The picture emerging from the 2014 Q4 earnings season at this admittedly early stage is one of weakness, with earnings and revenue growth rates tracking below levels that we have been seeing in other recent periods. But weak results from the Finance sector has an outsized effect on the aggregate earnings picture results at this stage. We don’t have as representative a sample of results outside of the Finance sector, but the picture isn’t that bad once Finance is excluded from the aggregate picture. That said, revenues are on the weak side, whether looked at with or without the Finance sector.

The rest of this week is the busiest of this reporting cycle thus far, with 37 S&P 500 members reporting Q4 results in the next three days. The reporting cycle really accelerates next week, with more than 140 S&P 500 members coming out with results. This week’s reporting docket is comprised of a diverse group of operators, ranging from General Electric (NYSE:GE- Analyst Report) to Starbucks (NASDAQ:SBUX - Analyst Report) and Verizon Communications (NYSE:VZ - Analyst Report).

The Q4 Scorecard (as of 1/20/2015)

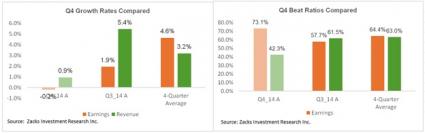

We have seen Q4 results from 52 S&P 500 members that combined account for 16.3% of the index’s total market capitalization. Total earnings for these companies are down -0.2% from the same period last year, with 73.1% beating EPS estimates. Total revenues are up +0.9% from the same period last year and 42.3% of them are coming ahead with top-line estimates.

The table below shows the current scorecard for the S&P 500 index

This is weak performance than we have seen from the same group of companies in other recent quarters. The charts below compare the Q4 growth rates and beat ratios for these 52 companies with what we had seen from the same group of companies in other recent quarters. As you can see, the earnings and revenue growth rates are weaker than what we have been seeing in other recent quarters. With respect to positive surprises, they are more numerous for earnings and less so for revenues.

The charts below compare the results thus far with what we have seen from the same group of companies in 2014 Q3 and the average for the preceding four quarters.

Finance has the most weightage in the results thus far, with Q4 reports from 36.8% of the sector’s total market capitalization already out. Total earnings for these Finance sector companies are down -10.5% on -3.9% lower revenues, with 64.3% beating EPS estimates and only 28.6% coming ahead of top-line expectations. This is the weakest performance that we have seen from these Finance sector companies in other recent quarters, thanks to tough comparisons at Citigroup (NYSE:C - Analyst Report) and J.P. Morgan (NYSE:JPM- Analyst Report). Had it not been for Citigroup and J.P. Morgan, the Finance sector earnings would be up +2.3% from the same period last year.

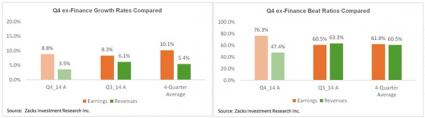

Keeping the Finance sector out of the results thus far, total earnings for the rest of the S&P 500 companies are up +8.8% on +3.5% higher revenues, which is actually better than what we have seen from the same group of ex-Finance companies in other recent quarters.

The charts below present the aggregate data thus far on an ex-Finance basis

What this shows is that the Q4 growth rate would be a lot better had it not been for the drag from the Finance. That said, the growth rates would still be on the weaker side relative to other recent quarters – the Q4 ex-Finance earnings growth rate is better than Q3, but below what these same companies reported on average in the preceding four quarters. The revenue growth rate is weak relative to Q3 as well as the 4-quarter average.

The Composite Q4 Picture

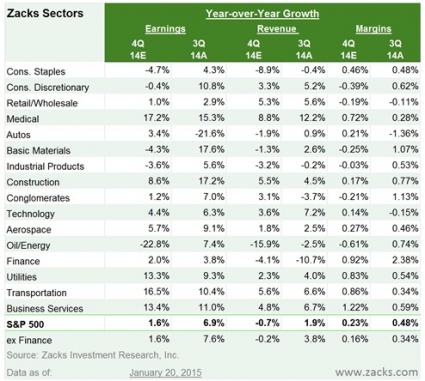

Combining the actual results for the 52 S&P 500 companies that have reported with the 448 still-to-come reports, total Q4 earnings are expected to be up +1.6% on -0.7% lower revenues.

Four sectors – Transportation, Medical, Utilities and Business Services –are expected to have double-digit earnings growth in Q4, while five sectors are expected to have lower total earnings this quarter relative to the year-earlier period. The Energy sector has the weakest growth profile for understandable reasons, with total earnings for the sector expected to be down -22.8% on -15.9% lower revenues.

The table below presents the summary picture for Q4 contrasted with what companies actually reported in the Q3 earnings season.

Falling Estimates

Estimates for the current period (2015 Q1) have started coming down at an accelerated pace, with total earnings for the quarter now expected to be up +1.3%, down from the +4% growth rate expected in mid-December. As was the case in Q4, Energy is the biggest driver of this negative revisions trend.

While total Q1 earnings for the energy sector were expected to be down (only) -35.6% in mid-December, they are now expected to be -52.4% year over year. Given the persistently weak oil prices, there is likely more room for downward adjustments to these estimates. Estimates for Q4 went through an even sharper negative revision process, though almost half of the drop in estimates was due to developments in the energy sector.

The Q4 energy sector results that we have seen thus far are fairly strong, with total earnings for the 11.5% of the sector’s market capitalization that have reported results are up +25.1% on +10.4% higher revenues. But this growth picture will look very different once the major oil companies come out with Q4 results in the coming days.

Here is a list of the 152 companies reporting this week, including 48 S&P 500 members.

| Company | Ticker | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time |

| THOMPSON CREEK | TC | 0.02 | -0.17 | 112.5 | Monday | AMC |

| FIRST DEFIANCE | FDEF | 0.56 | 0.5 | 33.96 | Monday | AMC |

| HALLIBURTON CO | HAL | 1.12 | 0.93 | 8.18 | Tuesday | BTO |

| BAKER-HUGHES | BHI | 1.08 | 0.62 | -11.3 | Tuesday | BTO |

| REGIONS FINL CP | RF | 0.21 | 0.22 | 4.76 | Tuesday | BTO |

| ALLEGHENY TECH | ATI | 0 | -0.08 | 100 | Tuesday | BTO |

| INTL BUS MACH | IBM | 5.43 | 6.13 | -14.42 | Tuesday | AMC |

| M&T BANK CORP | MTB | 1.94 | 1.61 | -2.02 | Tuesday | BTO |

| JOHNSON & JOHNS | JNJ | 1.25 | 1.24 | 5.63 | Tuesday | BTO |

| MORGAN STANLEY | MS | 0.49 | 0.5 | 42.59 | Tuesday | BTO |

| NETFLIX INC | NFLX | 0.44 | 0.79 | 5.49 | Tuesday | AMC |

| CA INC | CA | 0.56 | 0.8 | 5.08 | Tuesday | AMC |

| DELTA AIR LINES | DAL | 0.75 | 0.65 | 1.69 | Tuesday | BTO |

| UNILEVER PLC | UL | N/A | N/A | N/A | Tuesday | BTO |

| UNILEVER N V | UN | N/A | N/A | N/A | Tuesday | BTO |

| SAP AG ADR | SAP | 1.4 | 1.62 | 13.83 | Tuesday | BTO |

| MERCANTILE BANK | MBWM | 0.4 | 0.63 | -2.44 | Tuesday | BTO |

| ADV MICRO DEV | AMD | 0 | 0.06 | -25 | Tuesday | AMC |

| FIRST MIDWST BK | FMBI | 0.24 | 0.26 | -3.85 | Tuesday | AMC |

| NOVOZYMES A/S | NVZMY | 0.31 | 0.31 | -2.86 | Tuesday | |

| IGATE CORP | IGTE | 0.5 | 0.45 | 4.35 | Tuesday | BTO |

| PETMED EXPRESS | PETS | 0.25 | 0.23 | -9.52 | Tuesday | BTO |

| OMNOVA SOLUTION | OMN | 0.08 | 0.12 | -70.59 | Tuesday | BTO |

| NEW ORIENTAL ED | EDU | 0.08 | 0.03 | -14.46 | Tuesday | BTO |

| PINNACLE FIN PT | PNFP | 0.53 | 0.44 | 1.96 | Tuesday | AMC |

| WOODWARD INC | WWD | 0.47 | 0.34 | 1.32 | Tuesday | AMC |

| ADTRAN INC | ADTN | 0.07 | 0.21 | 0 | Tuesday | AMC |

| CREE INC | CREE | 0.11 | 0.34 | -45.83 | Tuesday | AMC |

| SOUTHWEST BC-OK | OKSB | 0.21 | 0.34 | 35 | Tuesday | AMC |

| PREFERRED BANK | PFBC | 0.47 | 0.44 | 4.55 | Tuesday | AMC |

| CELESTICA INC | CLS | 0.21 | 0.21 | 15 | Tuesday | AMC |

| SUPER MICRO COM | SMCI | 0.43 | 0.3 | 23.53 | Tuesday | AMC |

| SERVISFIRST BCS | SFBS | 0.54 | 0.53 | 3.85 | Tuesday | AMC |

| FULTON FINL | FULT | 0.21 | 0.22 | 5 | Tuesday | AMC |

| RENASANT CORP | RNST | 0.49 | 0.4 | 2.08 | Tuesday | AMC |

| INTERACTIVE BRK | IBKR | 0.05 | 0.07 | -78.26 | Tuesday | AMC |

| MGIC INVSTMT CP | MTG | 0.14 | -0.01 | 63.64 | Tuesday | BTO |

| SANDISK CORP | SNDK | 1.15 | 1.6 | 9.17 | Wednesday | AMC |

| FIFTH THIRD BK | FITB | 0.42 | 0.43 | 0 | Wednesday | BTO |

| XILINX INC | XLNX | 0.6 | 0.55 | 12.73 | Wednesday | AMC |

| EBAY INC | EBAY | 0.78 | 0.71 | 1.75 | Wednesday | AMC |

| CROWN CASTLE | CCI | 0.31 | N/A | 7.41 | Wednesday | AMC |

| US BANCORP | USB | 0.77 | 0.76 | 0 | Wednesday | BTO |

| NORTHERN TRUST | NTRS | 0.8 | 0.75 | -3.45 | Wednesday | BTO |

| AMPHENOL CORP-A | APH | 0.59 | 0.52 | 1.75 | Wednesday | BTO |

| AMER EXPRESS CO | AXP | 1.38 | 1.25 | 1.45 | Wednesday | AMC |

| DISCOVER FIN SV | DFS | 1.3 | 1.23 | 2.24 | Wednesday | AMC |

| UTD RENTALS INC | URI | 2.06 | 1.59 | 7.32 | Wednesday | AMC |

| UNITEDHEALTH GP | UNH | 1.5 | 1.41 | 6.54 | Wednesday | BTO |

| F5 NETWORKS INC | FFIV | 1.22 | 0.89 | 5.74 | Wednesday | AMC |

| NAVIENT CORP | NAVI | 0.53 | N/A | 1.96 | Wednesday | AMC |

| ASML HOLDING NV | ASML | 0.64 | 1.46 | 1.43 | Wednesday | BTO |

| TEXAS CAP BCSHS | TCBI | 0.78 | 0.67 | 4 | Wednesday | AMC |

| RAYMOND JAS FIN | RJF | 0.87 | 0.81 | 8.05 | Wednesday | AMC |

| SLM CORP | SLM | 0.05 | 0.61 | 0 | Wednesday | AMC |

| TD AMERITRADE | AMTD | 0.4 | 0.35 | 5.56 | Wednesday | BTO |

| PAC PREMIER BCP | PPBI | 0.29 | 0.25 | 6.9 | Wednesday | BTO |

| UTD CMNTY BK/GA | UCBI | 0.3 | 0.22 | 0 | Wednesday | BTO |

| SQUARE 1 FIN-A | SQBK | 0.3 | N/A | 20.83 | Wednesday | BTO |

| EAST WEST BC | EWBC | 0.65 | 0.55 | 3.33 | Wednesday | AMC |

| BOSTON PRIV FIN | BPFH | 0.22 | 0.2 | -4.76 | Wednesday | AMC |

| CVB FINL | CVBF | 0.24 | 0.24 | 0 | Wednesday | AMC |

| DOLBY LAB INC-A | DLB | 0.38 | 0.48 | 54.84 | Wednesday | AMC |

| EAGLE BCP INC | EGBN | 0.5 | 0.45 | 1.96 | Wednesday | AMC |

| COMMNTY BK SYS | CBU | 0.58 | 0.54 | 5.36 | Wednesday | AMC |

| PLEXUS CORP | PLXS | 0.71 | 0.61 | 0 | Wednesday | AMC |

| BRIGGS & STRATT | BGG | 0.14 | 0.05 | 43.24 | Wednesday | AMC |

| OLD SECOND BCP | OSBC | 0.05 | -0.08 | 20 | Wednesday | AMC |

| NVE CORP | NVEC | 0.71 | 0.57 | 6.67 | Wednesday | AMC |

| TRUSTCO BK -NY | TRST | 0.11 | 0.11 | 10 | Wednesday | AMC |

| SGS SA ADR SWIZ | SGSOY | N/A | N/A | N/A | Wednesday | |

| BANCORPSOUTH | BXS | 0.31 | 0.29 | -3.03 | Wednesday | AMC |

| CATHAY GENL BCP | CATY | 0.45 | 0.4 | 0 | Wednesday | AMC |

| PACIFIC CONTL | PCBK | 0.23 | 0.2 | 4.17 | Wednesday | AMC |

| COHEN&STRS INC | CNS | 0.49 | 0.43 | -13.04 | Wednesday | AMC |

| BANNER CORP | BANR | 0.64 | 0.6 | 24.59 | Wednesday | AMC |

| LOGITECH INTL | LOGI | 0.31 | 0.32 | 55.56 | Wednesday | AMC |

| CAPITAL ONE FIN | COF | 1.73 | 1.48 | 1.04 | Thursday | AMC |

| BB&T CORP | BBT | 0.73 | 0.72 | 0 | Thursday | BTO |

| KEYCORP NEW | KEY | 0.26 | 0.26 | 0 | Thursday | BTO |

| VERIZON COMM | VZ | 0.73 | 0.66 | -3.26 | Thursday | BTO |

| HUNTINGTON BANC | HBAN | 0.19 | 0.19 | 5.26 | Thursday | BTO |

| JOHNSON CONTROL | JCI | 0.77 | 0.69 | 2.97 | Thursday | BTO |

| PRECISION CASTP | PCP | 3.41 | 2.95 | -1.52 | Thursday | BTO |

| UNION PAC CORP | UNP | 1.51 | 1.27 | 1.32 | Thursday | BTO |

| STARBUCKS CORP | SBUX | 0.8 | 0.71 | 0 | Thursday | AMC |

| E TRADE FINL CP | ETFC | 0.23 | 0.2 | 31.82 | Thursday | AMC |

| KLA-TENCOR CORP | KLAC | 0.51 | 0.85 | 2.17 | Thursday | AMC |

| INTUITIVE SURG | ISRG | 3.39 | 4.28 | 20.9 | Thursday | AMC |

| COVIDIEN PLC | COV | 1.03 | 1 | 13.86 | Thursday | |

| TRAVELERS COS | TRV | 2.51 | 2.68 | 18.64 | Thursday | BTO |

| ALTERA CORP | ALTR | 0.35 | 0.31 | 2.7 | Thursday | AMC |

| SOUTHWEST AIR | LUV | 0.54 | 0.33 | 3.77 | Thursday | BTO |

| NATL PENN BCSHS | NPBC | 0.17 | 0.17 | 0 | Thursday | BTO |

| BANKUNITED INC | BKU | 0.44 | 0.5 | 15.91 | Thursday | BTO |

| HANCOCK HLDG CO | HBHC | 0.58 | 0.55 | 1.72 | Thursday | AMC |

| CDN PAC RLWY | CP | 2.25 | 1.72 | -8.11 | Thursday | BTO |

| FNB CORP | FNB | 0.21 | 0.21 | 0 | Thursday | BTO |

| FAIRCHILD SEMI | FCS | 0.15 | 0.11 | 33.33 | Thursday | BTO |

| AVNET | AVT | 1.2 | 1.17 | 5.15 | Thursday | BTO |

| SANDY SPRING | SASR | 0.43 | 0.38 | 0 | Thursday | BTO |

| POPULAR INC | BPOP | 0.48 | 0.71 | 13.04 | Thursday | BTO |

| GATX CORP | GMT | 1.26 | 1.14 | -1.72 | Thursday | BTO |

| QUALITY SYS | QSII | 0.13 | 0.1 | -7.69 | Thursday | BTO |

| SIMMONS FIRST A | SFNC | 0.65 | 0.48 | 5 | Thursday | BTO |

| TAL EDUCATN-ADR | XRS | 0.14 | 0.15 | 0 | Thursday | BTO |

| FLAGSTAR BANCP | FBC | 0.15 | -0.7 | -114.29 | Thursday | BTO |

| NETSCOUT SYSTMS | NTCT | 0.46 | 0.45 | 17.86 | Thursday | BTO |

| OLD REP INTL | ORI | 0.25 | 0.33 | 0 | Thursday | BTO |

| DELUXE CORP | DLX | 1.1 | 1.04 | 4.04 | Thursday | BTO |

| TRAVELZOO INC | TZOO | 0.02 | 0.21 | -83.33 | Thursday | BTO |

| CITY NATIONAL | CYN | 1.12 | 1 | 7.48 | Thursday | AMC |

| ASSOC BANC CORP | ASB | 0.3 | 0.28 | 3.33 | Thursday | AMC |

| MAXIM INTG PDTS | MXIM | 0.29 | 0.36 | 2.7 | Thursday | AMC |

| CELANESE CP-A | CE | 1.18 | 1.04 | 11.81 | Thursday | AMC |

| SVB FINL GP | SIVB | 1.29 | 1.27 | -1.61 | Thursday | AMC |

| HEXCEL CORP | HXL | 0.54 | 0.46 | 5.56 | Thursday | AMC |

| POLYCOM INC | PLCM | 0.15 | 0.12 | 25 | Thursday | AMC |

| INDEP BK MASS | INDB | 0.67 | 0.61 | 3.08 | Thursday | AMC |

| COBIZ FINL INC | COBZ | 0.18 | 0.18 | 5.56 | Thursday | AMC |

| OCEANFIRST FINL | OCFC | 0.31 | 0.3 | 0 | Thursday | AMC |

| UROPLASTY INC | UPI | -0.04 | -0.03 | 28.57 | Thursday | AMC |

| AMER RIVER BSH | AMRB | 0.13 | 0.1 | 16.67 | Thursday | AMC |

| BRYN MAWR BK CP | BMTC | 0.5 | 0.48 | 0 | Thursday | AMC |

| MICROSEMI CORP | MSCC | 0.55 | 0.37 | 7.69 | Thursday | AMC |

| IKANOS COMM INC | IKAN | -0.07 | -0.1 | -25 | Thursday | AMC |

| NIDEC CORP-ADR | NJ | N/A | 0.13 | N/A | Thursday | |

| ENTERPRISE FINL | EFSC | 0.37 | 0.26 | 13.89 | Thursday | |

| WEBSTER FINL CP | WBS | 0.53 | 0.52 | 1.92 | Thursday | BTO |

| ALASKA AIR GRP | ALK | 0.88 | 0.55 | 4.26 | Thursday | BTO |

| CYPRESS SEMICON | CY | 0.07 | -0.04 | 12.5 | Thursday | BTO |

| FEDERATED INVST | FII | 0.38 | 0.39 | 2.86 | Thursday | AMC |

| RESMED INC | RMD | 0.63 | 0.6 | 0 | Thursday | AMC |

| 8X8 INC | EGHT | 0.02 | -0.01 | 100 | Thursday | AMC |

| INFINERA CORP | INFN | 0.05 | -0.06 | 200 | Thursday | AMC |

| DIGI INTL INC | DGII | -0.01 | 0.02 | -33.33 | Thursday | AMC |

| UNITED CONT HLD | UAL | 1.11 | 0.78 | 1.85 | Thursday | BTO |

| JANUS CAP GRP | JNS | 0.2 | 0.21 | 0 | Thursday | BTO |

| WESTERN ALLIANC | WAL | 0.43 | 0.34 | 15 | Thursday | AMC |

| SKYWORKS SOLUTN | SWKS | 1.09 | 0.57 | 2.04 | Thursday | AMC |

| HONEYWELL INTL | HON | 1.42 | 1.24 | 1.42 | Friday | BTO |

| KANSAS CITY SOU | KSU | 1.24 | 1.03 | 2.38 | Friday | BTO |

| BANK OF NY MELL | BK | 0.59 | 0.55 | 4.92 | Friday | BTO |

| STATE ST CORP | STT | 1.24 | 1.15 | 10.66 | Friday | BTO |

| GENL ELECTRIC | GE | 0.55 | 0.53 | 2.7 | Friday | BTO |

| KIMBERLY CLARK | KMB | 1.36 | 1.44 | 4.55 | Friday | BTO |

| ROCKWELL COLLIN | COL | 1.09 | 0.96 | 3.17 | Friday | BTO |

| FIRST HRZN NATL | FHN | 0.17 | 0.21 | 11.76 | Friday | BTO |

| PROSPERITY BCSH | PB | 1.08 | 0.98 | 2.8 | Friday | BTO |

| FIRST NIAGARA | FNFG | 0.17 | 0.2 | 0 | Friday | BTO |

| SYNCHRONY FIN | SYF | 0.59 | N/A | 9.38 | Friday | BTO |

| INDEP BK MICH | IBCP | 0.18 | 0.21 | 0 | Friday | BTO |

Note: For a complete analysis of 2014 Q4 estimates, please check Earnings Trends report.