We are in the heart of the Q3 earnings season with a deluge of announcements this week. In total, we should see earnings reports from more than 950 companies, including 153 S&P 500 members. The bulk of the reporting season will be behind us by the end of this week as we will have seen results from 361 of the S&P 500 members by then. This week’s reporting docket presents a blend of companies from different industries, ranging from ‘growthy’ players like Twitter (NYSE:TWTR) to DuPont (NYSE:DD) and plenty in the middle.

We will see what the rest of this reporting season brings, but the picture emerging from what we have seen already is fairly decent. Earnings aren’t great, but they aren’t terrible either. In many respects, Q3 results aren’t materially different from what we have been seeing in recent quarters. There is not much growth and most companies providing guidance are guiding lower. But there is not much new there; that’s what has been on offer on the earnings front for a little over two years now.

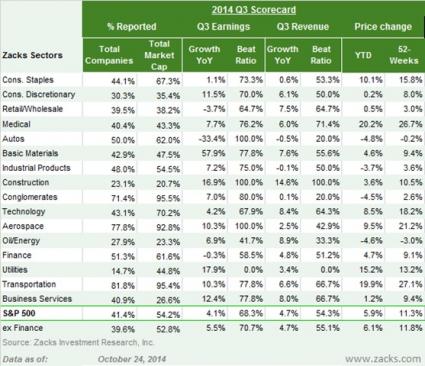

The Q3 Scorecard (as of October 24th)

We have seen Q3 results from 208 S&P 500 members that combined account for 54.2% of the index’s total market capitalization. Total earnings for these 208 companies are up +4.1% from the same period last year, with 68.3% of the companies beating earnings estimates. Total revenues are up +4.7% and 54.3% have come ahead of top-line estimates.

The chart below shows the current Q3 earnings Scorecard

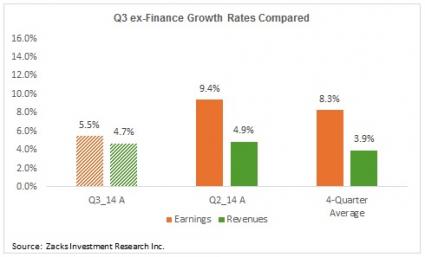

The charts below provide a context for how to look at the results thus far by comparing to them what we had seen from the same group of 208 S&P 500 members in Q2 and other preceding quarters (the 4-Quarter Average is the four quarters through 2014 Q2).

As you can see, it’s hard to make one all-encompassing narrative for the reporting cycle thus far- it’s mixed. Earnings growth is weak relative to other recent quarters, but Q3 revenue growth is tracking better. Earnings beat ratios are about in-line with recent history, though revenue surprises are a bit on the weak side.

The weak earnings growth rate in Q3 was primarily due to some tough comparisons in the Finance sector, particularly with Bank of America (NYSE:BAC). The growth picture would look a lot better when viewed on an ex-Finance basis or ex-BAC basis. But that’s no longer the case, as the comparison chart below shows

The growth challenge is evident from looking at the two largest sectors – Finance and Technology. Growth rates for both of these sectors are tracking below what we have been seeing from them in other recent quarters.

Few Positive Surprises from Finance Sector

Total earnings for the 41 Finance sector companies that have reported results already (out 80 total in the S&P 500 index) are down -0.3% on +4.8% higher revenues, with a weak 58.5% beating earnings estimates and 51.2% coming ahead of top-line expectations. Please note that these 41 Finance sector companies combined account for 61.6% of the sector’s total market capitalization and include all of the major banks and brokers.

The table below gives the sector’s scorecard at the constituent industry level. As you can see, the earnings season has ended for the Major Banks and Thrifts industries.

This is weak growth and beat ratios in Q3 relative to what we have been seeing from the same group of 41 companies in other recent quarters, as the charts below show.

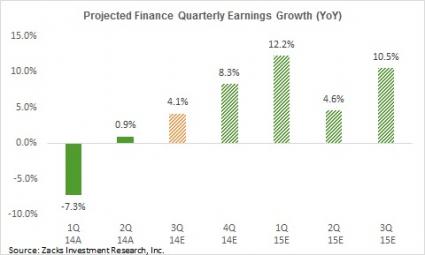

The lower ratio of positive surprises for the Finance sector in Q3 thus far is worrisome, though the sub-par earnings growth pace in the quarter is solely due to the huge Bank of America charge. The comparative growth picture improves materially once Bank of America is excluded from the data, as the chart below shows

The market’s negative response to otherwise decent banking results likely reflects the low interest rate backdrop, which makes the operating environment extremely difficult for the group to navigate. Low interest rates squeeze net interest margins that forces banks to make their earnings numbers primarily through cost cuts. Consensus estimates for the current and coming quarters reflect steady improvement in the ‘core’ business.

It wouldn’t be much of a problem if the current downtrend in yields turns out to be a temporary phenomenon. But if rates remain low for longer or start moving even lower the forward estimates for the sector remain at risk of significant negative revisions. The reason for that is current consensus estimates for the sector reflect a fair amount of improvement in the ‘core’ banking business, which can only happen if net interest margins start expanding as a result of rising interest rates.

The chart below shows consensus earnings growth expectations for the Finance sector as a whole in the coming quarters. Please note that the +4.1% earnings growth expected in Q3 is the composite growth rate for the sector, meaning a blend of the 41 sector companies that have reported results and estimates for the still-to-come 39 companies.

Weak Tech Results

The Tech sector where we have seen results from 70.2% of the sector’s market cap has been a relative laggard. Total earnings for the 28 Tech sector companies (out of 65 in the S&P 500 index) are up +4.2% on +8.4% higher revenues, with 67.9% beating EPS estimates and 64.3% coming ahead of top-line estimates. The beat ratios for the sector were tracking below historical levels earlier in the reporting cycle, but have caught on in recent days and now remain largely within historical ranges.

As the chart below shows, the growth rate is notably weaker than what we have seen from the cohort of 28 companies in other recent quarters.

The Composite Picture

The table below shows a composite (or blended) summary picture of Q3 that combines actual results from the 208 S&P 500 members that have reported with estimates for the remaining 292 index members. As you can see, total earnings are expected to be up +4.1% from the same period last year on +2.9% higher revenues and modest margin gains. The expected growth rate for Q3 has been steadily improving in recent days as companies report results and beat estimates.

Total earnings for the S&P 500 reached an all-time quarterly record in 2014 Q2 and current estimates for Q3 put the quarterly total as the second highest ever. But given the historical trend of roughly two-thirds of the companies beating earnings estimates, the final Q3 tally will likely be right in the preceding quarter’s record vicinity. The chart below shows that current consensus estimates reflect record tallies in the following quarters.

For these estimates to hold, we need an improvement on the guidance front, which has persistently been weak for almost two years now. But we are not seeing that, with a majority of the companies providing guidance guiding lower. As a result, we are starting to see estimates for the current quarter start coming down, which will likely accelerate even more in the coming days.

Monday-10/27

- The September Pending Home Sales numbers will be coming out after the market opens.

- Merck (NYSE:MRK) will be the notable earnings report in the morning, while Twitter reports after the close today.

Tuesday -10/28

- The two-day FOMC meeting gets underway today, while the September Durable Goods and the October Consumer Confidence survey results will be coming out.

- More than 200 companies will be reporting Q32 results today, including 48 S&P 500 members. Pfizer (NYSE:PFE) and DuPont are among a list of major companies reporting results before the market’s open, while Facebook (NASDAQ:FB) will report after the close.

- Zacks Earnings ESP or Expected Surprise Prediction, our proprietary leading indicator of positive earnings surprises, is showing Facebook coming out with an earnings beat.

- Our research shows that companies with positive ESP and Zacks Rank of 1, 2 or 3 are highly likely to beat earnings estimates. Facebook currently has Zacks Rank #2 (Buy) and Earnings ESP of +6.3%.

Wednesday-10/29

- The FOMC meeting announcement is the only notable economic development today.

- Eaton Corp (NYSE:ETN) and Ralph Lauren (NYSE:RL) are among the major reports on a day when more than 300 companies will be reporting Q2 results (33 S&P 500 members).

Thursday -10/30

- In addition to weekly Jobless Claims data, we will get the first read on the Q3 GDP, with consensus estimates of +3.1% growth in the quarter.

- We have the busiest day of the Q3 earnings season thus far, with 335 companies reporting results, including 47 S&P 500 members.

- ConocoPhillips (NYSE:COP) and MasterCard (NYSE:MA) are some of the notable companies reporting in the morning, while Starbucks (NASDAQ:SBUX) will report after the close.

- Earnings ESP is predicting a positive surprise from MasterCard, given the company’s Zacks Rank #3 (Hold) and Earnings ESP of +1.3%.

Friday-10/31

- We will get the September Personal Income & Outlays report and earnings reports from the energy giants Exxon (XOM) and Chevron (CVX).

Here is a list of the 962 companies reporting this week, including 153 S&P 500 members.

| Company | Ticker | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time |

| AMGEN INC | AMGN | 2.06 | 1.93 | 19.1 | Monday | AMC |

| AVALONBAY CMMTY | AVB | 2.01 | 1.63 | 3.01 | Monday | AMC |

| FRANKLIN RESOUR | BEN | 0.92 | 0.8 | -4.17 | Monday | BTO |

| GENL GRWTH PPTY | GGP | 0.32 | 0.29 | 0 | Monday | AMC |

| HARTFORD FIN SV | HIG | 0.84 | 1.03 | -54.41 | Monday | AMC |

| MASCO | MAS | 0.31 | 0.27 | 14.29 | Monday | AMC |

| MERCK & CO INC | MRK | 0.88 | 0.92 | 4.94 | Monday | BTO |

| PLUM CREEK TMBR | PCL | 0.3 | 0.44 | 3.33 | Monday | AMC |

| ROPER INDS INC | ROP | 1.53 | 1.42 | 4 | Monday | BTO |

| SEAGATE TECH | STX | 1.25 | 1.29 | 0 | Monday | BTO |

| UNIVL HLTH SVCS | UHS | 1.38 | 1.1 | 24 | Monday | AMC |

| XL GROUP PLC | XL | 0.62 | 0.53 | 22.89 | Monday | AMC |

| AGREE RLTY CORP | ADC | 0.56 | 0.54 | 0 | Monday | AMC |

| ADVENT SOFTWARE | ADVS | 0.25 | 0.22 | 16 | Monday | AMC |

| AMER CAP AGENCY | AGNC | 0.77 | 0.61 | 29.85 | Monday | AMC |

| ALLIANCE HLDGS | AHGP | 1.08 | 0.91 | 22.86 | Monday | AMC |

| ARLINGTON ASSET | AI | 1.09 | 0.98 | 76.12 | Monday | AMC |

| ALLISON TRANSMN | ALSN | 0.29 | 0.52 | 45.16 | Monday | AMC |

| AMKOR TECH INC | AMKR | 0.26 | 0.15 | -7.14 | Monday | AMC |

| ANADIGICS CORP | ANAD | -0.09 | -0.13 | 0 | Monday | AMC |

| ARTISAN PTNR AM | APAM | 0.83 | 0.67 | 0 | Monday | AMC |

| ALLIANCE RES | ARLP | 1.06 | 0.75 | 39.8 | Monday | AMC |

| ARMSTRONG WORLD | AWI | 0.78 | 0.87 | -7.69 | Monday | BTO |

| BLUE CAP REINSR | BCRH | 0.42 | N/A | -53.97 | Monday | AMC |

| BERKSHIRE HILLS | BHLB | 0.44 | 0.43 | 7.32 | Monday | AMC |

| BANK OF HAWAII | BOH | 0.93 | 0.85 | 5.62 | Monday | AMC |

| BRIXMOR PPTY GP | BRX | 0.47 | 0.43 | 2.22 | Monday | AMC |

| BUFFALO WLD WNG | BWLD | 1.06 | 0.95 | 4.17 | Monday | AMC |

| CANON INC ADR | CAJ | 0.52 | 0.52 | 44 | Monday | N/A |

| CBIZ INC | CBZ | 0.12 | 0.11 | 35.71 | Monday | BTO |

| COGNEX CORP | CGNX | 0.56 | 0.23 | 26.09 | Monday | AMC |

| CLIFFS NATURAL | CLF | 0.07 | 0.64 | 87.5 | Monday | AMC |

| COMPASS MINERLS | CMP | 0.82 | 0.46 | -38.1 | Monday | AMC |

| CRANE CO | CR | 1.17 | 1.04 | 0 | Monday | AMC |

| CROCS INC | CROX | 0.14 | 0.17 | 16.13 | Monday | AMC |

| CTS CORP | CTS | 0.27 | 0.24 | 13.64 | Monday | AMC |

| DUCOMMUN INC DE | DCO | 0.49 | 0.42 | 37.21 | Monday | AMC |

| DDR CORP | DDR | 0.29 | 0.28 | 0 | Monday | AMC |

| DENNY'S CORP | DENN | 0.09 | 0.08 | 12.5 | Monday | AMC |

| EDUCATION RLTY | EDR | 0.11 | 0.08 | 0 | Monday | BTO |

| ENDESA-CHILE | EOC | N/A | 0.82 | 16.67 | Monday | N/A |

| EXACT SCIENCES | EXAS | -0.34 | -0.16 | 4 | Monday | BTO |

| FIRST BNCRP P R | FBP | 0.12 | 0.09 | 0 | Monday | AMC |

| FIRST INTST MT | FIBK | 0.46 | 0.54 | 6.82 | Monday | N/A |

| FERRO CORP | FOE | 0.16 | 0.15 | 5.56 | Monday | AMC |

| GIGOPTIX INC | GIG | -0.04 | -0.06 | 50 | Monday | AMC |

| HEALTHSOUTH CP | HLS | 0.48 | 0.43 | 12.5 | Monday | AMC |

| HOMESTREET INC | HMST | 0.28 | 0.11 | 8.62 | Monday | AMC |

| HEARTLAND FINCL | HTLF | 0.59 | 0.38 | 7.69 | Monday | AMC |

| HUNTSMAN CORP | HUN | 0.54 | 0.54 | 22.92 | Monday | BTO |

| HUDSON VLY HLDG | HVB | 0.19 | 0.17 | -14.29 | Monday | AMC |

| INDEP BK MICH | IBCP | 0.2 | 0.17 | 44.44 | Monday | BTO |

| INTEGR DEVICE | IDTI | 0.17 | 0.08 | -6.67 | Monday | AMC |

| INNOPHOS HLDGS | IPHS | 0.9 | 0.56 | 2.2 | Monday | AMC |

| INTEVAC INC | IVAC | -0.21 | -0.11 | 16.67 | Monday | AMC |

| KADANT INC | KAI | 0.54 | 0.57 | -1.41 | Monday | AMC |

| KNOWLES CORP | KN | 0.35 | N/A | 35.29 | Monday | AMC |

| GLADSTONE LAND | LAND | N/A | 0.03 | -22.22 | Monday | AMC |

| LIGAND PHARMA-B | LGND | 0.2 | 0.12 | 25 | Monday | BTO |

| LUMINEX CORP | LMNX | 0.1 | 0.01 | 33.33 | Monday | AMC |

| MERU NETWORKS | MERU | -0.11 | -0.15 | 18.18 | Monday | AMC |

| MONOLITHIC PWR | MPWR | 0.27 | 0.19 | 0 | Monday | AMC |

| MONTPELIER RE | MRH | 0.84 | 1 | -22.45 | Monday | AMC |

| MICROSTRATEGY | MSTR | -0.01 | 1.52 | -468.75 | Monday | AMC |

| MANITOWOC INC | MTW | 0.45 | 0.39 | -14.63 | Monday | AMC |

| MAVENIR SYSTEMS | MVNR | -0.18 | -0.16 | 38.46 | Monday | AMC |

| NAVIOS MARIT LP | NMM | 0.16 | 0.19 | 15.38 | Monday | BTO |

| OMEGA HLTHCARE | OHI | 0.69 | 0.63 | -5.97 | Monday | AMC |

| OWENS & MINOR | OMI | 0.46 | 0.47 | -13.04 | Monday | AMC |

| OLD NATL BCP | ONB | 0.23 | 0.27 | 20.83 | Monday | BTO |

| OPUS BANK | OPB | 0.34 | N/A | 18.52 | Monday | BTO |

| ORCHID ISLAND | ORC | N/A | -0.3 | N/A | Monday | AMC |

| PRECISION DRILL | PDS | 0.16 | 0.1 | -3.03 | Monday | BTO |

| PMC-SIERRA INC | PMCS | 0.07 | 0.06 | 20 | Monday | AMC |

| PARTNERRE LTD | PRE | 3.44 | 5.7 | -6.47 | Monday | AMC |

| PRGX GLOBAL INC | PRGX | 0.09 | 0.16 | -66.67 | Monday | AMC |

| PS BUSINESS PKS | PSB | 1.2 | 1.2 | 3.28 | Monday | AMC |

| REINSURANCE GRP | RGA | 2.09 | 2.14 | 12.63 | Monday | AMC |

| REGAL ENTMNT GP | RGC | 0.2 | 0.38 | -3.57 | Monday | AMC |

| RETAIL PROPERTS | RPAI | 0.25 | 0.27 | 12 | Monday | AMC |

| SANMINA CORP | SANM | 0.48 | 0.45 | 11.63 | Monday | AMC |

| SEACOAST BKNG A | SBCF | 0.1 | 0.2 | 20 | Monday | AMC |

| SANDVIK AB | SDVKY | N/A | 0.2 | N/A | Monday | N/A |

| SELECT INCOME | SIR | 0.68 | 0.66 | 0 | Monday | BTO |

| STERLING BANCP | STL | 0.22 | 0.14 | 0 | Monday | AMC |

| SCORPIO TANKERS | STNG | -0.01 | 0 | 0 | Monday | BTO |

| SYMETRA FINL CP | SYA | 0.44 | 0.42 | 11.63 | Monday | AMC |

| TENNECO INC | TEN | 1.08 | 0.99 | 16.94 | Monday | BTO |

| TGC INDUSTRIES | TGE | 0.01 | -0.18 | 31.25 | Monday | BTO |

| T-MOBILE US INC | TMUS | 0.03 | -0.04 | 200 | Monday | AMC |

| TREX COMPANY | TREX | 0.24 | 0.22 | 4.55 | Monday | BTO |

| TWITTER INC | TWTR | -0.27 | N/A | 17.86 | Monday | AMC |

| AETNA INC-NEW | AET | 1.57 | 1.5 | 4.97 | Tuesday | BTO |

| AFLAC INC | AFL | 1.43 | 1.47 | 4.4 | Tuesday | AMC |

| AMETEK INC | AME | 0.61 | 0.52 | 3.39 | Tuesday | BTO |

| AMERIPRISE FINL | AMP | 1.98 | 1.91 | 4.52 | Tuesday | AMC |

| AUTONATION INC | AN | 0.86 | 0.75 | -4.6 | Tuesday | BTO |

| ANADARKO PETROL | APC | 1.31 | 1.13 | -1.49 | Tuesday | AMC |

| BOSTON PPTYS | BXP | 1.37 | 1.29 | 1.5 | Tuesday | AMC |

| CH ROBINSON WWD | CHRW | 0.8 | 0.69 | 3.9 | Tuesday | AMC |

| CINCINNATI FINL | CINF | 0.6 | 0.7 | 9.52 | Tuesday | AMC |

| CUMMINS INC | CMI | 2.28 | 1.94 | 1.67 | Tuesday | BTO |

| CONSOL ENERGY | CNX | 0.2 | -0.24 | -72 | Tuesday | BTO |

| COACH INC | COH | 0.45 | 0.77 | 9.26 | Tuesday | BTO |

| DU PONT (EI) DE | DD | 0.53 | 0.45 | 0 | Tuesday | BTO |

| DUN &BRADST-NEW | DNB | 1.72 | 2.01 | 8.09 | Tuesday | AMC |

| ELECTR ARTS INC | EA | 0.43 | 0.25 | 176.92 | Tuesday | AMC |

| ECOLAB INC | ECL | 1.21 | 1.04 | 0.98 | Tuesday | BTO |

| EDISON INTL | EIX | 1.35 | 1.46 | 30.12 | Tuesday | AMC |

| EQUITY RESIDENT | EQR | 0.8 | 0.73 | 1.3 | Tuesday | AMC |

| EXPRESS SCRIPTS | ESRX | 1.29 | 1.08 | 0.82 | Tuesday | AMC |

| FACEBOOK INC-A | FB | 0.32 | 0.17 | 15.38 | Tuesday | AMC |

| FREEPT MC COP-B | FCX | 0.63 | 0.87 | 18.37 | Tuesday | BTO |

| FISERV INC | FISV | 0.84 | 0.78 | 0 | Tuesday | AMC |

| AGL RESOURCES | GAS | 0.25 | 0.24 | -2.44 | Tuesday | AMC |

| GILEAD SCIENCES | GILD | 1.64 | 0.5 | 44.1 | Tuesday | AMC |

| CORNING INC | GLW | 0.38 | 0.33 | 0 | Tuesday | BTO |

| STARWOOD HOTELS | HOT | 0.65 | 0.71 | 1.32 | Tuesday | BTO |

| HARRIS CORP | HRS | 1.1 | 1.18 | 0.79 | Tuesday | BTO |

| KIMCO REALTY CO | KIM | 0.35 | 0.33 | 0 | Tuesday | AMC |

| LABORATORY CP | LH | 1.75 | 1.8 | 3.95 | Tuesday | BTO |

| MACERICH CO | MAC | 0.89 | 0.86 | 2.38 | Tuesday | AMC |

| MARRIOTT INTL-A | MAR | 0.62 | 0.52 | 5.97 | Tuesday | AMC |

| MCKESSON CORP | MCK | 2.74 | 2.27 | 6.41 | Tuesday | AMC |

| MARTIN MRT-MATL | MLM | 1.69 | 1.55 | 8.94 | Tuesday | BTO |

| MARSH &MCLENNAN | MMC | 0.52 | 0.46 | 5.33 | Tuesday | BTO |

| MEADWESTVACO CP | MWV | 0.53 | 0.49 | 6 | Tuesday | BTO |

| NOBLE ENERGY | NBL | 0.39 | 0.97 | 10.13 | Tuesday | BTO |

| NEWFIELD EXPL | NFX | 0.52 | 0.47 | -15.69 | Tuesday | AMC |

| OWENS-ILLINOIS | OI | 0.73 | 0.79 | -2.44 | Tuesday | AMC |

| PACCAR INC | PCAR | 0.96 | 0.87 | 1.12 | Tuesday | BTO |

| PG&E CORP | PCG | 1.15 | 0.88 | -8 | Tuesday | BTO |

| PFIZER INC | PFE | 0.55 | 0.58 | 3.57 | Tuesday | BTO |

| PARKER HANNIFIN | PH | 1.66 | 1.67 | -0.48 | Tuesday | BTO |

| SHERWIN WILLIAM | SHW | 3.18 | 2.68 | 3.45 | Tuesday | BTO |

| TOTAL SYS SVC | TSS | 0.49 | 0.46 | 0 | Tuesday | AMC |

| VERTEX PHARM | VRTX | -0.57 | -0.46 | -6.76 | Tuesday | AMC |

| WESTERN DIGITAL | WDC | 2.04 | 2.12 | 6.32 | Tuesday | AMC |

| WHIRLPOOL CORP | WHR | 3.15 | 2.72 | -9.03 | Tuesday | BTO |

| XYLEM INC | XYL | 0.52 | 0.49 | 9.09 | Tuesday | BTO |

| ARCH COAL INC | ACI | -0.41 | -0.01 | 4.17 | Tuesday | BTO |

| ACTIVE POWER | ACPW | -0.21 | -0.16 | -58.33 | Tuesday | BTO |

| ASSOC ESTATES | AEC | 0.33 | 0.32 | -3.12 | Tuesday | AMC |

| AMER FINL GROUP | AFG | 1.16 | 1.06 | 12.63 | Tuesday | AMC |

| AGCO CORP | AGCO | 0.64 | 1.27 | 5.36 | Tuesday | BTO |

| AIXTRON AG-ADR | AIXG | -0.12 | 0.03 | -30 | Tuesday | BTO |

| GALLAGHER ARTHU | AJG | 0.69 | 0.59 | -2.78 | Tuesday | AMC |

| ACADIA RLTY TR | AKR | 0.36 | 0.32 | 0 | Tuesday | AMC |

| ALERE INC | ALR | 0.52 | 0.54 | -25.86 | Tuesday | BTO |

| AMC ENTERTAINMT | AMC | 0.05 | N/A | -11.11 | Tuesday | AMC |

| APPLD MICRO CIR | AMCC | -0.1 | -0.02 | -75 | Tuesday | AMC |

| TD AMERITRADE | AMTD | 0.36 | 0.36 | 0 | Tuesday | BTO |

| APOLLO COMMERCL | ARI | 0.43 | 0.33 | 22.86 | Tuesday | AMC |

| ANIXTER INTL | AXE | 1.71 | 1.52 | -3.68 | Tuesday | BTO |

| ASPEN TECH INC | AZPN | 0.27 | 0.16 | 55.56 | Tuesday | AMC |

| BLACK BOX CORP | BBOX | 0.53 | 0.6 | -2.38 | Tuesday | AMC |

| BARRETT BUS SVS | BBSI | 1.32 | 1.21 | 5.38 | Tuesday | AMC |

| BIG 5 SPORTING | BGFV | 0.27 | 0.45 | -17.65 | Tuesday | AMC |

| BALLARD PWR SYS | BLDP | -0.01 | -0.05 | 0 | Tuesday | AMC |

| DYNAMIC MATLS | BOOM | 0.19 | 0.26 | 5 | Tuesday | AMC |

| BP PLC | BP | 0.98 | 1.17 | 2.61 | Tuesday | BTO |

| BG GRP PLC-ADR | BRGYY | 0.21 | 0.32 | 57.69 | Tuesday | N/A |

| BLACKSTONE MRTG | BXMT | 0.45 | 0.29 | 75 | Tuesday | AMC |

| CASCADE BANCORP | CACB | 0.03 | 0.03 | -60 | Tuesday | AMC |

| CAI INTL INC | CAP | 0.66 | 0.68 | -8.7 | Tuesday | AMC |

| CASTLE (AM) &CO | CAS | -0.28 | -0.3 | -145 | Tuesday | BTO |

| CIBER INC | CBR | 0.02 | 0.02 | -66.67 | Tuesday | BTO |

| CABOT CORP | CBT | 0.83 | 0.78 | -3.3 | Tuesday | AMC |

| CLEAR CHANL OUT | CCO | -0.01 | 0.01 | 366.67 | Tuesday | BTO |

| CORP EXEC BRD | CEB | 0.82 | 0.8 | 6.25 | Tuesday | AMC |

| CHEMTURA CORP | CHMT | 0.29 | 0.1 | 24.32 | Tuesday | AMC |

| CIT GROUP | CIT | 0.88 | 0.99 | 18.6 | Tuesday | BTO |

| CENTENE CORP | CNC | 0.95 | 0.88 | 28.38 | Tuesday | BTO |

| CLECO CORP | CNL | 1.23 | 1.09 | -13.64 | Tuesday | AMC |

| CNO FINL GRP | CNO | 0.32 | 0.33 | -6.45 | Tuesday | AMC |

| CAPELLA EDUCATN | CPLA | 0.55 | 0.48 | 2.38 | Tuesday | BTO |

| CRAY INC | CRAY | -0.1 | -0.4 | 21.05 | Tuesday | AMC |

| CRYOLIFE INC | CRY | N/A | 0.12 | 200 | Tuesday | BTO |

| CASCADE MICRO | CSCD | 0.09 | 0.11 | 18.18 | Tuesday | AMC |

| COMMVAULT SYSTM | CVLT | 0.28 | 0.25 | 35 | Tuesday | BTO |

| CYNOSURE INC-A | CYNO | 0.24 | 0.23 | 6.67 | Tuesday | BTO |

| DINEEQUITY INC | DIN | 1.07 | 1.1 | 9.43 | Tuesday | BTO |

| DIGITAL RLTY TR | DLR | 1.21 | 1.16 | 0 | Tuesday | AMC |

| DYAX CORP | DYAX | -0.06 | -0.06 | 60 | Tuesday | AMC |

| EMCOR GROUP INC | EME | 0.65 | 0.48 | 1.67 | Tuesday | BTO |

| ENTEGRIS INC | ENTG | 0.18 | 0.14 | 11.11 | Tuesday | BTO |

| EPIQ SYS INC | EPIQ | 0.14 | 0.24 | 90 | Tuesday | AMC |

| EPR PROPERTIES | EPR | 1.04 | 1 | 0 | Tuesday | AMC |

| EAGLE MATERIALS | EXP | 1.01 | 0.8 | -13.79 | Tuesday | AMC |

| EXTREME NETWRKS | EXTR | -0.05 | 0.04 | 0 | Tuesday | AMC |

| FARO TECH INC | FARO | 0.34 | 0.29 | 2.86 | Tuesday | AMC |

| FRESH DEL MONTE | FDP | 0.34 | 0.09 | 20.2 | Tuesday | BTO |

| FEI COMPANY | FEIC | 0.67 | 0.67 | 7.69 | Tuesday | AMC |

| 1800FLOWERS.COM | FLWS | -0.07 | -0.07 | 0 | Tuesday | BTO |

| FIRSTMERIT CORP | FMER | 0.37 | 0.37 | -2.78 | Tuesday | BTO |

| FOMENTO ECO-ADR | FMX | N/A | 1.1 | -16.67 | Tuesday | BTO |

| FRANKLIN ST PPT | FSP | 0.27 | 0.27 | 0 | Tuesday | AMC |

| FIRSTSERVICE CP | FSRV | 0.71 | 0.62 | 22.64 | Tuesday | BTO |

| GLADSTONE INVES | GAIN | 0.18 | 0.24 | 0 | Tuesday | AMC |

| GFI GROUP INC | GFIG | 0 | 0.01 | -66.67 | Tuesday | AMC |

| G&K SVCS A | GK | 0.73 | 0.69 | 4.11 | Tuesday | BTO |

| GAMING AND LEIS | GLPI | 0.6 | N/A | 8.2 | Tuesday | BTO |

| GREEN PLAINS | GPRE | 0.89 | 0.28 | -20.39 | Tuesday | AMC |

| HCA HOLDINGS | HCA | 1.17 | 0.79 | 0 | Tuesday | BTO |

| HCC INS HLDGS | HCC | 0.98 | 0.93 | 12.36 | Tuesday | AMC |

| HIGHWOODS PPTYS | HIW | 0.73 | 0.7 | 9.59 | Tuesday | AMC |

| HARMONIC INC | HLIT | 0 | 0.05 | -100 | Tuesday | AMC |

| HEIDRICK & STRG | HSII | 0.22 | 0.23 | 10.53 | Tuesday | BTO |

| HEALTHCARE TRST | HTA | 0.18 | 0.16 | 0 | Tuesday | AMC |

| HATTERAS FIN CP | HTS | 0.53 | 0.44 | 14.55 | Tuesday | AMC |

| HURON CONSLT GP | HURN | 0.67 | 0.65 | 25 | Tuesday | AMC |

| INDEP BANK GRP | IBTX | 0.63 | 0.38 | 1.79 | Tuesday | BTO |

| ICAD INC | ICAD | 0 | -0.11 | -100 | Tuesday | AMC |

| ICONIX BRAND GP | ICON | 0.63 | 0.59 | 5.63 | Tuesday | BTO |

| II-VI INCORP | IIVI | 0.17 | 0.21 | 15.79 | Tuesday | BTO |

| INTERNAP NETWRK | INAP | -0.16 | -0.07 | -18.75 | Tuesday | AMC |

| INVENSENSE INC | INVN | 0.1 | 0.18 | -100 | Tuesday | AMC |

| IPG PHOTONICS | IPGP | 0.98 | 0.81 | 6.98 | Tuesday | BTO |

| INPHI CORP | IPHI | -0.02 | -0.06 | -50 | Tuesday | AMC |

| KAO CORP ADR | KCRPY | N/A | 0.42 | N/A | Tuesday | N/A |

| KEYW HOLDING CP | KEYW | -0.03 | -0.02 | 100 | Tuesday | AMC |

| KFORCE INC | KFRC | 0.28 | 0.27 | 3.13 | Tuesday | AMC |

| KONA GRILL INC | KONA | 0.02 | 0.08 | 81.82 | Tuesday | AMC |

| KILROY REALTY | KRC | 0.68 | 0.69 | 4.35 | Tuesday | AMC |

| QUAKER CHEMICAL | KWR | 1.05 | 0.91 | 1.83 | Tuesday | AMC |

| LEMAITRE VASCLR | LMAT | 0.05 | 0.05 | 80 | Tuesday | AMC |

| MEDIDATA SOLUTN | MDSO | 0.08 | 0.12 | -42.86 | Tuesday | BTO |

| MERCURY SYSTEMS | MRCY | -0.02 | -0.03 | 250 | Tuesday | AMC |

| MIDSOUTH BANCRP | MSL | 0.38 | 0.27 | 6.06 | Tuesday | AMC |

| MSC INDL DIRECT | MSM | 1.01 | 0.95 | 0 | Tuesday | BTO |

| MARTHA STWT LIV | MSO | -0.05 | -0.06 | 0 | Tuesday | BTO |

| MUELLER WATER | MWA | 0.12 | 0.08 | 0 | Tuesday | AMC |

| MYERS INDS | MYE | 0.17 | 0.25 | -4.35 | Tuesday | AMC |

| NANOMETRICS INC | NANO | -0.25 | -0.06 | 0 | Tuesday | AMC |

| NATL INTERST CP | NATL | 0.35 | 0.33 | -256.76 | Tuesday | AMC |

| NAVIGANT CONSLT | NCI | 0.27 | 0.25 | -12 | Tuesday | BTO |

| NEUROMETRIX INC | NURO | N/A | -0.58 | N/A | Tuesday | BTO |

| NOVARTIS AG-ADR | NVS | 1.29 | 1.25 | 0 | Tuesday | BTO |

| PENN RE INV TR | PEI | 0.52 | 0.45 | 0 | Tuesday | AMC |

| PIONEER EGY SVC | PES | 0.16 | 0 | 133.33 | Tuesday | BTO |

| PLANTRONICS INC | PLT | 0.64 | 0.55 | 17.54 | Tuesday | AMC |

| PANERA BREAD CO | PNRA | 1.43 | 1.35 | -0.57 | Tuesday | AMC |

| PORTLAND GEN EL | POR | 0.48 | 0.4 | 22.86 | Tuesday | BTO |

| PERICOM SEMICON | PSEM | 0.1 | 0.06 | 25 | Tuesday | AMC |

| PRICESMART INC | PSMT | 0.73 | 0.69 | 0 | Tuesday | AMC |

| PURE BIOSCIENCE | PURE | -0.07 | -0.18 | -40 | Tuesday | AMC |

| QTS REALTY TRST | QTS | 0.49 | N/A | 4.17 | Tuesday | AMC |

| RADWARE LTD | RDWR | 0.16 | 0.14 | -6.67 | Tuesday | BTO |

| REPUBLIC AIRWAY | RJET | 0.34 | 0.34 | 5.56 | Tuesday | AMC |

| GIBRALTAR INDUS | ROCK | 0.23 | 0.31 | 26.67 | Tuesday | BTO |

| ROGERS CORP | ROG | 0.71 | 0.82 | 1.75 | Tuesday | AMC |

| RPX CORP | RPXC | 0.18 | 0.16 | 6.25 | Tuesday | AMC |

| SAIA INC | SAIA | 0.66 | 0.51 | -24.29 | Tuesday | BTO |

| SPIRIT AIRLINES | SAVE | 0.95 | 0.79 | 1.11 | Tuesday | BTO |

| SCHNITZER STEEL | SCHN | 0.31 | -0.51 | 128.57 | Tuesday | BTO |

| COMSCORE INC | SCOR | 0 | 0.12 | 350 | Tuesday | BTO |

| SHIN-ETSU CHEM | SHECY | N/A | 0.19 | -29.41 | Tuesday | N/A |

| SIRIUS XM HLDGS | SIRI | 0.02 | 0.02 | 0 | Tuesday | BTO |

| TANGER FACT OUT | SKT | 0.5 | 0.49 | 0 | Tuesday | AMC |

| SM ENERGY CO | SM | 1.52 | 1.54 | -1.89 | Tuesday | AMC |

| SYNCHRONOSS TEC | SNCR | 0.32 | 0.2 | -6.67 | Tuesday | BTO |

| SANOFI-AVENTIS | SNY | 0.94 | 0.93 | -8.86 | Tuesday | N/A |

| SOUTH STATE CP | SSB | 0.98 | 0.85 | 2.22 | Tuesday | BTO |

| SENSATA TECHNOL | ST | 0.62 | 0.55 | 0 | Tuesday | BTO |

| ISTAR FINL INC | STAR | -0.16 | -0.14 | 171.43 | Tuesday | BTO |

| S&T BANCORP INC | STBA | 0.47 | 0.41 | 11.36 | Tuesday | BTO |

| STOCK BUILDING | STCK | 0.24 | 0.18 | -4.76 | Tuesday | BTO |

| SOLARWINDS INC | SWI | N/A | 0.36 | 3.33 | Tuesday | AMC |

| SYNALLOY CORP | SYNL | 0.33 | 0.2 | 3.13 | Tuesday | BTO |

| SYNERGY RES CP | SYRG | 0.13 | 0.04 | 0 | Tuesday | BTO |

| TECHNE CORP | TECH | 0.87 | 0.83 | 3.53 | Tuesday | BTO |

| TIMKEN CO | TKR | 0.65 | 0.56 | -1.52 | Tuesday | BTO |

| TRIQUINT SEMICO | TQNT | 0.2 | 0.12 | 200 | Tuesday | AMC |

| TRUSTMARK CP | TRMK | 0.43 | 0.49 | 13.95 | Tuesday | AMC |

| TRINITY INDS IN | TRN | 0.84 | 0.63 | 32.89 | Tuesday | AMC |

| TRIMAS CORP | TRS | 0.45 | 0.64 | 0 | Tuesday | BTO |

| TRW AUTOMTV HLD | TRW | 1.69 | 1.52 | 9.43 | Tuesday | BTO |

| TILE SHOP HLDGS | TTS | 0.07 | 0.08 | -27.27 | Tuesday | BTO |

| TITAN INTL INC | TWI | 0.03 | 0.14 | -76.92 | Tuesday | BTO |

| TWIN DISC | TWIN | 0.29 | 0.2 | -19.23 | Tuesday | BTO |

| UBS AG | UBS | N/A | 0.17 | -20.69 | Tuesday | BTO |

| UDR INC | UDR | 0.4 | 0.37 | 2.63 | Tuesday | AMC |

| ULTIMATE SOFTWR | ULTI | 0.26 | 0.22 | 4.55 | Tuesday | AMC |

| UMB FINL CORP | UMBF | 0.76 | 0.83 | 0 | Tuesday | AMC |

| UPM-KYMMENE ADR | UPMKY | N/A | 0.36 | N/A | Tuesday | N/A |

| USANA HLTH SCI | USNA | N/A | 1.16 | -8.11 | Tuesday | AMC |

| UTD THERAPEUTIC | UTHR | 1.83 | 1.17 | 26.51 | Tuesday | BTO |

| VASCO DATA SEC | VDSI | 0.09 | 0.12 | 200 | Tuesday | BTO |

| VERISK ANALYTIC | VRSK | 0.64 | 0.62 | 1.79 | Tuesday | AMC |

| VIRTUS INVESTMT | VRTS | 2.48 | 2.56 | -15.66 | Tuesday | AMC |

| VISHAY INTERTEC | VSH | 0.28 | 0.2 | 8 | Tuesday | BTO |

| WABTECH | WAB | 0.88 | 0.76 | 4.6 | Tuesday | BTO |

| WADDELL&REED -A | WDR | 0.92 | 0.8 | 6.52 | Tuesday | BTO |

| WESTERN GAS PTR | WES | 0.55 | 0.53 | 5.56 | Tuesday | AMC |

| WESTERN GAS EP | WGP | 0.26 | 0.2 | 4.17 | Tuesday | AMC |

| WABASH NATIONAL | WNC | 0.26 | 0.24 | -7.69 | Tuesday | AMC |

| WILLIS GP HLDGS | WSH | 0.16 | 0.19 | -16.95 | Tuesday | AMC |

| WATTS WATER TEC | WTS | 0.69 | 0.58 | 1.47 | Tuesday | AMC |

| UTD STATES STL | X | 1.17 | -0.14 | 151.52 | Tuesday | AMC |

| EXCO RESOURCES | XCO | 0.01 | 0.04 | -40 | Tuesday | AMC |

| XOOM CORP | XOOM | -0.03 | 0.03 | 200 | Tuesday | AMC |

| ZELTIQ AESTHETC | ZLTQ | -0.1 | -0.08 | 153.85 | Tuesday | AMC |

| AUTOMATIC DATA | ADP | 0.6 | 0.68 | 0 | Wednesday | BTO |

| ASSURANT INC | AIZ | 1.58 | 1.71 | 5.88 | Wednesday | AMC |

| AKAMAI TECH | AKAM | 0.46 | 0.35 | 0 | Wednesday | AMC |

| ALLSTATE CORP | ALL | 1.36 | 1.53 | 26.25 | Wednesday | AMC |

| CBRE GROUP INC | CBG | 0.36 | 0.3 | 2.86 | Wednesday | AMC |

| EATON CORP PLC | ETN | 1.23 | 1.12 | 0 | Wednesday | BTO |

| EXELON CORP | EXC | 0.7 | 0.78 | 2 | Wednesday | BTO |

| F5 NETWORKS INC | FFIV | 1.22 | 0.98 | 1.9 | Wednesday | AMC |

| FMC CORP | FMC | 0.96 | 0.82 | -0.98 | Wednesday | AMC |

| GARMIN LTD | GRMN | 0.72 | 0.69 | 36 | Wednesday | BTO |

| GOODYEAR TIRE | GT | 0.71 | 0.68 | 0 | Wednesday | BTO |

| HESS CORP | HES | 1.07 | 1.18 | 15 | Wednesday | BTO |

| HERSHEY CO/THE | HSY | 1.08 | 1.04 | 0 | Wednesday | BTO |

| KRAFT FOODS GRP | KRFT | 0.75 | 0.65 | -3.61 | Wednesday | AMC |

| LINCOLN NATL-IN | LNC | 1.42 | 1.34 | 7.3 | Wednesday | AMC |

| METLIFE INC | MET | 1.38 | 1.34 | -1.42 | Wednesday | AMC |

| MCGRAW HILL FIN | MHFI | 0.95 | 0.8 | 8.16 | Wednesday | BTO |

| MURPHY OIL | MUR | 1.09 | 1.34 | -20.35 | Wednesday | AMC |

| NOBLE CORP PLC | NE | 0.56 | 0.85 | 35.82 | Wednesday | AMC |

| PHILLIPS 66 | PSX | 1.69 | 0.87 | -10.65 | Wednesday | BTO |

| PRAXAIR INC | PX | 1.63 | 1.51 | -0.63 | Wednesday | BTO |

| RALPH LAUREN CP | RL | 2.05 | 2.23 | 2.86 | Wednesday | BTO |

| RANGE RESOURCES | RRC | 0.35 | 0.28 | -40.54 | Wednesday | AMC |

| SEALED AIR CORP | SEE | 0.46 | 0.39 | 10.53 | Wednesday | BTO |

| SOUTHERN CO | SO | 1.07 | 1.08 | 1.49 | Wednesday | BTO |

| TE CONNECT-LTD | TEL | 1 | 0.93 | 1.01 | Wednesday | BTO |

| UNUM GROUP | UNM | 0.9 | 0.85 | 4.6 | Wednesday | AMC |

| VISA INC-A | V | 2.11 | 1.85 | 3.83 | Wednesday | AMC |

| WISC ENERGY CP | WEC | 0.5 | 0.6 | 11.54 | Wednesday | BTO |

| WELLPOINT INC | WLP | 2.27 | 2.1 | 7.02 | Wednesday | BTO |

| WASTE MGMT-NEW | WM | 0.68 | 0.65 | 1.69 | Wednesday | BTO |

| WILLIAMS COS | WMB | 0.22 | 0.19 | 0 | Wednesday | AMC |

| DENTSPLY INTL | XRAY | 0.6 | 0.57 | 1.47 | Wednesday | BTO |

| BARRICK GOLD CP | ABX | 0.17 | 0.58 | 0 | Wednesday | AMC |

| ACCO BRANDS CP | ACCO | 0.25 | 0.25 | 11.76 | Wednesday | BTO |

| ARCH CAP GP LTD | ACGL | 0.96 | 0.8 | 18.18 | Wednesday | AMC |

| ACADIA HEALTHCR | ACHC | 0.42 | 0.3 | 87.1 | Wednesday | AMC |

| ACCESS MIDSTRM | ACMP | 0.3 | 0.22 | -33.33 | Wednesday | AMC |

| ADEPTUS HEALTH | ADPT | -0.07 | N/A | -46.67 | Wednesday | BTO |

| AEGION CORP | AEGN | 0.43 | 0.44 | -2.86 | Wednesday | AMC |

| AGNICO EAGLE | AEM | 0.15 | 0.28 | -27.59 | Wednesday | AMC |

| ALLIANCE FIBER | AFOP | 0.31 | 0.3 | 3.13 | Wednesday | AMC |

| ASPEN INS HLDGS | AHL | 1.19 | 1.05 | 4.48 | Wednesday | AMC |

| APPLD INDL TECH | AIT | 0.73 | 0.63 | -4.05 | Wednesday | BTO |

| ALON USA PTNRS | ALDW | 1.12 | -0.26 | 400 | Wednesday | AMC |

| ALKERMES INC | ALKS | -0.12 | 0.12 | -125 | Wednesday | BTO |

| ALLY FINANCIAL | ALLY | 0.41 | N/A | 31.25 | Wednesday | BTO |

| AMEDISYS INC | AMED | 0.17 | -0.01 | 47.06 | Wednesday | BTO |

| AMERISAFE INC | AMSF | 0.65 | 0.54 | 13.56 | Wednesday | AMC |

| ACCURAY INC | ARAY | -0.13 | -0.21 | -85.71 | Wednesday | AMC |

| AMER RAILCAR | ARII | 0.99 | 0.98 | 29.06 | Wednesday | AMC |

| ARRIS GROUP INC | ARRS | 0.65 | 0.36 | -1.56 | Wednesday | AMC |

| ARROW ELECTRONI | ARW | 1.32 | 1.18 | 0.7 | Wednesday | BTO |

| ON ASSIGNMENT | ASGN | 0.51 | 0.38 | 36.59 | Wednesday | AMC |

| ATMEL CORP | ATML | 0.08 | 0.06 | 0 | Wednesday | AMC |

| ATLANTIC TELE-N | ATNI | 0.64 | 0.63 | 63.64 | Wednesday | AMC |

| AU OPTRONCS-ADR | AUO | 0.14 | 0.09 | 40 | Wednesday | BTO |

| YAMANA GOLD INC | AUY | 0.05 | 0.09 | 66.67 | Wednesday | AMC |

| AVX CORP | AVX | 0.21 | 0.17 | 41.18 | Wednesday | BTO |

| AXIS CAP HLDGS | AXS | 1.19 | 1.74 | 32.52 | Wednesday | AMC |

| BOOZ ALLEN HMLT | BAH | 0.36 | 0.47 | 25 | Wednesday | BTO |

| BANCO BILBAO VZ | BBVA | N/A | 0.19 | N/A | Wednesday | N/A |

| BANK COMMUN LTD | BCMXY | N/A | 0.77 | N/A | Wednesday | N/A |

| BELDEN INC | BDC | 1.12 | 0.95 | 2.94 | Wednesday | BTO |

| GENL CABLE CORP | BGC | 0.39 | 0.45 | 7.41 | Wednesday | AMC |

| BAIDU INC | BIDU | 1.62 | 1.41 | 31.45 | Wednesday | AMC |

| BLACKBAUD INC | BLKB | 0.25 | 0.32 | 21.74 | Wednesday | AMC |

| BIOMED RLTY TR | BMR | 0.37 | 0.33 | 11.11 | Wednesday | AMC |

| BOK FINL CORP | BOKF | 1.12 | 1.1 | 5.77 | Wednesday | BTO |

| BROOKLINE BC | BRKL | 0.14 | 0.13 | 7.69 | Wednesday | AMC |

| CREDIT ACCEPT | CACC | 3.19 | 2.72 | 1.36 | Wednesday | AMC |

| CACI INTL A | CACI | 1.21 | 1.74 | 5.59 | Wednesday | AMC |

| CALIX INC | CALX | 0.01 | 0.1 | 116.67 | Wednesday | AMC |

| CAMTEK LIMITED | CAMT | 0.03 | 0.02 | 166.67 | Wednesday | BTO |

| AVIS BUDGET GRP | CAR | 1.8 | 1.48 | 7.94 | Wednesday | AMC |

| CARDTRONICS INC | CATM | 0.55 | 0.51 | 5.77 | Wednesday | AMC |

| CAVIUM INC | CAVM | 0.22 | 0.12 | -5.88 | Wednesday | AMC |

| CBL&ASSOC PPTYS | CBL | 0.54 | 0.52 | 1.85 | Wednesday | AMC |

| CAMECO CORP | CCJ | 0.2 | 0.51 | 28.57 | Wednesday | BTO |

| CEMPRA INC | CEMP | -0.59 | -0.41 | 10.91 | Wednesday | AMC |

| CENTURY ALUM CO | CENX | 0.51 | -0.31 | 23.53 | Wednesday | AMC |

| CAPITOL FEDL FN | CFFN | 0.14 | 0.11 | 0 | Wednesday | N/A |

| CULLEN FROST BK | CFR | 1.1 | 0.96 | 0.99 | Wednesday | BTO |

| CARLYLE GROUP | CG | 0.46 | 0.51 | 10.61 | Wednesday | BTO |

| COMPUGEN LTD | CGEN | -0.11 | -0.12 | 30 | Wednesday | BTO |

| CELADON GROUP | CGI | 0.35 | 0.28 | -9.38 | Wednesday | AMC |

| CHURCHILL DOWNS | CHDN | 0.31 | 0.51 | -5.59 | Wednesday | AMC |

| C&J ENERGY SVCS | CJES | 0.34 | 0.25 | 12 | Wednesday | AMC |

| CLICKSOFTWARE | CKSW | 0 | -0.11 | -100 | Wednesday | BTO |

| CLOUD PEAK EGY | CLD | 0.01 | 0.34 | -450 | Wednesday | AMC |

| TOWN SPORTS INT | CLUB | -0.09 |