Forex News and Events

Auckland housing market worries RBNZ officials

In a speech delivered to the Northern Club earlier this morning, Deputy Governor Grant Spencer shared RBNZ’s concerns about the housing market and more specifically the real estate bubble in Auckland, saying “when something keeps you awake at night, it is good to do something about it.” In Auckland, median house price rose 20.50% in the year to July to NZD 735,000 compared to an increase of 11.80% in national median price, up to NZD 465,000 from NZD 416,000 a year earlier. Last Friday, the RBNZ announced a modification in the Loan to Value Ratio restriction rule (LVRs) as announced in May this year. The new rules will become effective on 1 November 2015 and mean that borrowers will generally need a 30% deposit for a mortgage loan secured against Auckland rental property. However, we do not believe that the real estate bubble in Auckland will prevent the RBNZ to further cuts.

In his speech, Governor Spencer emphasized that the RBNZ has no choice but to keep cutting interest rate further in an attempt to bring inflation within the 1%-3% target band, first of all, and to stimulate a slowing economy, suffering from falling export prices. Despite growing concerns about the housing market in Auckland, we expect the Reserve Bank to cut the official cash rate by another 25bps on September 10, bringing the benchmark rate down to 2.75%.

Norway’s economy shrinks amid low oil prices

The collapse of oil prices is largely hitting Norway. The country’s economy relies on its oil exports and depressed oil market drags down revenues. Tomorrow, an investment survey will provide investment expectations up to end 2016. This report is seen as a good indicator of a possible pick-up.

Norway’s main economic drivers relies upon the oil industry. Indeed, its reserves are massive. There is no doubt that the current weakness in the global oil market will have a strong impact on the Norwegian growth. Norges Bank, which will meet in September, is likely to further cut rate. Early July, it signaled that another rate cut was at 70% chance while the Brent price was about $20 higher to what it is now. A 1.5% decrease in deposit rates is already priced in the exchange rate.

We consider that the decline in the oil prices will continue. Fears of oversupply cause plunge of oil to continue. We target the krone to reach its lowest level of the year against the dollar at 8.4188 within the next few weeks. However, on the short-term, the dollar is likely to suffer, as U.S. rate expectations for September are moving to December.

China weighs

Global equity indices continued to hemorrhage as China’s “Black Monday” takes hold. Significant weakness can be across assets class as Shanghai Composite falls -8.49% (erasing 2015 gains). This selling comes while Chinese authorities are rumored to be preparing to flood the markets with cash. Investors are expecting further cuts in the reserves requirement ratio (RRR) and fast-tacking of fiscal stimulus. However, officials currently seem unprepared to face the duality of the immediate challenge: to combat panic-like behavior over stock markets valuations at the same time as manage fears over a rapidly decelerating economy. Over the weekend, China's official stated they would allow pension funds to buy shares for the first time, yet this awkward move failed to halt capital outflows. The expected cut in RRR never happened, and lack of action sparked today's heavy selling. We are seeing capitulation in global markets, indicating that a Chinese style “bazooka” is required to break the current collapse. Baring a heavy and public display, positive Chinese data will also help relieve the panic factor. On Wednesday, markets will get Chinese consumer sentiment for August. With this read, we will start to see if the consumer held up during the early stages of the stock market sell-off. While the role of discretionary spending is not widely watched, compared to investment and exports, a positive outcome would help marginally offset weakness in other data.

EUR/USD - Breaking The 200-Day MA

The Risk Today

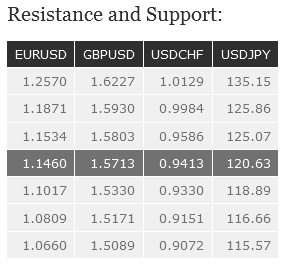

EURUSD EUR/USD has broken the hourly resistance at 1.1436 (18/06/2015). Over the last month, the pair is setting higher highs. There is a short-term upside momentum. Resistance lies at 1.1534 (02/02/2015 high). Support can be found at 1.0809 (20/07/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBPUSD GBP/USD has shifted into a consolidation pattern after slight bullish recovery. However, drift lower indicates persistent selling pressure. Stronger support is given at the 38.2% Fibonacci retracement at 1.5409. Hourly resistance is given at 1.5733 (01/07/2015 high). The short-term structure shows an upside momentum. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USDJPY USD/JPY is declining toward hourly support at 120.41. The hourly support given by the 38.2% Fibonacci retracement at 122.04 has been broken. Stronger support can be found at 118.89 (14/05/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USDCHF USD/CHF is moving lower, suggesting persistent selling pressures. The pair has broken the 38.2% Fibonacci retracement. We are now into a short-term declining trend-line. In the long-term, the pair has broken resistance at 0.9448, suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).