STATEMENT SUMMARY:

-

RBA lowered the cash rate by 25 basis points to 1.25%

-

Downside risks stemming from the trade disputes have increased

-

Strong employment growth has led to a pick-up in private sector wage growth (yet remain low overall)

-

Lower than expected CPI suggests subdued inflationary pressures across the economy, yet RBA still anticipate it to pick up

-

Adjustments in the established housing markets are continuing

-

Rate of price declines has slowed and auction clearance rates have increased

-

Today’s decision assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target.

-

The Board will continue to monitor developments in the labour market closely

The statement doesn’t imply a need for further easing, although it does reiterate that they’ll continue to monitor developments in the housing market shortly. That said, Lowe is due to speak shortly and the RBA has a history of dropping their easing cues via public comments or interviews, over the actual statement. This likely explains the mediocre reaction from markets, as neither bull or bear feel like they’re out of the woods just yet.

AUD/USD has been helped higher by a weaker US dollar along with news that Australia narrowly escaped Trump’s latest tariffs. Yet now, traders are clearly awaiting Lowe’s cue for its next directional move.

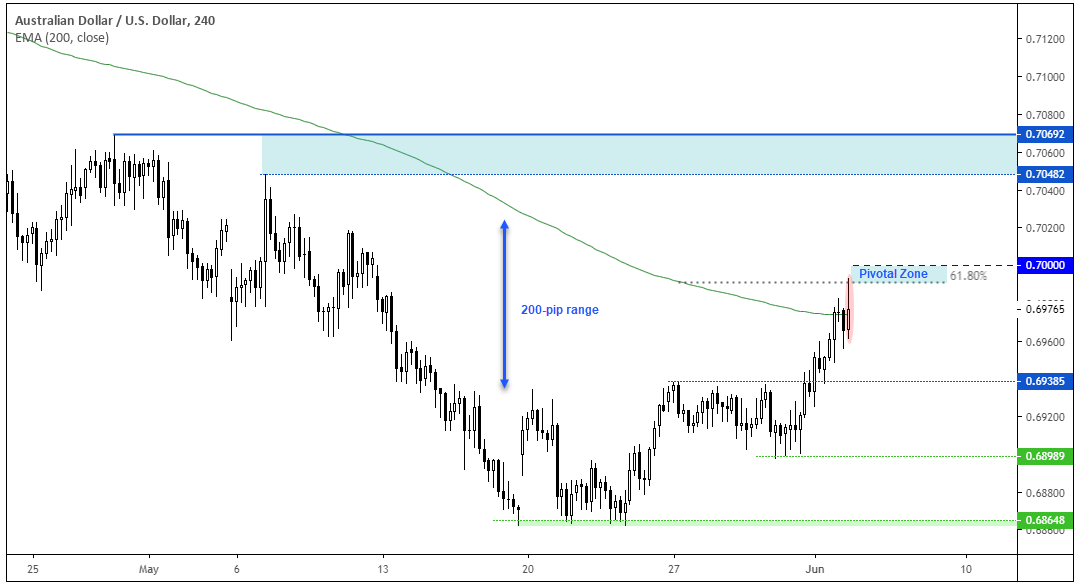

Trading just below 70c, it’s found resistance near the 200-period eMA and 61.8% Fibonacci level, making 0.6990 – 0.7000 a pivotal zone. Furthermore, as it’s trading near the centre of a 200-pip range, it could leave plenty of meat on the bone around this key level depending on how dovish (or not) Lowe is in a few hours.

-

A break above 0.70 opens-up a run for the 0.7048-62 highs

-

If bearish momentum returns below 0.70, bears would eye 0.6938 and 0.6890 as targets whilst it remains within the range.