Traders read the tape - ticker tape in the old days to determine the recent buying and selling pressure. Here lies the importance of volume. It's easy to spot a large buyer or seller when the volume is light. Big buyers usually enter before big moves.

Jesse Livermore read the tape and never fought it.

Of course there is always a reason for fluctuations, but the tape does not concern itself with the why or wherefore. It doesn’t go into explanations. I didn’t ask the tape why when I was fourteen, and I don’t ask it today at forty…, Reminiscences of a Stock Operator.

While the tape, often triggered by price in reaction or anticipation of the new flow, is triggered by price, it's fueled by force. Volume is the domain of force. Traders/investors must learn to read the force behind the trend.

The trading masters, particularly Richard Wyckoff, Jesse Livermore, as well as those influenced by them, used volume as a means of measure force. Years of observation, often accompanied by loses, revealed that trends (impulses) propelled by falling volume (force) often reversed unexpectedly. Reversals still surprise the majority today because they completely ignore VOLUME! Volume is the reason why the primary trend alignments are defined Price as (LTCO) and Volume (LTREV) by the computer. Trading notes defines the primary trend for many key markets.

Traders/investors that do not understand the message of volume, it's alignment or disconnect with price, will be surprised more than those that do. Surprises generally translate to loses.

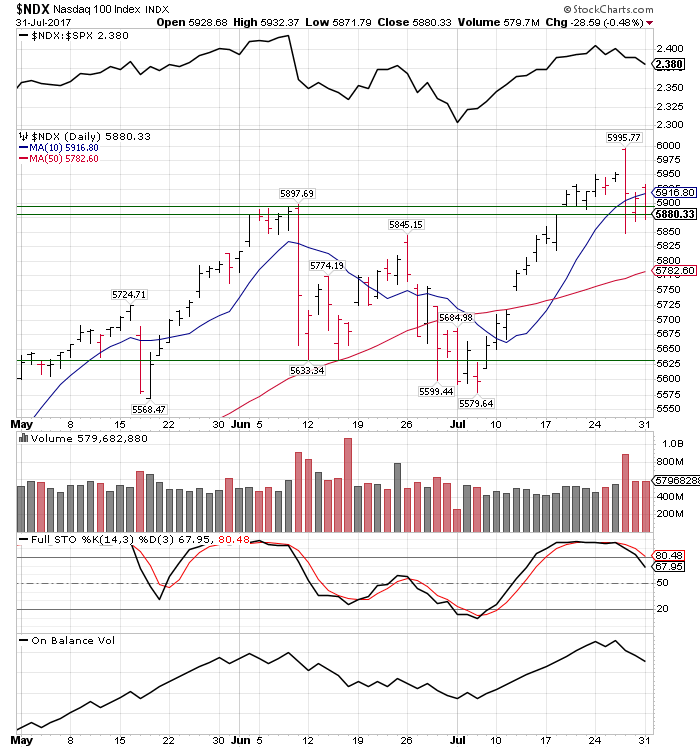

Reading the Tape on NASDAQ 100

Upside gap was formed on 7/19 on 522M shares (NASDAQ 100). 522M shares is the reference point. This gap was tested on 7/27 and 7/31 on 893M and 579M shares. Each test displayed an expansion of volume, thus, expanding downside force. Wyckoff recognized long ago that 7/27 high volume test would be repeated. It was repeated on 7/31. While volume contracted, it's still greater than 522M. This favors another test. A test on contracting volume creates not only a bullish setup but also increases the probability of an unexpected reversal. Short-term trends often produce more than one bullish or bearish setups.

Wyckoff and Livermore, lacking access to computers, focused solely on the short-term trend as described above. Computers, masters at high speed calculations, can translate the direction of force for the short-, intermediation, and long-term trends.

My REV calculation focuses on the intermediate trend (see Trading notes). Smart money never trades against it. A bullish setup(s) generated while the intermediate trend is aligned down should be ignored.