Friday marked the unofficial start to the second quarter earnings season when JPMorgan (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) reported results. Once again the banks started us off on strong footing, with JPM and Citi beating on both the top and bottom line, and Wells Fargo, due to its unique set of issues missed on both. Drivers for the banks included strong equity trading revenues, with FICC trading revenues recovering nicely from last quarter. Investment banking revenues remained the wild card in Q2, Citigroup saw a decline of 4% while JPMorgan grew 19% after being down 6% in Q1. We’ll hear more from the largest investment banks when Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) report Tuesday and Wednesday. Goldman is expecting investment banking revenues to increase 9% YoY, and Morgan Stanley is anticipated to rise 7%.

Overall, this quarter is shaping up to be another big one for US corporations, and analysts on Estimize are predicting 22% earnings per share (EPS) growth from the year ago period, still slightly below Q1’s 25% growth figure, but still marking the two highest back-to-back quarters for growth since Q3 and Q4 2010. Revenues are nothing to sneeze at either, expected to increase 9% YoY.

As with every quarter there hot topics that will undoubtedly show up in press releases. One such topic last quarter was tariffs. In March US Customs and Border Protection began collecting duties of 25% on steel and 10% on aluminum on roughly $48B of trade coming into the US. That kicked off a war of (mostly) words, with other countries including Mexico, China, and Canada threatening to put tariffs on everything from US steel to yogurt, soybeans, soup, and dozens of other US made products. In Q1 we saw roughly a quarter of all S&P companies mentioning the tariffs, especially those within the industrials. Half of those companies expected negative impacts from tariffs, the other half expected they would have little impact on their businesses.

With steel and aluminum tariffs being in effect for the entirety of the second quarter, we are sure to hear about impacts from Alcoa (NYSE:AA) when they report on Wednesday, and the steel manufacturers when they report in a couple of weeks. Other potentially impacted companies may issue new guidance for the back half of the year based on what they’re seeing early on, but thus far we have seen second half guidance remain strong and steady. Even the stock market hasn’t reacted to tariff talk in a sustained manner, suggesting investors believe cooler heads will prevail on the matter and that most of the talk is just for negotiating purposes. Global trade is beneficial for all countries, and to enter into a trade war means that every country will shave a bit off of GDP growth, and that corporations will report lower earnings, and no nation wants that.

Winners and Losers

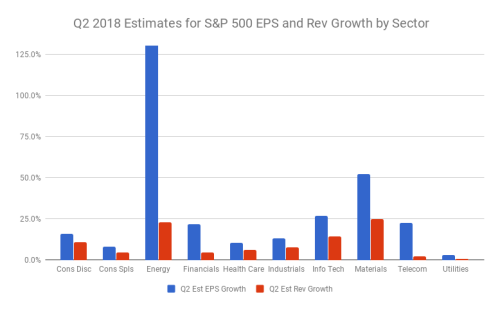

Another reality is that a lot of the gains this quarter are dependent on Tech pulling its weight once again. While Energy and Materials are expected to be the two biggest winners again due to easier YoY comparisons, with EPS growth anticipated to come in at 147% and 52%, respectfully, those expectations are not a true representation of overall sector strength.

Enterprise technology in particular has been the beneficiary of a massive spending cycle, with companies increasing tech Capex spending for the first time in a decade, allocating money for things like marketing, sales and human capital management software. Tax reform has put even more cash into corporations’ pockets, further bolstering investment in this area. Companies like Hubspot, ZenDesk and WorkDay have benefitted. Due to this, the enterprise tech industry is THE place for investors to focus as companies in this space are showing large and upwardly revised revenue growth estimates and have massive leverage on that revenue given the limited need for headcount in a very tight labor market.

You know it’s expected to be a good earnings season when some of the ‘losers’ are those names only expecting 8% - 10% earnings growth. Those names this quarter include Health Care, Consumer Staples and Utilities. Consumer Discretionary has settled in the middle of the pack, anticipated to see EPS grow 16%, with retail again being the focus this quarter. This sector is really a story of haves and have nots, not a ton of middle ground. Consumer sentiment remains strong but has wavered due to increased tariff talk. Another area for concern, despite a strong US labor market, June nonfarm payrolls showed that retail was the one area that contracted, shedding 22,000 during the month.

This week we’ll get results from 60 S&P 500 companies, mostly from information tech companies, with the true peak earnings season beginning next week and lasting through August 3. Stay up to date with this season’s earnings calendar here!