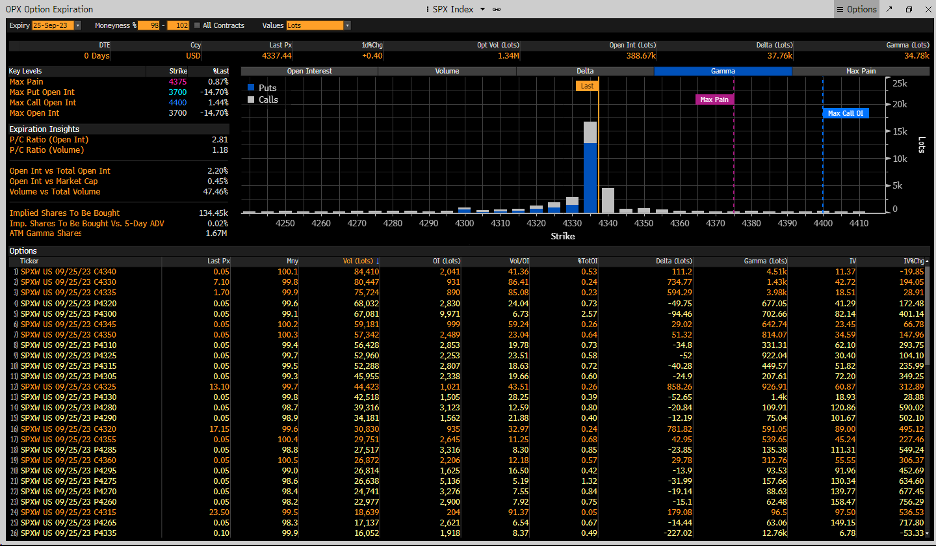

Stocks finished yesterday's session higher, climbing by 40 bps. Most of the gains came in the final minutes. It was clear that the 0-DTE crowd was trying to close the S&P 500 index over the 4,330 level, and accomplished their goal.

The most active options were the 4,330 and 4,440 calls for yesterday's expiration. So it seemed pretty obvious what the driver to the late-day surge was. Additionally, the put wall was at $4300, offering a support level early at the start of the trading day.

The chart clearly shows that the level acted as resistance, and it took a late-day surge to rescue the call option.

I do not think much changed yesterday from a technical perspective as the index was barely changed in the longer-term time frame and it most likely served as a pause day.

10-Year Rate Rallies

The 10-year rate rose sharply, ten bps, a new high for the cycle. At this point, the next level of resistance comes around 4.7%.

20Yr + Bond ETF: Will the Support Hold?

Meanwhile, the 30-year was up 13 bps on the day and closed at 4.66%, which drove the TLT down by 2.5% to close at $89.18. The ETF is coming up on a big level of support at $87.40.

It could go lower from a technical standpoint, but I think that $87.40 would at least in the short term, offer a pretty healthy level of support to slow things down.

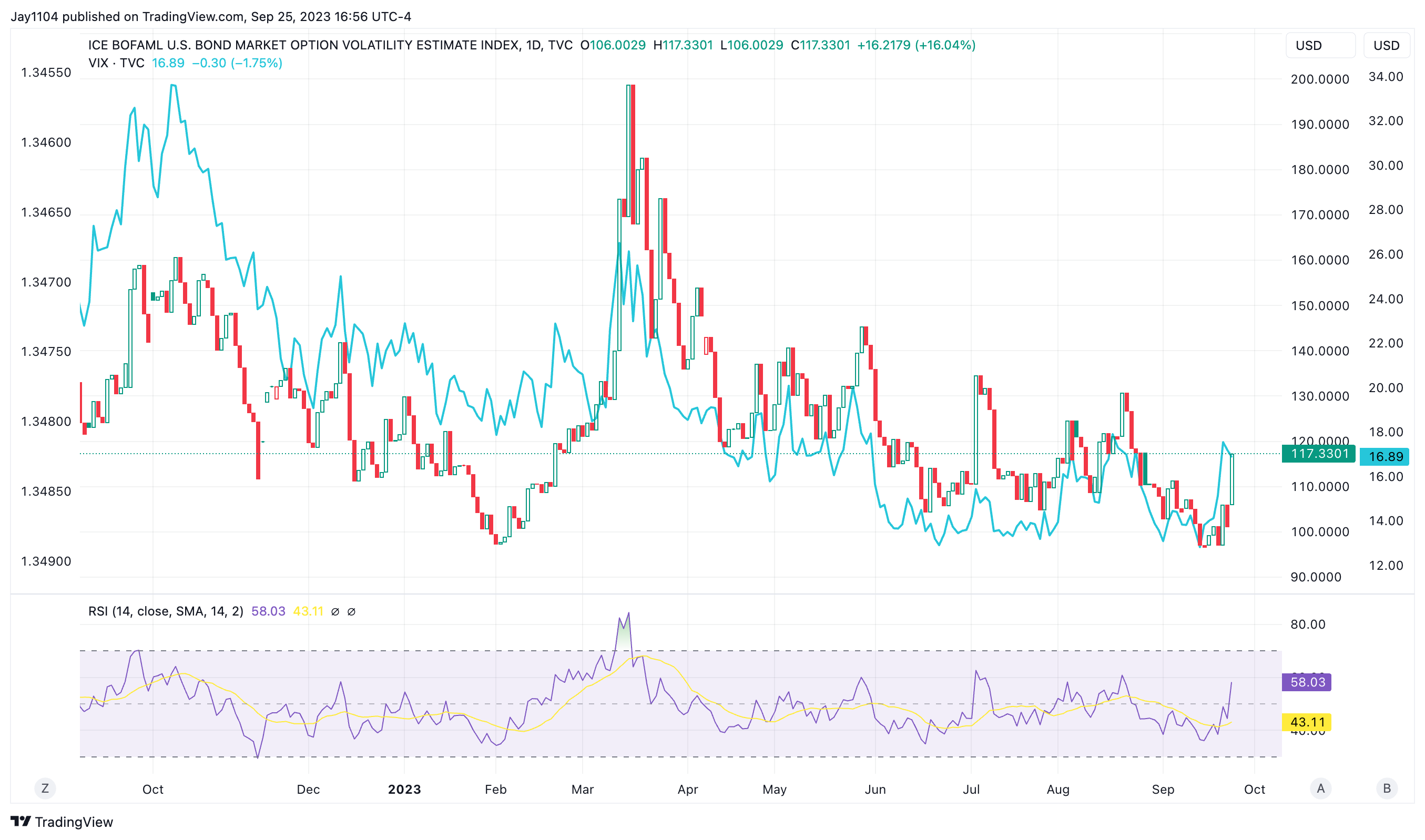

ICE BOFA Bond Market Volatility Index Jumps

This led to a big move higher in the ICE BofAML MOVE index. But despite the big jump in the MOVE index, the VIX index was lower on the day.

We will have to see what today brings. I suspect the selling isn’t finished because rates are up a lot, and the move has been fast. At least for yesterday, the put wall at 4,300 and the 0DTE crowd appear to be enough to save the day.

As we move closer to Friday and the JPM Collar expiration date, I wouldn’t be surprised to see that put wall roll lower towards 4,200, which could open the path to a more significant drop.