Rates – May 31

The German 10-Year is now trading at its lowest level ever -20bps.

But more interesting is that spread between the US and German Bonds have now fallen below key support at 2.4%, and that means the spread will fall further to around 2.25%. That means US 10-Year Bonds could fall another 10-15 bps. That would take it to 2-2.05%.

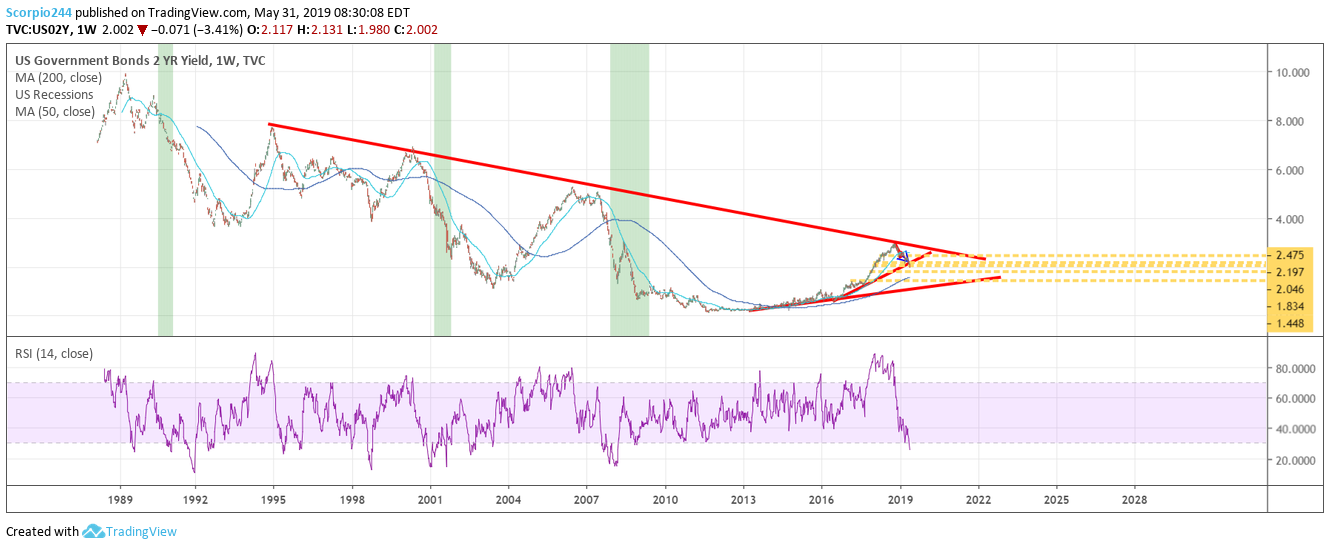

But perhaps more important is that the 2-Year needs to hold at 2%, or the 2-Year is falling a long way, to like 1.8% or perhaps even further to 1.45%.

Sometimes long term downtrends are just too difficult to overcome.

Another Day Another Worry

Stocks are falling on May 31 on the news overnight about the pending tariffs with Mexico. If anything things are never boring, and continually testing your resolve as too much how much you are willing to withstand.

S&P 500 (SPY)

You can see in the E-mini S&P 500 futures is dropping on May 31; the index is falling below the lows on May 29. Should the S&P 500 open below 2,768, it will be a bad sign. That level will now act as resistance. So let’s hope support at 2,768 holds at the open.

Autos

Obviously, tariffs for Mexico will be terrible news for the likes of GM and Ford. While GM will claim it hurts American jobs and makes it more expensive for consumers, they have no leg to stand on. Trump will fire back, open that plant in Ohio you just closed, bring your jobs back to the US.

GM (GM)

General Motors Company (NYSE:GM) fell below support at $34.60 and now is at risk of falling even further to $32.16.

Ford (F)

Ford Motor Company (NYSE:F) is also hovering at support at $9.30 and could be on its way to around $9.

Intel (INTC)

I will be watching the Semi stocks closely, to see how the group responds to the broader market weakness. It will tell us if they are bottoming out or not.

Intel Corporation (NASDAQ:INTC) is the one to watch and that stock has held firmly around $43.

Apple (AAPL)

Apple Inc (NASDAQ:AAPL) will also need to be watched closely on May 31. I’m waiting for support at $175.

Biotech (XBI)

Finally, Biotech is the last one to watch. The XBI continues to hold support at $80. We do not want to see that break.