The Reserve Bank of New Zealand surprised no one this morning by leaving the official cash rate on hold at 1.75%.

While there is no Monetary Policy Statement for release with today’s decision (or press conference from Governor Wheeler for that matter), the RBNZ did say that monetary policy would remain “accommodative” for “a considerable period”.

Markets have digested this as being a clear neutral stance on rates from Wheeler as the expectation continues to be that they will not be raising rates into 2018.

Forex traders pushed the kiwi slightly higher in the wake of the interest rate decision as the kiwi rose from US 72.31 cents to US 72.51 cents and also gained about 0.20 cents against the euro within minutes of the statement.

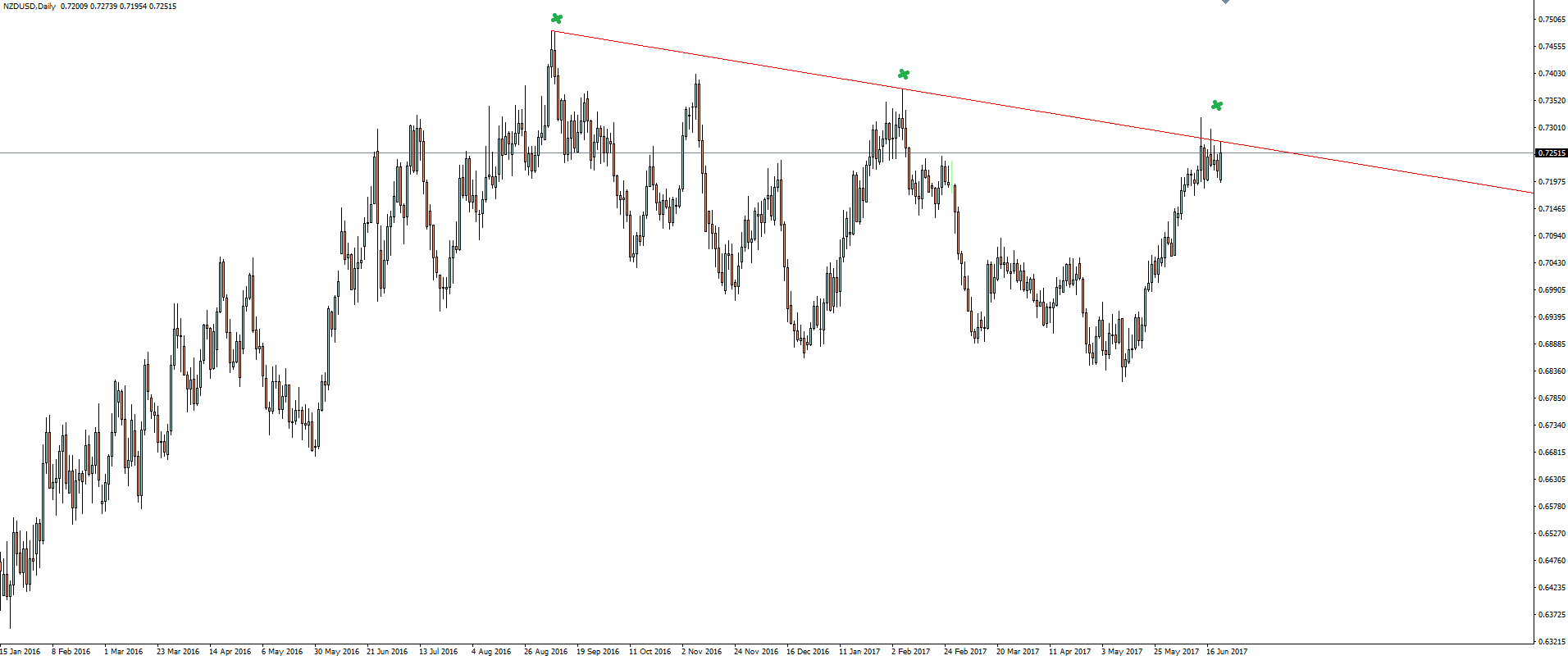

But while price rocketed up to NZD/USD trend line resistance, half of those gains were given back once technical resistance was touched. Not much has changed fundamentally and this is reflected in the kiwi daily chart below:

This level is still key heading forward and any intraday shorts will depend on it holding. Remember, if you’re trading NZD/USD then screenshot your chart and be sure to mention @VantageFX on Twitter to contribute to the discussion.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and Australian forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.