The calendar is rather interesting this week, with two major central banks holding their monetary policy gatherings: the RBA and the ECB. The former is expected to hike interest rates by 25bps, but due to the overly hawkish expectations for its future course of action, the accompanying statement may be more important.

The ECB is not expected to hike, but due to the increasing best over hikes in July and September, we will look for hints on that front. The US inflation numbers and Canada’s employment data could well shape expectations around the Fed and the BoC, while China’s price figures could prove important for the broader market sentiment.

On Monday, the calendar appears light, with no top-tier data on the schedule, while New Zealand’s and Switzerland’s markets stay closed due to the Queen’s Birthday and the Pentecost, respectively.

On Tuesday, the main item on the agenda may be the RBA interest rate decision. At its latest meeting, this bank decided to hike interest rates by 25bps, to 0.35% from 0.10%, surprising the financial community, which expected a 15bps increase. The bank committed to doing what is necessary to ensure that inflation returns to target over time and explicitly said that this will require a further lift in interest rate over the period ahead.

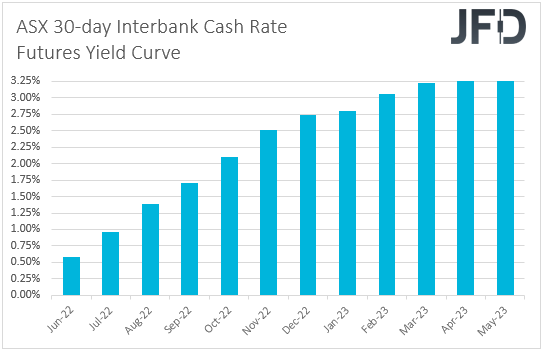

This week, the bank is expected to continue hiking by another 25bps, but this may not be enough with extremely elevated market expectations over officials’ actions. According to the ASX 30-day interbank cash rate futures yield curve, market participants expect another 9 quarter-point hikes by the end of the year.

Thus, for the Aussie to gain, the RBA needs to accompany this increase with very hawkish remarks or even surprise participants again by delivering another larger-than-expected hike. Data since the previous meeting support the notion of the RBA staying hawkish.

The trade data for March and April revealed an increasing surplus, retail sales accelerated by more than expected in Q1, and GDP slowed, but less than the consensus suggested. Only the employment report came on the weak side, but with the unemployment rate staying at 3.9%, the lowest since 1974.

As for the rest of Tuesday’s events, we get the final UK services and composite PMIs for May, but as is usually the case, the final prints are expected to confirm their preliminary estimates. Canada’s trade balance for April is also due to be released, and the forecasts point to an increasing surplus.

Following the nation’s current account balance, which turned positive and marked the widest surplus since the second quarter of 2008, this, combined with a decent employment report on Friday, could keep expectations over more tightening by the BoC elevated, and thereby allow participants to keep buying USD/CAD.

On Wednesday, during the Asian session, Japan releases its final GDP numbers for Q1, with the forecasts suggesting a slight downside revision to -0.3% QoQ from -0.2%. A negative GDP rate is unlikely to alter BoJ officials’ plans to maintain an ultra-loose monetary policy.

Later in the day, we have the UK construction PMI for May, which is expected to have slid fractionally, to 58.0 from 58.2, and the final print of Eurozone’s GDP for Q1, which is expected just to confirm its initial estimates.

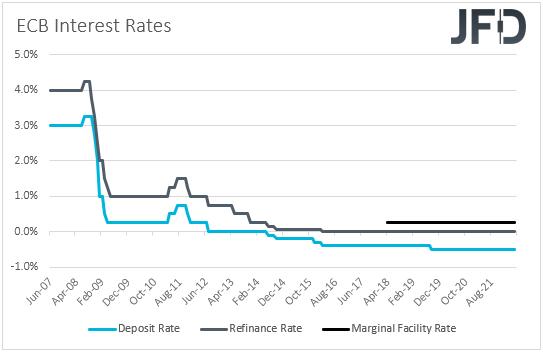

On Thursday, the ECB will make an interest rate decision. Interest rates are not expected to be touched, but we believe this will be a crucial meeting, as it will set the stage for the bank’s next couple of moves.

A couple of weeks ago, President Christine Lagarde said that the ECB is likely to take its deposit facility rate out of the negative territory by the end of September and could lift it further if needed. Given that the deposit rate is at -0.50%, we initially believed this meant two quarter-point liftoffs, one in July and one in September. Some other ECB officials also supported that view.

However, last week, Eurozone’s preliminary CPI data showed that headline inflation accelerated to 8.1% YoY from 7.4%, at a time when the forecast was at 7.7%, while the core rate rose to +3.8% YoY from 3.5%.

This may have sparked speculation of more aggressive action by the ECB, perhaps that the size of the July hike may be 50bps. Even if the officials hike by 25bps in July, they could hint at a bigger increase for September.

A hawkish narrative by policymakers could help the euro recover some more ground, especially against currencies the central banks of which are expected to stay ultra-loose, like the yen.

However, we doubt that it could keep outperforming its US counterpart for long, especially after several Fed officials expressed that they are not supporting a break-in rate hike after summer, at least at the moment and with the data they have in hand.

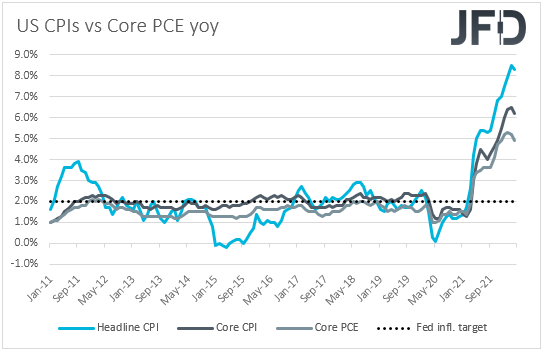

After all, the US economy is in a better shape than the Eurozone, which could allow Fed officials to keep delivering double hikes, despite some worries over a slowdown recently. To start examining the case of stronger advances in EUR/USD, we would like to have convincing evidence that inflation in the US is easing and headed back towards the Fed’s 2% target.

The CPI data on Friday may be a good starting point. If the ECB disappoints, the common currency is likely to come under immediate selling pressure. As for the rest of Thursday’s events, the only data set worth mentioning is China’s trade balance for May, with the surplus expected to have increased to $58.00bn from $51.12bn.

This could be positive for the broader market sentiment, especially amid relaxing COVID-related restrictions in the world’s second-largest economy, especially if Chinese inflation eases on Friday. Finally, on Friday, besides the Chinese inflation data, which we already mentioned, later in the day, we have two more top-tier data sets due to be released, and those are the US CPIs for May and Canada’s unemployment report for the same month.

Getting the ball rolling with the US, the headline rate is expected to have held steady at 8.3% YoY, but the core one is seen declining to +5.9% from 6.2%. This could revive some speculation that the Fed could slow, or indeed pause, its hiking process after summer, but, in our view, it is too early to say with certainty something like that.