Forex News and Events

Japanese and Australian Central banks on hold

There were no surprises from the Reserve Bank of Australia or the Bank of Japan, with both central banks leaving their rates unchanged at 1.5% and -0.1% respectively. Financial markets had already priced in this patient stance and so, no major move occurred in the AUD or JPY.

The BoJ has once again postponed the deadline of reaching its inflation target. The central bank is now forecasting that Japan will hit the inflation target “around fiscal 2018” (from fiscal 2017) which means around March 2018. The BoJ is stating that monetary policy will remain on hold unless a major shock happens.

From our vantage point, there is actually little that the BoJ can do. Consumer activity has not seen any boost over the past few years and the CPI is on its way down. Moreover, it will be difficult for the Japanese central bank to keep its pledge of its asset bond purchase program as there are less and less opportunities.

Relief will come in the form of a December decision from the Fed, which will interest the spread between the US and Japan and as a result lower buying pressures on the yen.

In Australia, the RBA decided to keep rates at 1.5% as labour market data is on the soft side and inflation is mixed. iron ore is also at a six-month high and this should prevent the RBA from cutting. Though AUD/USD has increased since the rate decision, we remain bearish on the pair and believe that demand for USD will increase. Indeed, a US December rate hike is looking very likely.

US inflation keeps running below the Fed target

US data has remained at the centre of the market’s attention over the last few weeks with the Federal Reserve on the verge of tightening its monetary policy before year-end. Economic data has been rather mixed recently as the job market continues to stabilise, while retail sales rebound sharply. The unemployment rate ticked up to 5% in September as the participation rate kept increasing slowly. Private jobs creation edged lower in September, reaching 156k new jobs and below its 6-month moving average.

On the other hand, retail sales ex auto and gas surged in September (+0.3%) after collapsing in August (-0.2%m/m). This improvement augurs well for the end of the year, proving that consumers will gain some momentum ahead of the holiday season. Finally, inflationary pressures remained subdued in September, with the Fed’s favourite measure of inflation, the Core PCE, remaining stable at 1.7%y/y

The preliminary GDP growth figures released last week were more ambiguous. The US economy grew at an annualised pace of 2.9% in Q3, beating the median forecast of 2.6% and 1.4% in the second quarter. The growth rebound came on the back of rising inventories and booming exports.

For the first time since Q1 2015, inventories contributed to growth as it jumped 0.61% in the September quarter. Exports rose 1.17% compared to 0.21% in the previous quarter. On the other hand, personal consumption eased to 1.47% from 2.88% in the June quarter.

Unfortunately, consumer spending has been the key driver in recent quarters with the strength of the dollar weighing on exports and consequently the industrial sectors. Therefore, we believe it will not derail a Fed rate hike in December but will however put a significant drag on monetary tightening next year.

EUR/GBP - Bouncing Within Uptrend Channel

The Risk Today

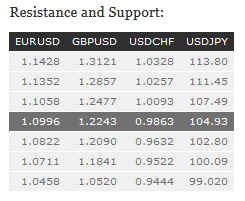

EUR/USD is moving higher. Strong resistance lies at 1.1058 (13/10/2016 high). Key resistance is located far away at 1.1352 (18/08/2016 high). Expected to move higher towards 1.1000. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is trading above 1.2200. However, the medium-term momentum still seems negative. Hourly support is given at 1.2083 (25/10/2016 low) while hourly resistance lies at 1.2329 (11/10/2016 high). Key resistance stands far away at 1.2620 then 1.2873 (03/10/2016). Expected to show continued weakness. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's momentum is positive. Hourly resistance is given at 105.53 (28/10/2016). Next key resistance lies at 107.49 (21/07/2016 high) while hourly support is given at 102.81 (10/10/2016 low). Key support can be found at 100.09 (27/09/2016). We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

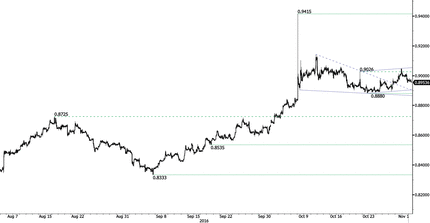

USD/CHF's bullish momentum has ended. The pair has broken uptrend channel. Hourly support is located at 0.9843 (20/10/2016 low) in on target . Stronger support lies at 0.9632 (26/08/2016 base low) while resistance area is given around the parity. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.