Economic numbers out of the Eurozone weren’t thrilling at all today. The export number for the month of August for the so-called economic engine of the eurozone plunged. The German exports came in at -1.8%, the forecast was for -1.0%. This data shows how feeble the economic conditions are in the eurozone.

Trade Talk= Cease-Fire?

Trade talks resumed in the midst of heightened tensions between the two countries: the United States and China. The tit-for-tat behavior has been going on for some time and the hopes are that both countries would be able to hammer out an intern deal which perhaps draws a cease-fire line.

We have used our words carefully because the cease-fire doesn’t mean the reversal of current tariffs which are weighing on both economies. If we see anything meaningful and constructive on this, then it would be a landslide victory for the officials of both countries.

Bull and Bear Spread Favour Bearish sentiment

Despite the fact that we have seen some gains for the US markets yesterday but the bulls are still losing control. The reason behind this statement is that the equity bull and bear spread favors bear. As of yesterday, 20.31% of US investors had a bullish view, while 35.73% neutral and whopping 43.96% hold a bearish view. This means the bull/bear spread stands at -23.65%.

This is the key reason that we argue that equity investors are no longer that thrilled about the QE. This pill used to had a significant impact when it was introduced, and now, this doesn’t have the same kind of effect.

Smart Money Is Confused

Smart money is confused than ever and the reason for this is that if we look at the weekly chart of S&P 500, it confirms three consecutive weeks of losses and yet we are not only 4% off from record highs (something which we pointed out yesterday as well)

Investors Pulling Money Out of US equities

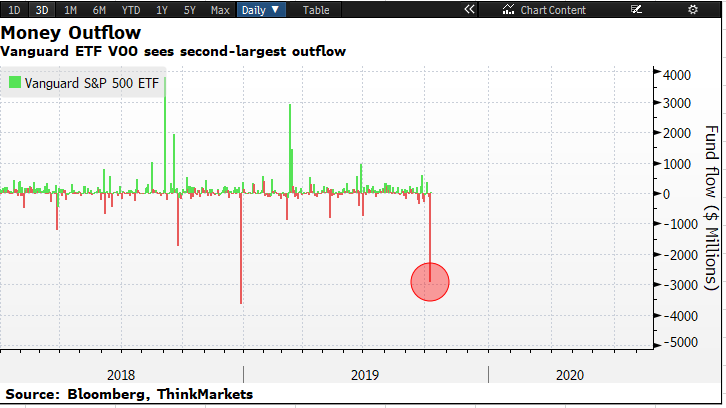

The general stance among investors is that they want to stay on the sideline ahead of current trade talk. The vanguard’s S&P500 ETF (with ticker Vanguard S&P 500 (NYSE:VOO)) shows an outflow of $2.9 billion at the beginning of this week and this has been the biggest withdrawal for the past 10 months, in other words, the second biggest on record since the inception of the fund.

Gold Price Likely To Stay Above 1500

As for now, safe haven trade is the most popular among investors and this has pushed the gold price to its highest level for this week. It made a high of 1517 and currently trading at 1507. We expect this uptrend to remain intact especially that the price has moved above the 50-day SMA on a daily time frame.

UK GDP and Manufacturing Data

As for Brexit, we are going to see its colors on the economy when the UK’s GDP number will be released along with the manufacturing production numbers later today. The recent CFTC data shows that British pound asset manager institutional net total combined positions sit at -74053 and British pound leveraged funds net total combined -21957. Clearly, market participants are extensively short on the currency and consensus among traders is for Sterling to move lower. A positive surprise in the economic numbers today and if the threat of no-deal Brexit fades away could lead to an intense short squeeze. This means the sterling-dollar pair could move to 1.26 to 1.27.

Jeremy Corbyn is going to back for a general election which could take place by Nov 26th provided that Brexit deadline is extended. The early polls show a lead for him for whatever they are worth.

If we have learned anything during the past three years from these polls is that they are as unreliable as someone reading the tea leaves.