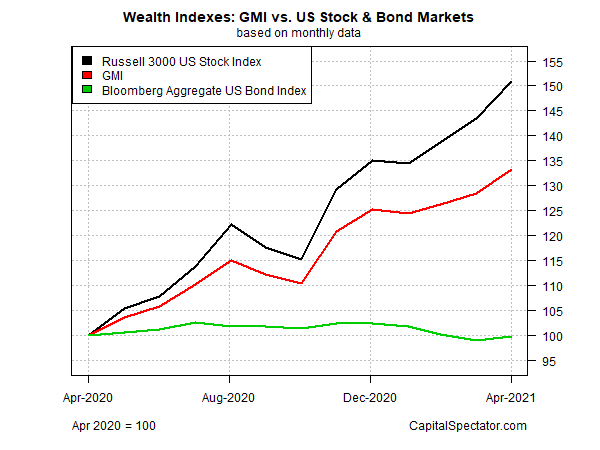

The widespread rallies continued to lift the Global Market Index (GMI) in April. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose for a third straight month, gaining a solid 3.6%. Year-to-date, GMI is up an impressive 6.4%—higher than all but four of the asset classes listed above. GMI’s performance edge over most of the field this year is a reminder that holding a passive, global mix of betas remains a tough act to beat in 2021.

One of the few exceptions: US stocks, which continue to outperform GMI by a wide margin. Over the past year the Russell 3000 US Stock Index is up nearly 51% on a total-return basis. The unusually high one-year total return (for stocks and other markets) reflects the bounce from the coronavirus crash in the spring of 2020.

GMI’s one-year return is relatively modest by comparison, although its 33.2% total return is still impressive for a multi-asset-class benchmark. All the more so when you consider that the investment-grade US bond benchmark is essentially flat over the past year: Bloomberg US Aggregate Bond Index is off fractionally for the one-year window, ticking down 0.3% through April’s close.