Street Calls of the Week

Last week, the Dow Jones Industrial Average (DJI) notched a weekly gain of 1.57%, thanks to a strong stretch for blue-chip stocks. While the Nasdaq Composite (IXIC) tagged an all-time high on Wednesday, July 25, the index ended in the red for the week -- down 1.06% -- due to a rough round of earnings reactions in the tech and social media sectors. This divergence between the Dow and the Nasdaq sent up a signal we've seen just one other time in the last decade.

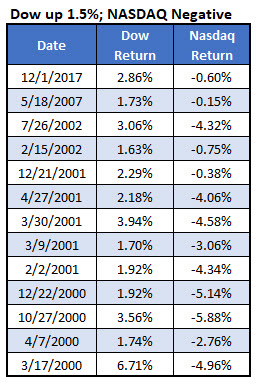

Similar Skew During Dot-Com Bubble Deflation

The last time the DJI was up 1.5% or more on the week at the same time the Nasdaq was negative for the week was in early December 2017. Prior to that, you'd have to go back to May 2007 for a signal, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Further, the last time the Dow was up 1.5% and the Nasdaq was down more than 1% in the same week was in July 2002, when the dot-com bubble was deflating.

Stocks Tend to Slide After Signals

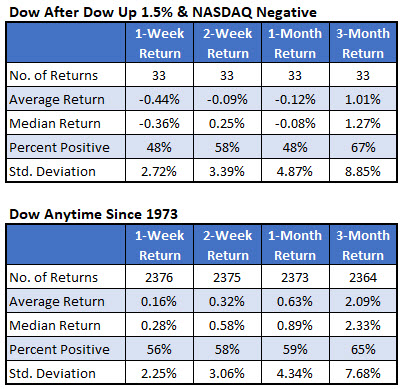

Since 1973, there have been 33 of these signals, after which both indexes have tended to underperform. One week, two weeks, and one month later, the DJI was in the red, on average, compared to average anytime gains. Three months later, the Dow was up just 1.01% -- not even half its average anytime three-month gain of 2.09%.

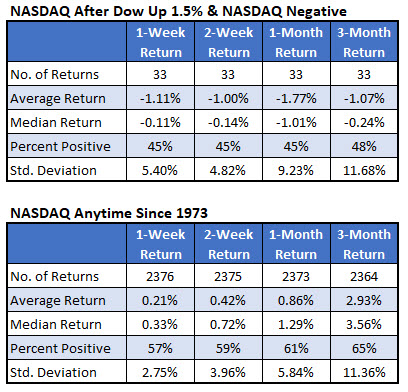

Meanwhile, weakness tends to beget weakness for the Nasdaq. The tech-rich index was in the red at all four of the aforementioned checkpoints, and higher no more than 48% of the time. Most notably, the IXIC was down 1.77% one month after signals, compared to an average anytime gain of 0.86%.

Earnings, Fed Could Move Stocks

In conclusion, if past is prologue, both stock market indexes could suffer in the short term. In fact, so far today, both benchmarks are in the red, with the Nasdaq down more than 1% at midday on FAANG stock weakness. However, the market's trajectory will likely be determined by the next spate of earnings reports -- including Apple's (NASDAQ:AAPL) release, expected after the close on Tuesday, July 31 -- as well as the Federal Open Market Committee (FOMC) meeting decision on Wednesday, Aug. 1.