Market Brief

It will be a light week in terms of economic data with very few indicators due for release over the next five days. Even the BoJ and Fed meetings taking place on Thursday and Wednesday respectively are expected to be non-events. Both central banks are expected to keep their respective monetary policies unchanged after a turbulent first quarter.

In spite of the recent JPY appreciation, we do not expect the BoJ to announce a new set of measures just yet. During the second half of the month of April, USD/JPY trimmed losses and returned above the 110 threshold. The pair rose almost 4% but tumbled over the 112 resistance implied by its 50dma before stabilising at around 111.15. Looking at the one-month 25 delta risk reversal, it seems that the market sees limited downside potential in USD/JPY as the gauge rose to -0.60% on Friday from -2.75% in February.

The Federal Reserve should keep its federal fund rate target of between 0.25% and 0.5%. There will be no press conference after the release of the decision, only a statement. Investors will therefore be strongly focused on the statement, hoping to get some hint regarding a potential rate hike in June. However, we expect that the Fed will remain very cautious in order to avoid any further dollar strength. Indeed, the recent dollar weakness helped financial assets and commodities to exhibit solid gains as the risk sentiment stabilised. However, the USD has bottomed out with the dollar index being unable to move below the 94 threshold. In EUR/USD, the pair consolidated slightly above the 1.12 level. In our opinion, further dollar weakness is very unlikely in the absence of significant news. Dollar bulls are just waiting for the smallest signal from Yellen before loading long USD positions.

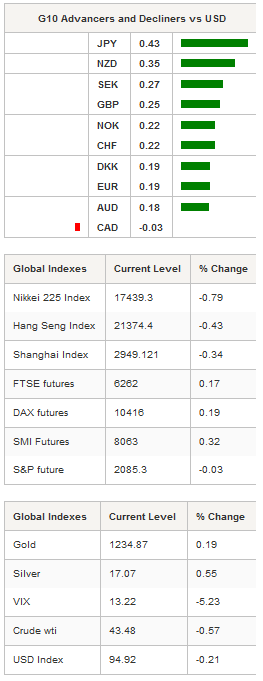

In Asia, crude oil stabilised with the West Texas Intermediate edging down 0.57% to $43.48, while the Brent slid 0.31% to $44.97. Precious metal were also blinking green on the screen with gold rose 0.19%, silver 0.55% and platinum 0.6%. In such an environment, AUD/USD rose 0.18% to 0.7721, while the kiwi was up 0.35% to 0.6875. This small rally in commodity currencies is rather due to the dollar weakness ahead of Wednesday FOMC meeting than a reaction to commodity prices.

On the equity market, Asian regional markets were broadly trading in negative territory. Japanese shares fell 0.76%. In mainland China, the CSI 300 slipped 0.45%, while in Hong Kong the Hang Seng edged down 0.43%. In Europe, equity futures are blinking green for now. Nevertheless, given the few buyers on the market, we wouldn’t be surprised to see equities moving back and forth over the flatline.

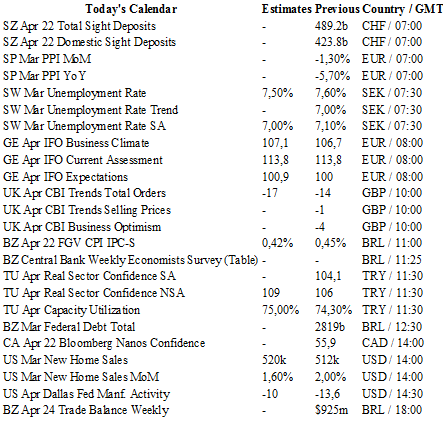

Today traders will be watching total sight deposits from Switzerland; the unemployment rate from Sweden; IFO business climate from Germany; capacity utilization from Turkey; new home sales and Dallas Fed manufacturing gauge; Brazil’s weekly trade balance.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1240

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4668

R 1: 1.4514

CURRENT: 1.4412

S 1: 1.4132

S 2: 1.4006

USD/JPY

R 2: 113.80

R 1: 112.68

CURRENT: 111.30

S 1: 107.63

S 2: 105.23

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9766

S 1: 0.9476

S 2: 0.9259