- On Tuesday in the Asian session (04:30, GMT), we get RBA’s interest rate decision and it is expected to remain on hold at +1.50%.

- Currently AUS OIS imply a probability for the bank to remain on hold at 99.59%.

- Market focus could shift to the accompanying statement and comments regarding GDP, inflation, world trading conditions and household spending could gain the market’s attention.

- Should there be a neutral to dovish tone in the accompanying statement we could see the AUD weakening.

Leftist candidate wins Mexican presidential elections

- According to media, exit polls show that leftist candidate Andres Manuel Lopez Obrador (AMLO) won Mexico’s elections yesterday.

- AMLO could move Mexico to a nationalistic and social direction as he promised to reduce economic dependence on the US.

- The new government will inherit the NAFTA negotiations and some quite tense relationships with the US.

- Should there be further headlines about the intentions of the new president volatility may arise on MXN.

Today’s other economic highlights

- Germany: Final Mfg PMI for June, Survey: 53.1 Prior: 53.1, 07:55 (GMT), could weaken EUR

- France: Final Mfg PMI for June, Survey: 55.9 Prior: 55.9, 07:55 (GMT), could weaken EUR

- Eurozone: Final Mfg PMI for June, Survey: 55.0 Prior: 55.0, 08:00 (GMT), could weaken EUR

- UK: Mfg PMI for June, Survey: 54.0 Prior: 54.4, 08:30 (GMT), could weaken GBP

- Eurozone: Unemployment Rate for May, Survey: 8.5% qoq Prior:8.5%, 09:00 (GMT), neutral for EUR

- US: ISM Mfg PMI for June, Survey: 58.1 Prior: 58.7, 14:00 (GMT), could weaken USD

- Speakers: ECB’s Peter Praet (13:30, GMT) speaks.

As for the rest of the week

- On Tuesday, we get Riksbank’s (Sweden) interest rate decision

- On Wednesday, we get Australia’s Retail Sales for May and UK’s Services sector PMI for June.

- On Thursday, we get the US ISM Non-Mfg PMI for June as well as the FOMC meeting minutes.

- On Friday, we get the US Employment report with the NFP figure and Canada’s employment data, both for June.

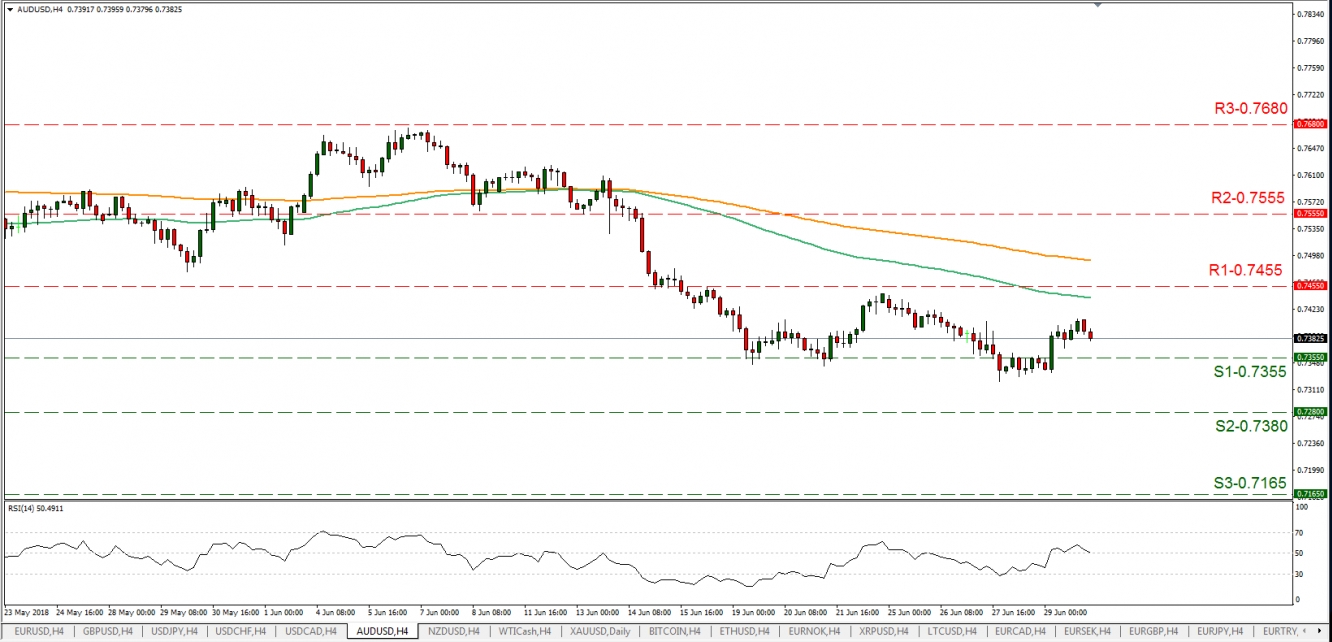

·Support: 0.7355(S1), 0.7280(S2), 0.7165(S3)

·Resistance:0.7455(R1),0.7555(R2),0.7680(R3)

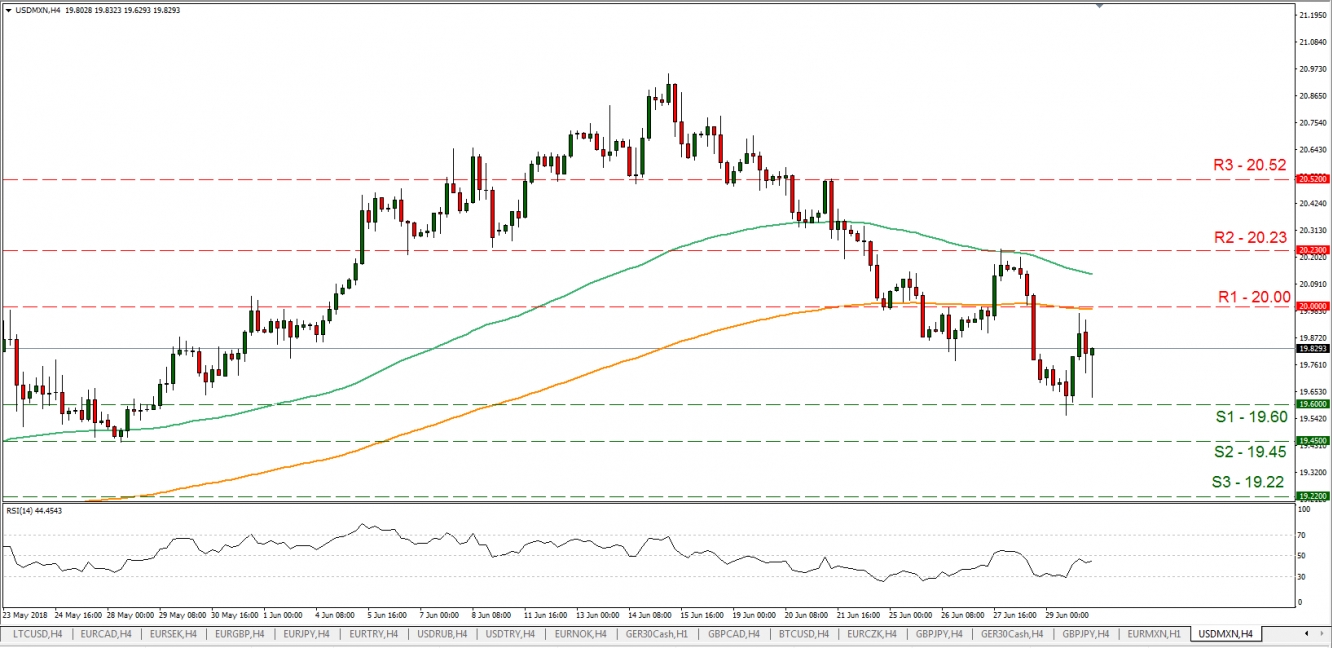

USD/MXN

·Support: 19.60(S1), 19.45(S2), 19.22(S3)

·Resistance: 20.00(R1), 20.23(R2), 20.52(R3)