RBA remains on hold, AUD couldn’t care less

- RBA remained on hold at +1.50% as was widely expected.

- The accompanying statement had a rather neutral to dovish tone as it cited inflation likely to remain slow for some time, wage growth also to remain slow and household consumption remaining a source of uncertainty.

- The statement sounded similar to the June statement with main issues remaining the same as well as the tone.

- AUD/USD did not have a major reaction, practically ignoring the release. We could see the pair being USD driven for some days.

US President Trump indirectly threatens WTO

- US President Trump, indirectly warned WTO that “we’ll be doing something” if the US is not treated properly.

- The threat was made just after the EU stated that US tariffs on cars would have an adverse effect on the US car industry and would prompt retaliation measures from the EU.

- During a meeting with Dutch PM Rutte, president Trump also mentioned the possibility of EU-US negotiations about trade talks.

- Trump’s willingness to “fix” WTO could consist a new level of trade tensions and should there be further headlines we could see increased volatility for the greenback.

Today’s other economic highlights

- Turkey: CPI for June, Survey: N/A Prior: 12.15% yoy, 07:00 (GMT), any reading> 12.15% yoy could strengthen TRY

- Sweden: Riksbank interest rate decision, Survey: -0.50% Prior:-0.50%, 07:30 (GMT), SEK OIS probability:98.33% to remain on hold

- Sweden: Press conference for interest rate decision, 09:00 (GMT)

- Eurozone: Producer Prices for May, Survey: +0.4%mom Prior:0.00%mom, 09:00 (GMT), could strengthen EUR

- Eurozone: Retail Sales for May, Survey: +0.1%mom Prior:+0.1%mom, 09:00 (GMT), could weaken EUR

- New Zealand: Milk Auctions, Survey: N/A Prior: 3,481 tons, Tentative time, any reading>3,481 tons could support NZD

- US: Factory orders for May, Survey: 0.00% mom Prior:-0.8% mom, 14:00 (GMT), could strengthen USD

- US: API weekly crude oil inventories, Survey: N/A Prior:-9.228m, 20:30 (GMT),

- Speakers: ECB’s Peter Praet (16:00, GMT) speaks.

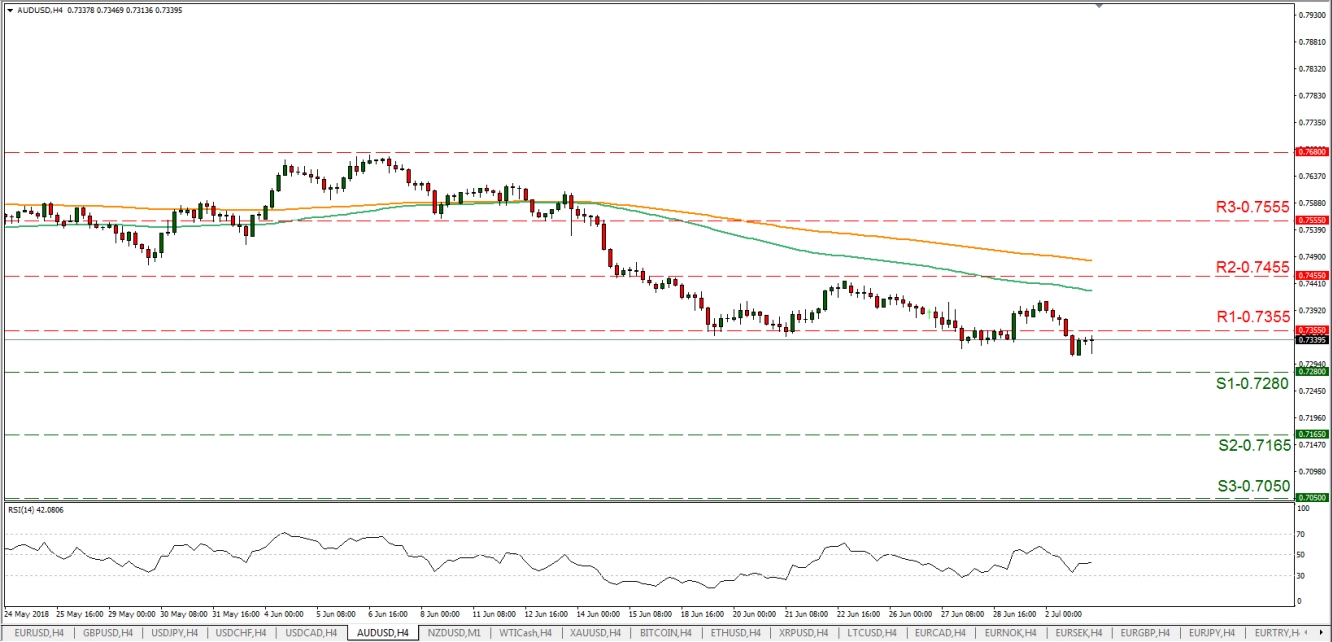

AUD/USD

·Support: 0.7280(S1), 0.7165(S2), 0.7050(S3)

·Resistance:0.7355(R1),0.7455(R2),0.7555(R3)

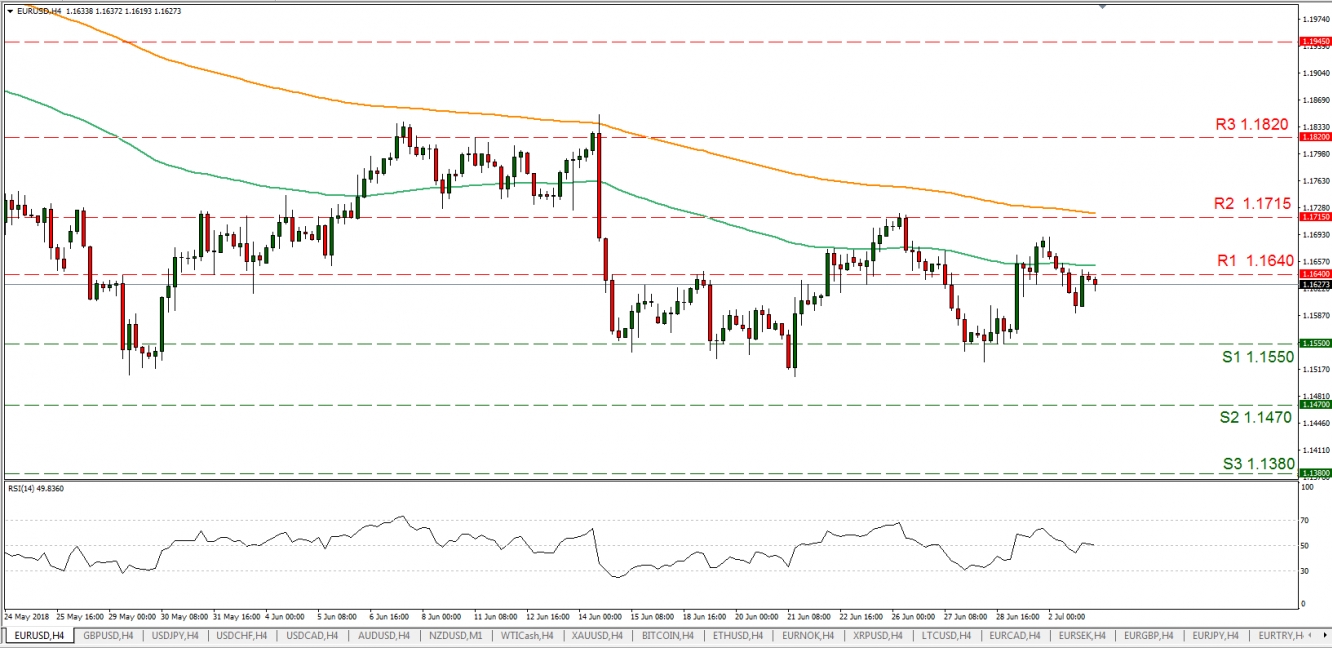

EUR/USD

·Support: 1.1550(S1), 1.1470(S2), 1.1380(S3)

·Resistance: 1.1640(R1), 1.1715(R2), 1.1820(R3)