September was a down month for the stock market, and market risk has turned decidedly higher. For a number of months, we have seen the S&P 500 grind higher while waning market breadth continued to warn of internal market weakness.

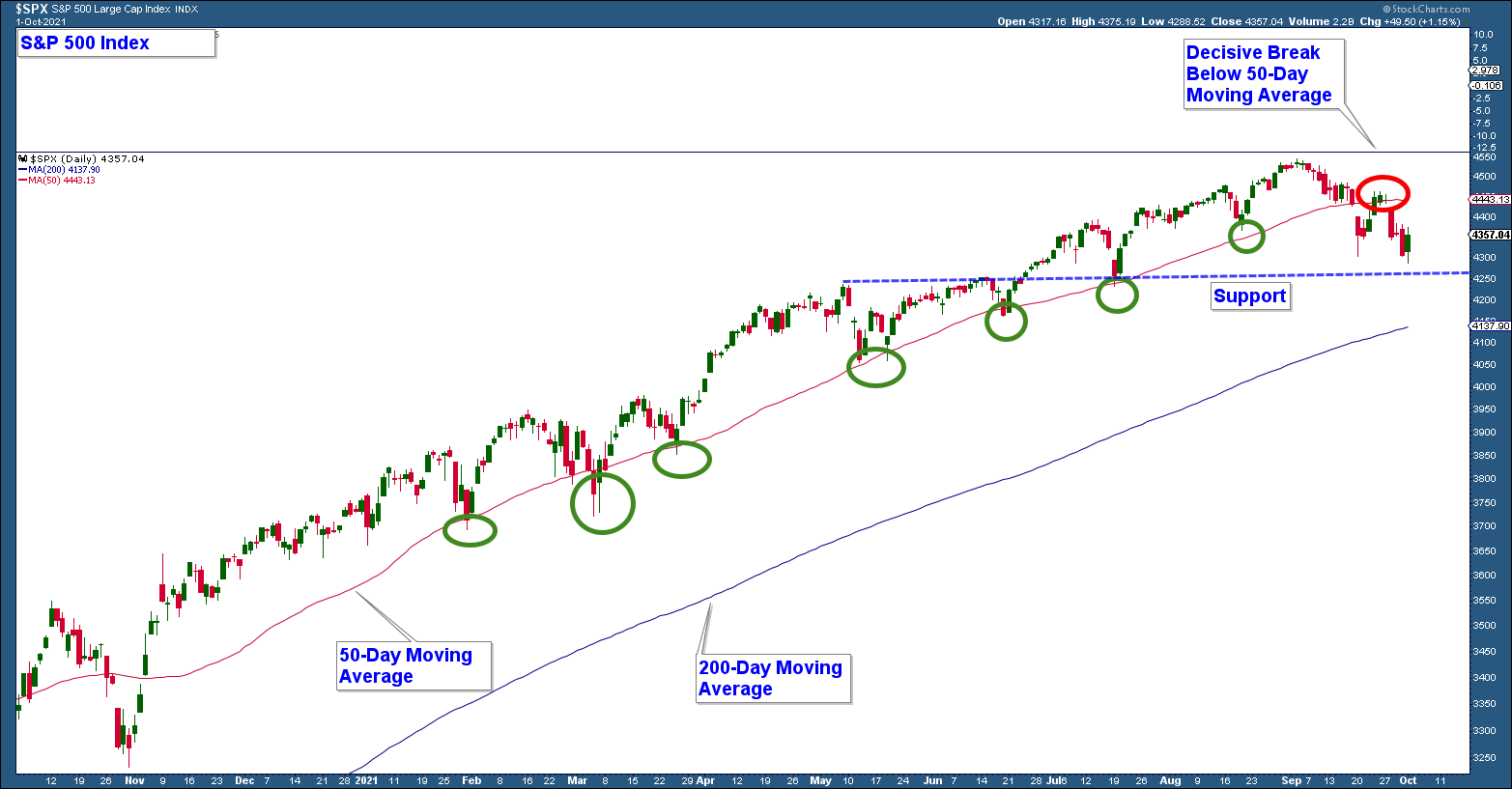

Over the past month, the market finally broke down. Below is a chart of the S&P 500, which has trended higher using its 50-day moving average as support for any minor pullback. That dynamic broke down last month when the index fell decidedly below this moving average. Now, the average is acting as resistance.

The levels that I will be watching as possible areas of support are at about 4260 (notated with the blue horizontal line) and the 200-day moving average. If the index falls below its 200-day moving average (about 5% below Friday’s close) it would be extremely bearish for the market.

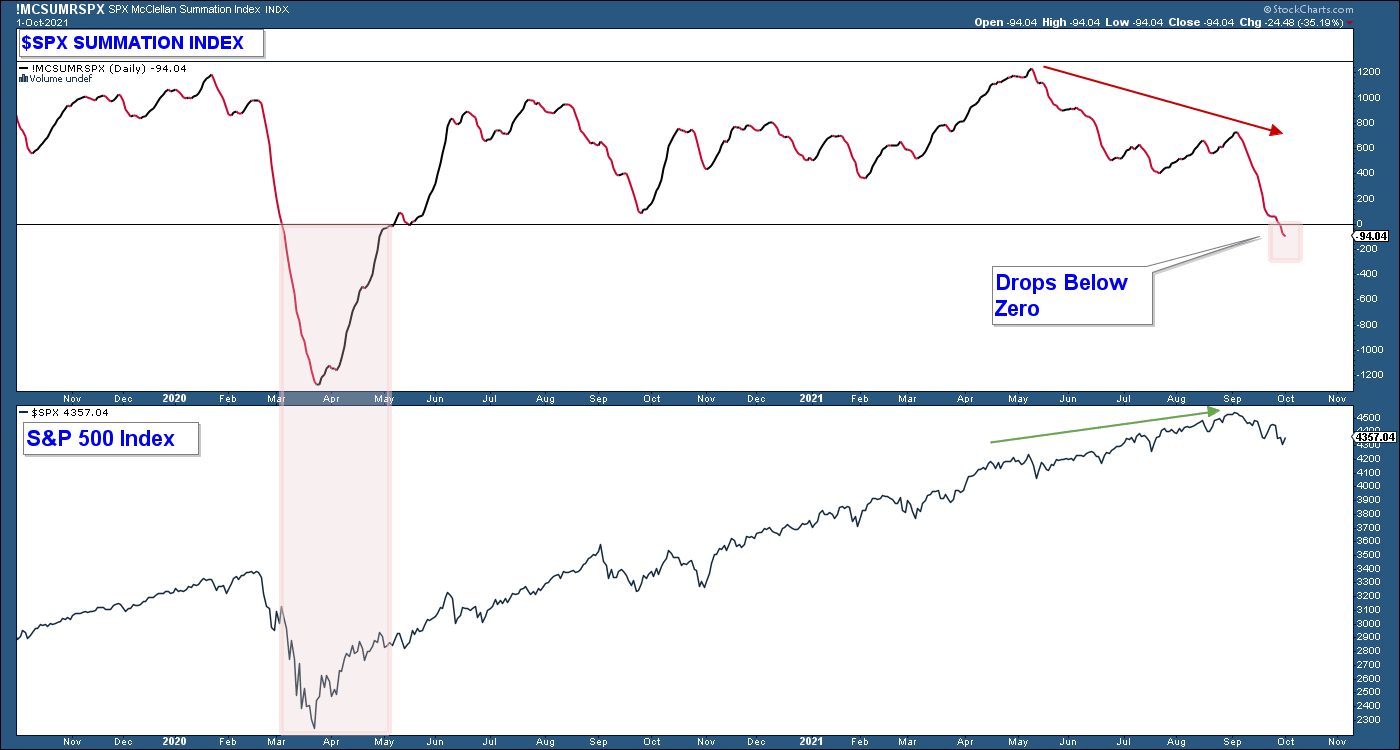

Market Breadth Continues To Deteriorate

Market breadth continues to deteriorate. Major market indexes (that are capitalization-weighted) continue to grind higher, however, the number of stocks that are participating in that advance has been on the decline for months.

Below is a chart of the S&P 500 Summation Index (a market breadth indicator) in the upper panel. Notice how over the past five months the S&P 500 Index has risen as the Summation Index has fallen.

Recent market weakness has pushed the summation into negative territory. I view stock market risk as being severely elevated any time the index falls below zero.

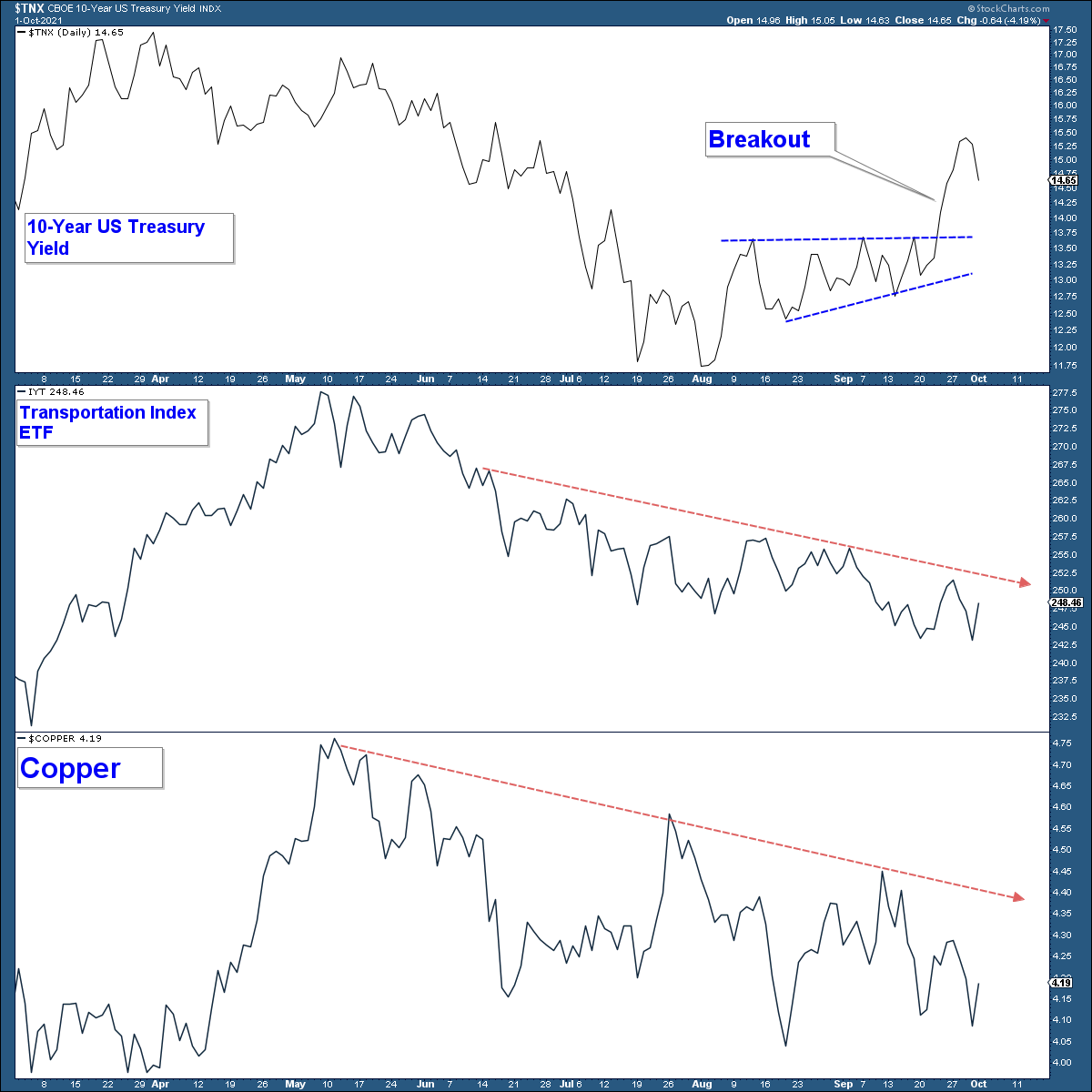

Bond Yields Break Out

Historically, rising bond yields have been bullish for stocks in that it is a sign of economic growth that offers a strong tailwind for the stock market. On the flip side, falling yields can be a sign of weakness and bearish for stocks.

Note in the chart below how yields topped in May, which seems to coincide with the decline in the summation index as well as other breadth indicators.

So, why is the stock market breaking down as rates are rising? Shouldn’t rising yields be a welcome sign for stock investors?

If rising rates were being driven by economic strength, I would expect to see transportation stocks and copper (both of which are economically sensitive) to be advancing. Notice in the chart below how they have been falling for months. The recent advance in rates was not accompanied by corresponding strength in those areas that typically benefit from economic strength.

I believe investors see the rise in rates as being driven mainly by inflation – not economic strength. This combined with a Fed that has turned hawkish has the market worried.

If this dynamic doesn’t change soon, it could create more downside for stocks.