It really wasn’t that long ago that we were talking about NZD/USD breaking support!

The daily swing lows from December had broken back in May on the back of the RBNZ holding interest rates steady and the intraday price action was conducive to day trading.

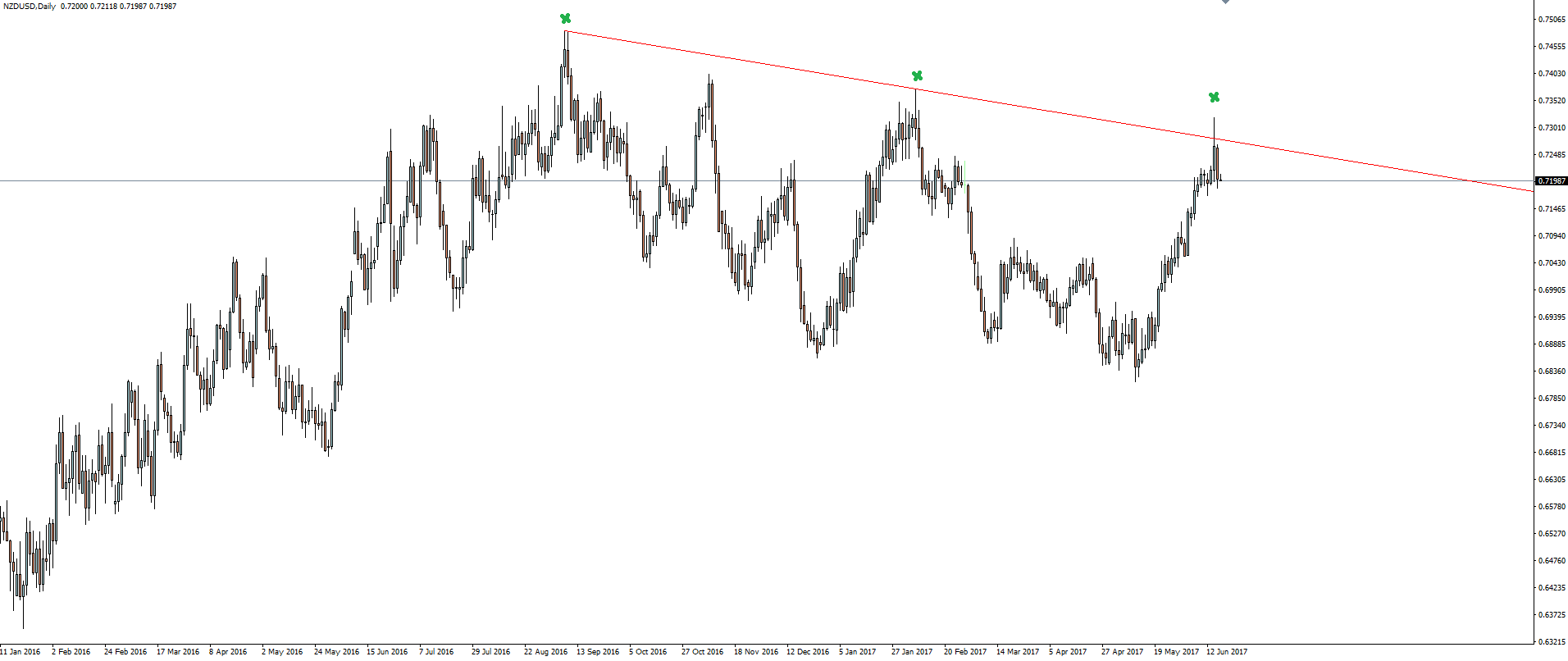

Fast forward back into the present day and take a look at the NZD/USD daily chart we’ve featured below:

Price ripped off support and 4500 pips later, has been halted by trend line resistance. A nice higher time frame resistance point.

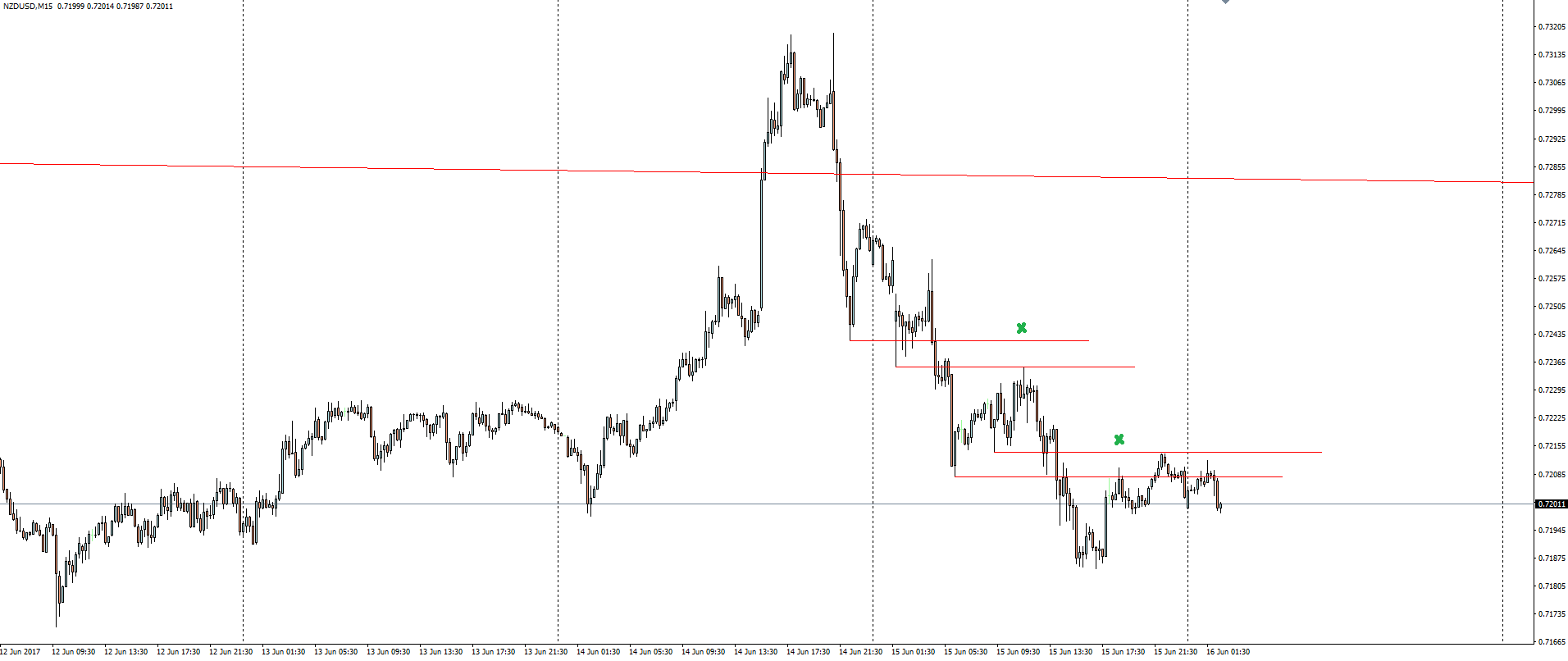

Zoom into an intraday 15 minute chart and lets have a look at the price action:

After a higher time frame level holds, we want to trade in that direction. In this case short.

Take a look at how price has reacted to each short term support level and cleanly held it as resistance.

Will this trend continue?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.