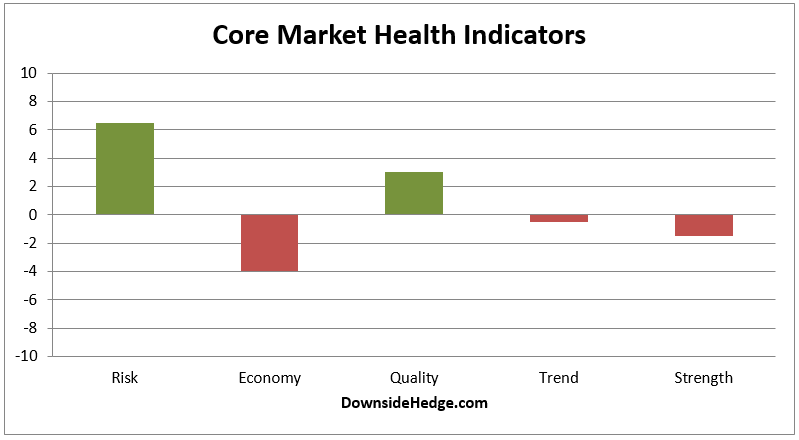

Over the past few weeks, my core market health indicators improved significantly, with the exception of my measures of the economy. The strength seen suggests that the market wants to rally. Although my measures of trend and strength are still negative, they are on a trajectory to turn positive within a week or two.

One thing of note is that the current strength is coming from mega cap stocks. This isn’t a healthy condition. Normally, a healthy rally will have broad participation from the stocks in the S&P 500 Index (SPX). This isn’t happening. Look at the ratio between SPX equal weighted (S&P 500 Equal Weighted). It is still falling. Bulls want to see this ratio turn up if the market breaks higher.

Another sign of poor participation in the market comes from the percent of SPX stocks above their 200 day moving average. As SPX is approaching new highs, the percent of SPX stocks above their 200 dma is falling. This increases the risk that a breakout rally will be followed by a large decline.

Conclusion

My core indicators suggest that SPX is getting ready to surge to new highs, but measures of breath aren’t confirming the move. If broad participation doesn’t accompany a break out, I suspect we may see a blow off type top.