Defense major Raytheon Company’s (NYSE:RTN) business segment, Missile Systems, has clinched a modification contract for manufacturing 17 Standard Missile-3 (SM-3) Block IIA missiles. Work related to the deal is expected to be over by March 2020.

Details of the Deal

Valued at $614.5 million, the contract was awarded by the Missile Defense Agency, Dahlgren, VA. Per the terms of the agreement, Raytheon will provide production and engineering support, obsolescence monitoring, technical baseline engineering support as well as render quality assurance for the SM-3 Block IIA missiles. The company will also provide containers for the missiles.

Work will be executed in Tucson, AZ. The company will utilize fiscal 2017 research, development, test and evaluation funds to complete the contract.

A Short Note on SM-3 missiles

The SM-3 is a ship-based missile system used by the U.S. Navy to intercept short- to intermediate-range ballistic missiles as part of Aegis Ballistic Missile Defense System. SM-3 interceptor continues to excel during testing on both land and sea. The program has more than 25 successful space intercepts, and more than 240 interceptors have been delivered to U.S. and Japanese navies.

SM-3 Block IIA, the next-generation variant in the SM-3 family, developed in collaboration with Japan, will be deployable on land as well as on sea. It incorporates larger rocket motors that will allow the interceptor to defend broader areas from ballistic missile threats and a larger kinetic warhead. The Block IIA variant is the centerpiece of the European missile defense system. The program is on track for 2018 deployment on sea and land in Poland.

What’s Favoring Raytheon?

With the increase in cyber-attacks, terrorism threats and geopolitical instability, there is an immediate need of all countries to elevate their level of security and defense. Major defense contractors in the nation like Raytheon, AeroVironment, Inc. (NASDAQ:AVAV) , Orbital ATK, Inc. (NYSE:OA) , Rockwell Collins, Inc. (NYSE:COL) are putting their best effort to make most of this opportunity and expand their business in the country.

In particular, Raytheon’s advanced Missile Systems business segment enables it to win consistent orders from the United States as well as international customers. To this end, in April, the company won a $113.2 million worth contract from the U.S. Navy to provide engineering and technical services for Standard Missile (SM).

Moreover, in late June, the U.S. State Department filed Congressional Notification for a potential deal with Taiwan valued at up to $1.4 billion, approximately half of which Raytheon expects to book within the next 24 months. These programs include the company’s Standard Missile-2s along with a handful of other defense equipment. This emerging opportunity reflects the continued solid demand that Raytheon enjoys in the foreign market, apart from its domestic front.

Based on the 11% sales growth that Missile Systems unit witnessed in the second quarter of 2017 and similar strong performance anticipated ahead, the company expects to observe improved operating margin for this business in the second half of 2017. We believe the recently won award along with similar ones anticipated in the near future will enable the company to achieve its targets for missile business.

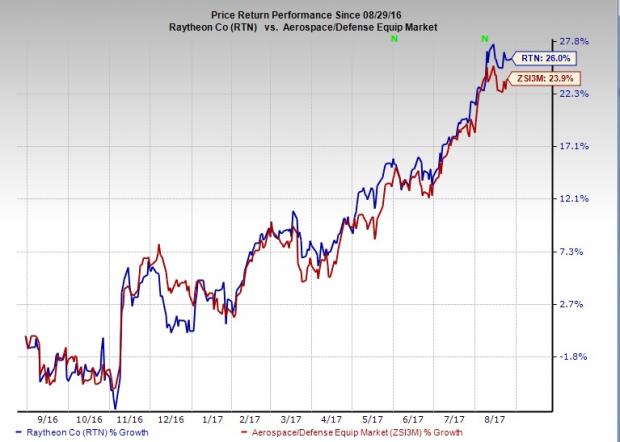

Price Performance

Raytheon’s stock has returned 26% in the last one year, outperforming the 23.9% rally of the industry it belongs to. This might have been driven by its wide range of combat-proven defense products, on account of which the company continues to receive orders from both Pentagon as well as foreign allies of the nation.

Zacks Rank

Raytheon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Orbital ATK, Inc. (OA): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research