During the session on Tuesday, without a doubt the most important piece of economic news will be the Reserve Bank of Australia’s interest-rate decision. While we do not expect any type of change, you have to keep in mind that there is the possibility that perhaps people will get spooked to buy something that the central bank says. With this, we believe that the Aussies could move stock markets in general.

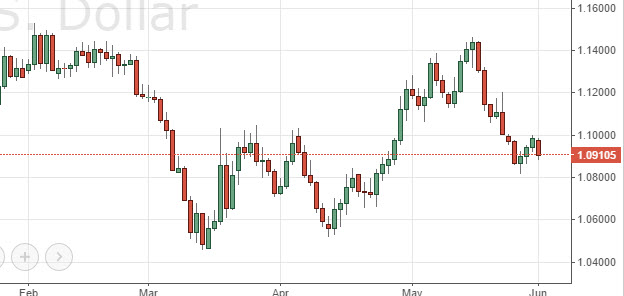

The EUR/USD pair fell during the day on Monday, and it looks like it is trying to get to the 1.08 level. Because of this, we believe that buying puts on short-term charts will be the way going forward, and if we can break down below the 1.08 level, we could in fact head back towards the 1.06 handle. We have no interest in buying calls until we get above the 1.10 level.

Silver markets tried to rally during the course of the day on Monday, but found the $17 level to be a bit too strong to overcome. However, we believe that all the market is going to do now is simply consolidate between the 16.50 level on the bottom, and the $17 level on the top.

The S&P 500 fell a bit flat during the session on Monday, and looks like it is ready to pull back a little bit. Nonetheless, we believe ultimately it’s going to be more or less sideways action, so we are willing to buy calls on pullbacks that show signs of either bouncing or support.