With the recent resurgence in the US indices and the potential new leg up in the 2009 bull market, we took a look at the foreign indices we track. The objective was to find indices that had dramatic selloffs during 2015-2016, and appear to have completed bear markets. Of the twenty indices we track, three in particular look the best longer term.

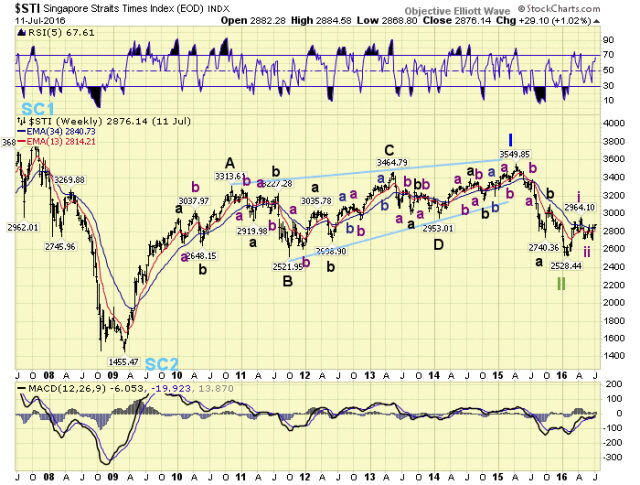

Singapore had a terrific advance between 2009 and 2010, rising about 150%. Then for the next five years it formed a diagonal triangle which ended in early 2015. The 2015-2016 bear market took the STI within 6 points of the B wave low in 2011. A classic retracement.

At the low, the monthly, weekly and daily charts displayed positive divergences. Off the February 2016 low the STI rallied in five waves, then formed a flat correction. It recently confirmed a new uptrend.

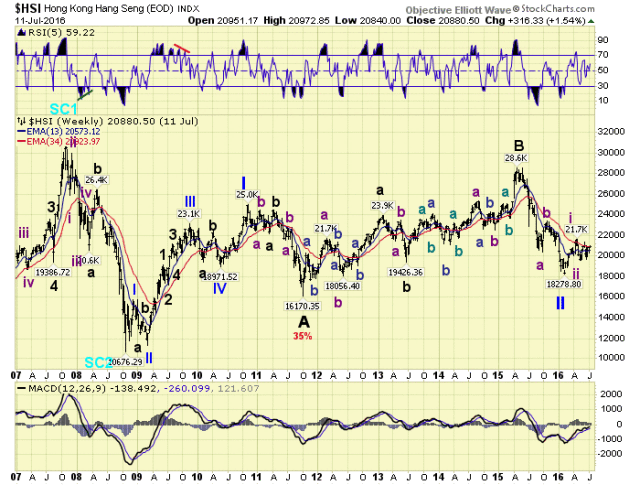

Hong Kong formed a much different pattern after its 150% rise from 2008-2010. It declined in an A wave into a 2011 low, rallied in a corrective B wave into a 2015 high, then dropped in a C wave into its recent February low.

The C wave did not fully retrace back to the A wave low, so it looks like a failed C. At that low its also had positive divergences on its monthly, weekly and daily charts. It then impulsed higher in 5 waves into April, corrected into May, and is currently in an uptrend.

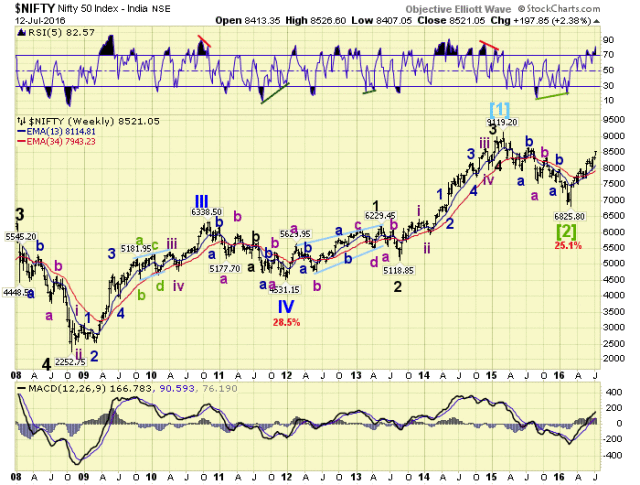

India has had two bull markets and two bear markets since its 2008 low. It nearly tripled in two years during the first bull, dropped 29%, then more than doubled again during the second bull market.

During the recent bear market it dropped 25%, made a low in February, and has been in an uptrend ever since. This uptrend looks similar to the third waves in each of the bull markets. This suggests that, since it is only a first wave, a potential big move is underway.